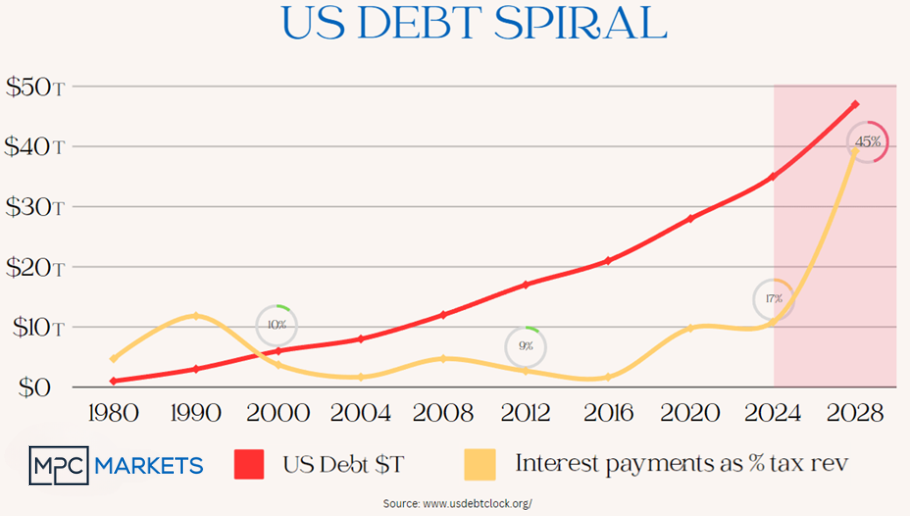

Uncertainty around the global economy, trade wars, a stuttering Chinese economy, the US debt spiral, geopolitical noise (the list goes on) have sucked all the momentum we have had in the last 2 years & given investors good reason to take some money off the table. But what now?

Many of the market darlings of the last 2 years have been from the consumer discretionary, High PE growth and tech areas of the market, unfortunately not the types of sectors you want to consider in the current environment. So how are investors going to navigate uncertain times with some safety, and still get some upside? The answer, gold and silver

Gold has historically served as a safe-haven asset, particularly during times of economic uncertainty. Its value often appreciates when investors lose confidence in traditional assets like stocks and bonds. The U.S. debt crisis, coupled with a weakening USD, has bolstered gold’s appeal. The U.S. holds significant gold reserves, officially valued at $42 per ounce, far below the current market price of around $2,900 per ounce. This disparity has sparked discussions about potential gold revaluation as a strategy to address the national debt, which could further boost gold’s value. Additionally, the potential for interest rate cuts in 2025 could reduce the opportunity cost of holding gold, making it more attractive to investors.

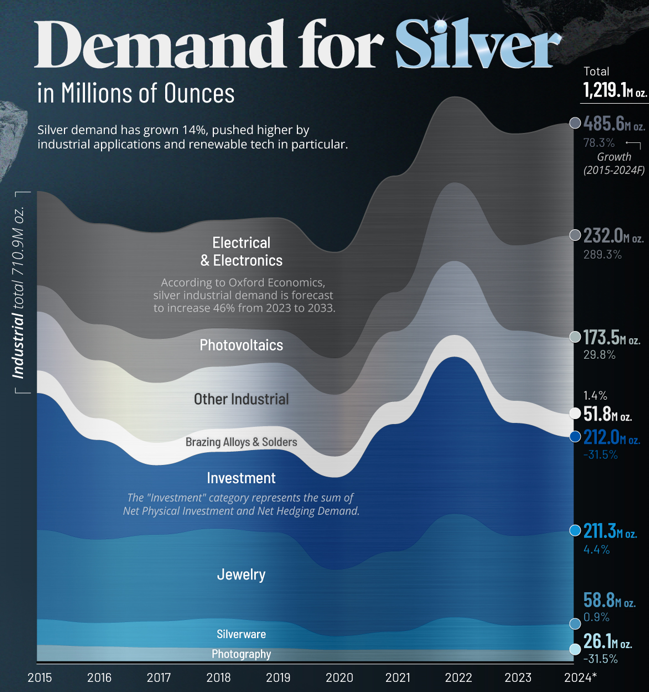

Gold’s “little brother” Silver, may be set to step out of big brothers shadow, with most analysts predicting that silver could outperform gold in 2025, with price targets ranging from 10% to 50% higher. Currently Silver is knocking on the door at key resistance $35, a 12.5 year high. Silvers multi use as a store of value and increased industrial applications could see competing forces triggering a breakout, as silver enters its 5th year of supply deficit.

Add to this the gold-silver ratio currently sits above historical averages, (suggesting that silver is undervalued relative to gold) a similar to historical pattern observed in the early 2000s marked the beginning of a prolonged bull run for silver.

How to play it?

It depends on your preference.

Diversified: there is an option if you just want one option to cover all, ETPMPM – Diversified Physical Metals basket is 60% Gold, 20% Silver, 10% Platinum and 10% Palladium (the later two are 90% produced by BRICS nations, a geopolitical hedge)

But beware, this ETF is often illiquid until the market is open for an hour or so

Gold – Miners are lagging the gold price significantly and should enjoy fat margins and increased profits for some time.

ETF – Gold Miners ETF GDX

Large cap – we like Newmont due to geographical diversity and it’s capacity to ramp up copper production (our other favourite metal) if the price is right

Silver – unfortunately we aren’t spoilt for choice in silver in the large cap space so we use an ETF instead of a large cap

ETF – ETPMAG Physical Silver

Small cap – Polymetals POL was covered by our very own Jonathan Tacadena on the Call on the 25th of February

Want to know more? Ask Mark a question

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.