Understanding Stagflation: A Tricky Economic Problem

Stagflation is a tough economic situation where the economy slows down, many people lose their jobs, and prices keep rising all at once. This mix of problems makes it hard for policymakers to fix things because solving one issue often makes the other problems worse. Even though it seemed impossible at first, stagflation has happened several times since the 1970s.

In 2022, there was a lot of talk about the possibility of stagflation in the United States. Many believed it might happen if policymakers focused on reducing unemployment first and dealt with inflation later.

What Makes Stagflation Special?

Stagflation is unique because it combines three bad things: slow economic growth, high unemployment, and rising prices. It was once thought that these issues couldn’t happen together, but history has shown otherwise. The challenge with stagflation is that fixing one problem often makes another worse, making it a tough nut to crack.

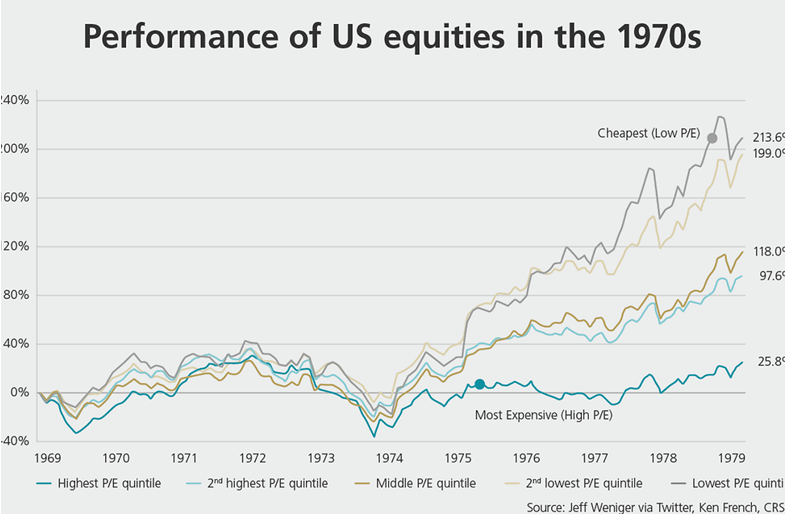

The term “stagflation” was first used by a British politician named Iain Macleod in 1965, during a difficult economic time in the UK. It became widely known in the U.S. during the 1970s oil crisis, which caused a big recession. During this time, the economy shrank, inflation soared, and unemployment reached 9% by May 1975. The misery index, which adds the inflation and unemployment rates, was used to show how bad things were.

The History and Theories Behind Stagflation

For a long time, economists believed that high inflation and high unemployment couldn’t happen at the same time. They thought that if you fixed one, the other would automatically improve. This idea was turned upside down by the reality of stagflation. Since the 1970s, every major recession in the U.S. has seen prices keep going up, even when the economy was shrinking.

Why Does Stagflation Happen?

Experts don’t agree on what exactly causes stagflation. One popular theory blames sudden spikes in oil prices, like during the 1970s OPEC oil embargo, which made everything more expensive and led to job losses. However, not every period of stagflation has had an oil crisis.

Another idea is that poor economic policies, such as President Nixon’s tariffs and price controls in the 1970s, caused economic chaos. Some economists also think that when Nixon took the U.S. off the gold standard, it led to uncontrolled money printing and inflation.

What Stagflation Means Today

Stagflation is still a tricky problem. Most economists agree that increasing productivity is key to solving it. This means making more goods and services without causing prices to rise further. Policymakers need to be careful and proactive to balance economic growth, employment, and stable prices.

Understanding stagflation helps us see why it’s such a tough issue and why careful planning is essential to keep economies stable and healthy.