What is the YEN carry trade, and what does it mean for your investments?

A lot of people asking what caused the recent stock market selloff, here’s the answer, the unwind of the YEN carry trade. Although Its never just one reason with this type of move, more of a domino effect that has been brewing. But you can point to the Yen ‘carry trade’ as the culprit. Just look at the Aussie/Yen pair.. gave up the whole years gain.

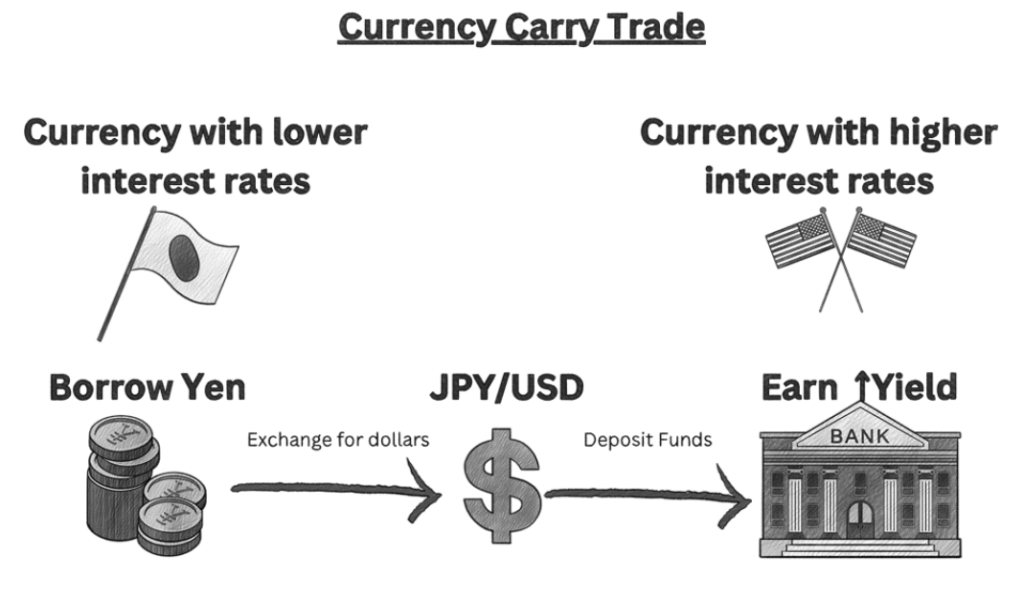

So what is the Yen Carry trade? Well put simply, the Japanese are great savers and export those savings to other countries as borrowing, to get a better yield than the ZERO percent interest rates they have been getting at home for nearly 30 years

- Borrowing Cheaply in Japan: Imagine you can borrow lemons from your friend in Japan at a very low cost. This is because Japan has very low-interest rates. So, you take advantage of these cheap lemons.

Investing in Australia: Now, you go to another friend in Australia who loves lemonade and is willing to pay a high price for it. Australia has higher interest rates, so your money can earn more there. You use the borrowed lemons to make and sell lemonade in Australia, where you can make more profit.

Earning the Difference: After selling your lemonade in Australia and making a good profit, you return the borrowed lemons to your friend in Japan and keep the extra money you made. This extra money is your profit from the carry trade.

So, the Australian dollar versus Japanese yen carry trade is about borrowing cheaply in Japan, investing in Australia where returns are higher, and making a profit from the difference!

Now imagine trillions of dollars doing this globally and investing it in the same handful of hot stocks. When interest rates change suddenly or at least the perception of future rates.. it creates a tidal wave of risk as those borrowed dollars get unwound and that lemonade stand you opened quickly needs to be shutdown because your friend in Japan wants his lemons back.

Much of this investment into Australia is focused on the Big4 Banks and real estate, so we would expect the unwind of the carry trade to effect to be on the Financials and REITs sectors