Warren Buffett, one of the most successful investors of all time, has long championed the power of compound interest in building wealth. Often referred to as the “Oracle of Omaha,” Buffett’s investment philosophy and personal success story provide compelling examples of how compound interest can transform modest investments into substantial fortunes over time.

Understanding Compound Interest

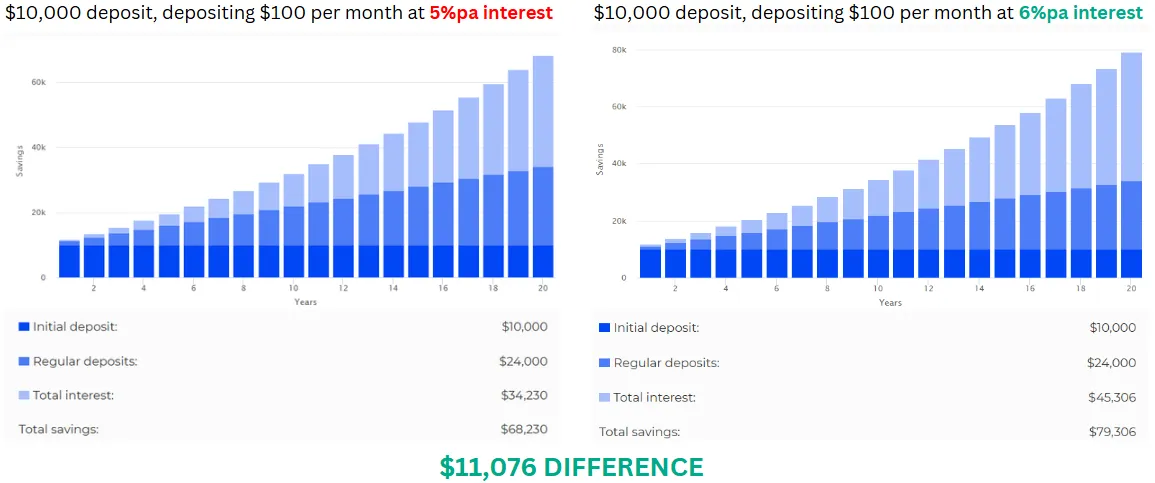

Compound interest is the process by which interest is earned not only on the initial principal but also on the accumulated interest from previous periods. This “interest on interest” effect can lead to exponential growth over time, making it a powerful tool for long-term investors. Warren Buffett famously described compound interest as the “eighth wonder of the world,” emphasizing its significance in wealth accumulation.

He once said, “My life has been a product of compound interest,” highlighting how this principle has been central to his investment strategy and success.

The Buffett Effect: Time and Patience

One of the most striking aspects of Warren Buffett’s wealth is that he accumulated the vast majority of it later in life. In fact, 99% of Buffett’s net worth was earned after his 50th birthday. This remarkable statistic underscores two crucial elements of compound interest:

- The power of time: Buffett began investing at a young age, allowing his investments decades to grow and compound.

- The importance of patience: By consistently reinvesting his earnings and avoiding the temptation to cash out early, Buffett maximized the effects of compounding.

Buffett’s Early Start: A Case Study in Compounding

Warren Buffett’s journey as an investor began early, demonstrating the advantage of starting young when it comes to compound interest. He bought his first stock at age 11 and filed his first tax return at 13. This early start gave his investments an enormous head start in terms of compounding. To illustrate the power of this early start, consider this hypothetical scenario:

- If Buffett had started investing at age 25 instead of 11 and earned the same returns until retirement at 65, his net worth would be approximately $11.7 million.

- While $11.7 million is a substantial sum, it’s a mere fraction (about 0.013%) of Buffett’s actual net worth, which is in the billions.

This stark contrast highlights the exponential effect of those additional 14 years of compounding.

The Snowball Effect

Buffett often uses the analogy of a snowball to describe compound interest. He suggests that the key to successful investing is to find a “very long hill” (time) and start with a “very small snowball” (initial investment). As the snowball rolls down the hill, it gathers more snow, growing larger and faster – much like how compound interest causes wealth to accumulate over time.

Practical Lessons from Buffett’s Approach

- Start Early: The earlier you begin investing, the more time your money has to compound and grow.

- Reinvest Earnings: Buffett advises, “Do not save what is left after spending, but spend what is left after saving.” By consistently reinvesting dividends and earnings, you can accelerate the compounding process.

- Long-Term Perspective: Buffett famously said, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.” This long-term mindset is crucial for benefiting from compound interest.

- Quality Investments: Focus on purchasing quality investments at reasonable prices to maximize the potential for long-term growth and compounding.

- Patience and Discipline: Avoid the temptation to frequently trade or cash out investments. Buffett’s success comes from allowing his investments to grow over decades.

Conclusion

Warren Buffett’s extraordinary success serves as a powerful testament to the potential of compound interest when combined with time, patience, and wise investment choices. While not everyone can become a billionaire, understanding and applying the principles of compound interest can significantly enhance anyone’s potential for wealth accumulation and financial independence.

By starting early, reinvesting earnings, maintaining a long-term perspective, and choosing quality investments, investors can harness the power of compound interest to work in their favor. As Buffett’s example shows, the disciplined application of these principles can lead to remarkable results over time, making compound interest a fundamental concept for anyone looking to build wealth through investing.