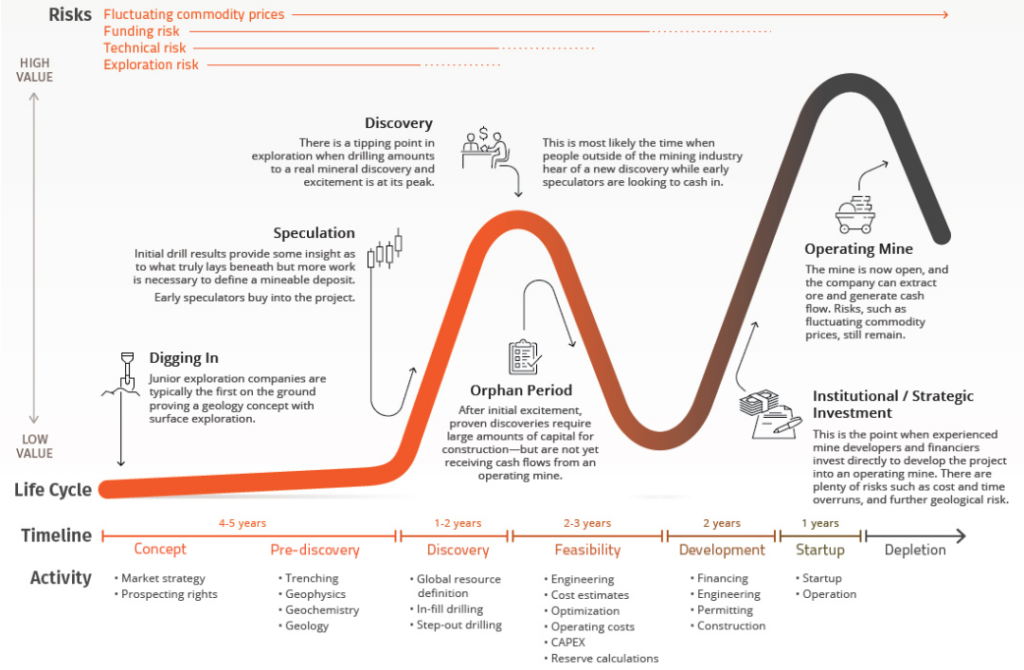

The Lassonde Curve is a valuable tool for investors in the mining sector, particularly those interested in junior exploration companies. Named after Pierre Lassonde, a prominent figure in the mining industry, this curve illustrates the typical life cycle of a mining project and its corresponding value creation

The curve depicts the relationship between time, risk, and value throughout a mining project’s development. It consists of several key stages:

- Concept/Pre-Discovery: This initial phase carries the highest risk and lowest value. Geologists develop theories about potential mineral deposits based on preliminary data

- Discovery: As exploration progresses and promising results emerge, speculative interest grows, potentially leading to a spike in perceived value

- Feasibility Studies: Following discovery, the project enters a period of detailed analysis. This stage often sees a dip in perceived value as excitement wanes and the complex realities of mine development set in

- Development and Construction: As the project moves towards production, perceived value typically begins to rise again

- Production: The final stage represents the realization of the project’s potential, with value generally reaching its peak

For investors, the Lassonde Curve offers several insights:

- It helps in timing investments by identifying potential entry and exit points

- It illustrates the cyclical nature of mining investments, preparing investors for periods of both growth and stagnation

- It highlights the importance of key milestones, such as resource estimates and feasibility studies, in driving value

- It demonstrates the high-risk, high-reward nature of early-stage mining investments

Understanding the Lassonde Curve can help investors set realistic expectations, manage risk, and identify opportunities throughout a mining project’s lifecycle. However, it’s important to note that while the curve provides a general framework, individual projects may deviate from this pattern due to various factors such as market conditions, commodity prices, and project-specific challenge

Example: Pilbara Minerals PLS:ASX

Other common mining terms

- Exploration: The initial stage of searching for mineral deposits through geological surveys, sampling, and preliminary drilling

- Discovery: The point at which a significant mineral deposit is found, often leading to a surge in investor interest and share price

- Resource Estimation: The process of quantifying the size and grade of a mineral deposit, typically occurring after discovery

- Preliminary Economic Assessment (PEA): An early-stage study that provides an initial economic evaluation of a mineral project

- Feasibility Study: A comprehensive technical and economic study of a project’s viability, including detailed assessments of all aspects of the proposed mine

- Development: The stage where a company prepares for mine construction, including securing funding and building an operational team

- Production: The phase where the mine is operational and generating revenue from mineral extraction

- Depletion: The gradual exhaustion of the mineral resource as mining progresses

- Orphan Period: A time during the feasibility stage when investor interest may wane due to lack of exciting news flow

- Drill Core: A cylindrical sample of rock obtained through drilling, used to analyze mineral content and assess a deposit’s potential