The Trump administration has unleashed a sweeping new trade regime: a 10% tariff on all imports, with even higher rates for dozens of countries. The fallout is already visible—supply chains disrupted, inflation fears rising, and stocks sliding fast.

As Oaktree’s Howard Marks put it: “The world economy was shook up like a snow globe.”

Policy uncertainty is now the biggest variable. And it’s incredibly hard to forecast what happens next.

Apple has dropped 20% since the announcement. Stellantis halted production in Mexico. The Dow had its worst day since the pandemic crash. Meanwhile, gold hit a record, and Treasury yields tumbled as investors scrambled for safety.

So what do we do now?

It is important to see the forest through the trees in times like this, here is your guide.

Got a question about this article? Ask the Author

📜 What Just Happened?

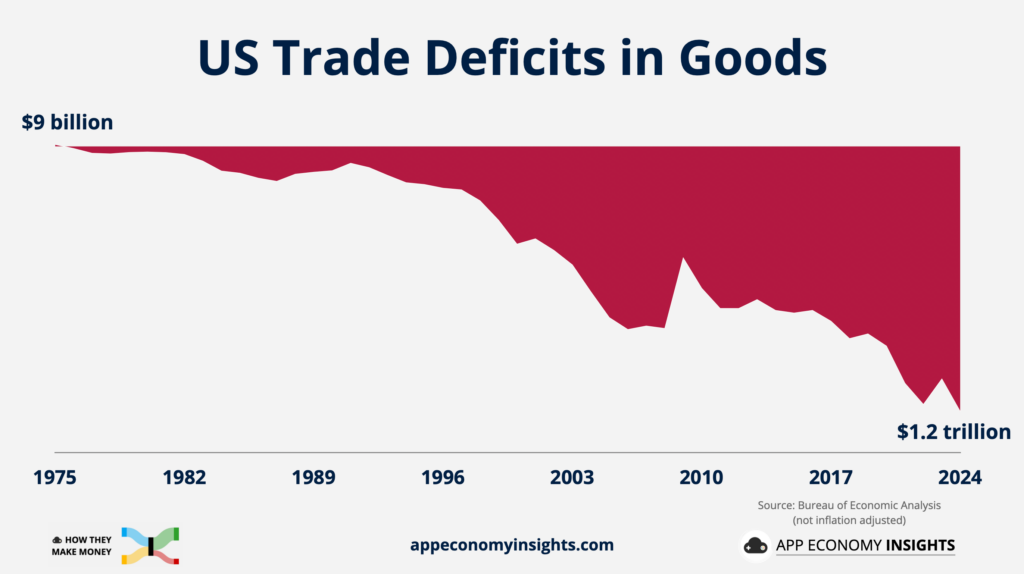

America’s trade deficit has been growing for decades.

From a small surplus in the 1970s to a $1.2 trillion goods deficit in 2024, the US has become increasingly reliant on imports. This imbalance is now central to President Trump’s justification for sweeping tariffs—framing them as a way to “level the playing field.”

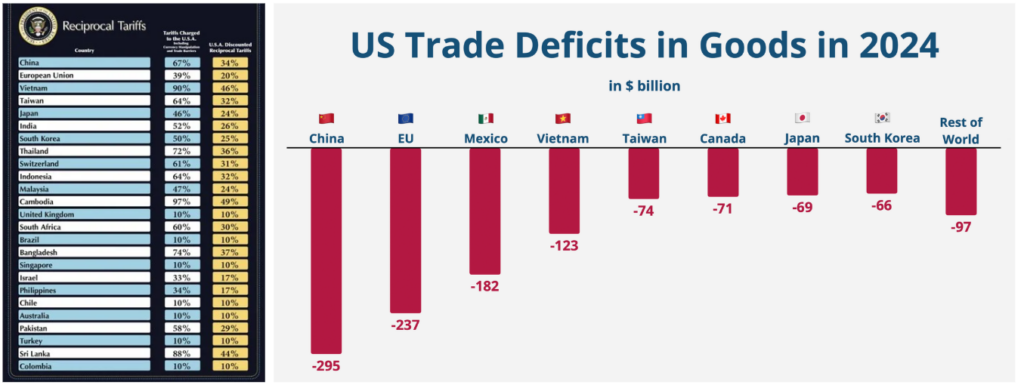

On April 2, Trump introduced the most aggressive US trade policy shift in decades:

- A 10% universal tariff on all imports to the US.

- Higher “reciprocal tariffs” on over 60 countries, calculated based on their trade surplus with the US.

- China faces an additional 34% duty on top of the existing 20%.

- Major partners hit include the EU, Japan, South Korea, Vietnam, and more.

- Canada and Mexico are temporarily exempt from the reciprocal tariff list.

🔍 Not exactly “reciprocal”

The Trump administration pitched the new tariffs as “reciprocal”—matching what other countries charge the US. But in practice, they’re not based on actual tariff schedules. Instead, the White House used a rough formula:

Trade deficit ÷ total exports × ½That means the new tariffs are based on how much a country exports to the US without importing in return—not the actual duties they impose. It’s more about punishing trade surpluses than matching trade rules.

👉 The administration argues the formula accounts for broader trade barriers, including non-tariff barriers like quotas, subsidies, and burdensome regulations. But critics say it oversimplifies—and risks escalating tensions based on vague or subjective measures.

The result? A hit list of top trade deficit partners. The tariffs disproportionately target countries where the US buys more than it sells—regardless of their actual import duties. As shown below, China and the European Union have the largest goods trade imbalances with the US, making them prime targets under the new formula.

📦 Hundreds of goods are affected, including electronics, autos, clothing, food, and luxury items like wine and watches.

🛑 Some sectors are spared—for now. Semiconductors, critical minerals, and pharmaceuticals were left off the initial list but flagged for possible future tariffs.

⏱️ Timing:

The 10% baseline tariff took effect at midnight on April 5.

Higher country-specific tariffs go into effect on April 9.

In response, China retaliated with its own 34% blanket tariff on US goods and restricted exports of several rare earth materials critical to tech and defense industries.

Other countries are weighing similar responses. The EU is reportedly considering targeted tariffs on US tech firms, while allies like Japan and Thailand have expressed “regret” and opened negotiations for exemptions.

🌍 Why It Matters

Tariffs raise costs. US companies that rely on imports now face higher input prices. That includes retailers, automakers, apparel brands, and electronics giants. Many could pass those costs on to consumers, driving up prices on everyday goods—from phones and shoes to coffee and chocolate.

US importers, not foreign countries, typically foot the bill. Those costs often trickle down the chain, eventually landing with American households and small businesses. In effect, tariffs function like a hidden sales tax.

Low-income households will feel it most. Basic necessities make up a larger share of their budgets, and even small price increases hit harder. Analysts warn this is effectively a regressive tax.

Businesses are caught in limbo. With supply chains scrambled and margins under pressure, companies may pause hiring, delay investments, or cut costs. Some are already halting production.

Market confidence has cracked. The selloff isn’t just about economics—it’s about uncertainty. If these policies escalate or change on a whim, forecasting becomes nearly impossible.

In short: this is more than a trade story. It’s a macro shock—one that hits consumers, companies, and markets all at once.

🔮 Why It’s Hard to Predict

The biggest challenge with these tariffs? No one knows what comes next.

As Howard Marks put it, “We know much less today than usual. […] If you tell us what our own rules will be six months from now, I’ll bet you’re wrong.”

Trade policy has become fluid—almost improvisational. Tariffs are announced, amended, reversed, and negotiated in real time, often via social media or press conferences. That makes it nearly impossible for businesses—or investors—to plan with confidence.

Trump has already hinted that some tariffs may be rolled back in exchange for concessions, including on TikTok and fentanyl enforcement. Meanwhile, countries like China and the EU are launching swift retaliation, raising the stakes further.

On Monday, Trump threatened to impose an additional 50% tariff on China unless Beijing withdraws its 34% retaliation. He added that talks would be “terminated” if no deal is reached by April 8. Indexes dipped further on the news.

Just days earlier, he had a “very productive call” with Vietnam’s leadership—hinting that the newly announced 46% tariff could drop if a deal is reached. Apparel stocks like Nike and Lululemon have been a rollercoaster, swinging 5% or more based on the flavor of the day.

Even if tariffs are softened down the line, the damage to predictability is done. Companies may still delay hiring or investment, unsure whether the rules will stick. Markets aren’t just reacting to the policy—they’re reacting to the lack of clarity around it. And that can be even more destabilizing than the tariffs themselves.

This kind of volatility reinforces the point: policy is being made—and unmade—in real time.

🧘♂️ How to Think Long-Term

When markets swing on headlines, it’s tempting to panic. But long-term investing isn’t about reacting to noise—it’s about staying anchored to fundamentals.

Yes, these tariffs are significant. Yes, they may escalate. And yes, stock prices could fall further from here.

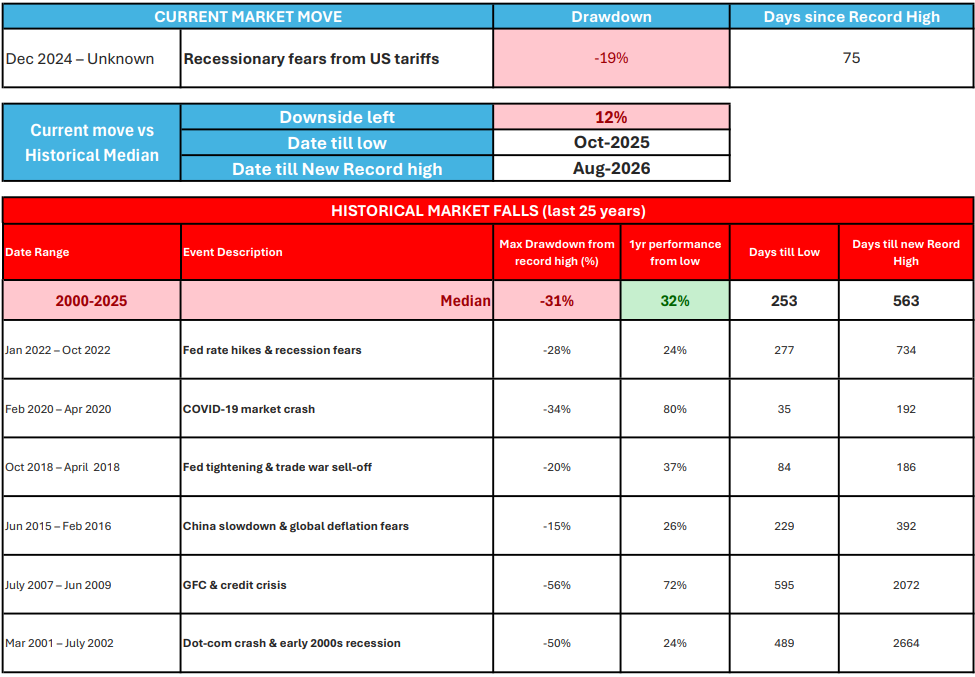

But we’ve been here before.

In 2018, markets tumbled during the US–China trade war—only to rebound when tensions eased.

In 2020, the COVID crash erased a third of the market in weeks—before setting the stage for a massive bull run.

Today, investors are again facing a wall of uncertainty—on inflation, rates, and now trade.

The key lesson? Policy shocks don’t always translate to permanent damage.

Trump has already signaled that tariffs may be revised or dropped based on negotiations. That means what looks like a headwind today could become a tailwind tomorrow.

Meanwhile, stocks are already much cheaper than they were just weeks ago. If you’re investing with a 3–5 year horizon, this could be a moment to look closer—not run for the exits.

Long-term returns are rarely made in calm, predictable environments.

They’re made when others are afraid to look

This is where we lean on historical index moves. The global pandemic only saw a 34% drop in the S&P500 and it recovered quickly, and that was FAR more uncertain than a “man made” Trade war that can be reversed in a instant.

The tactic of Dollar Cost Averaging based on both price and time is the only way investors can rationally buy the dip, as trying to pick lows is most definitely a fools errand

🏭 Who Gets Hit?

Here are a few high-profile examples:

📱 Consumer Electronics

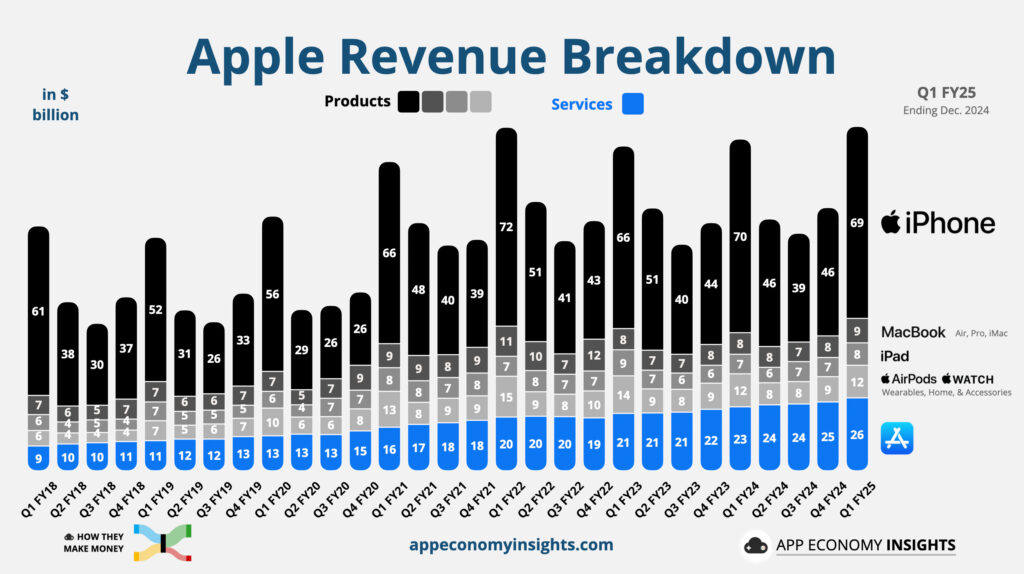

Apple (AAPL) produces most iPhones in China—now facing a 54%+ tariff rate. The company has diversified into Vietnam and India, but those countries also face steep duties (46% and 26%, respectively). The squeeze could mean higher prices or tighter margins. Services already account for nearly half of Apple’s gross profit—and their role in the company’s bottom line is about to grow even more.

🧵 Retailers & Apparel Brands

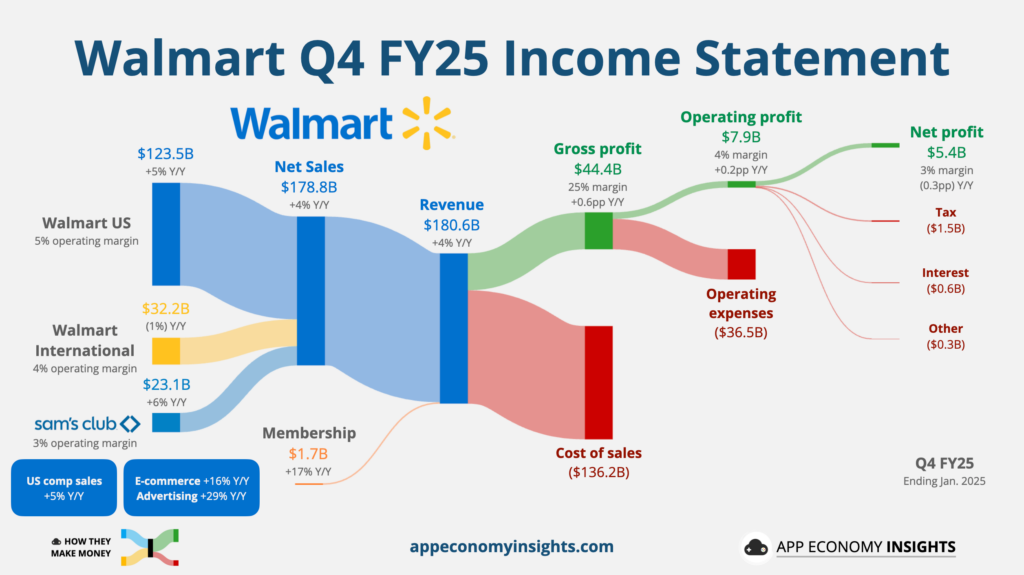

Nike (NKE) and Lululemon (LULU) manufacture most of their apparel in Vietnam—now facing a 46% tariff. These costs ripple through retailers like Target, Walmart, and Dick’s Sporting Goods, which rely heavily on low-cost imports.

Retail stocks initially tanked but bounced back after Trump hinted at negotiations with Vietnam and Cambodia to reduce tariffs to zero.

Still, uncertainty remains—and margins are razor-thin in retail (see Walmart below).

🚘 Automakers & Components

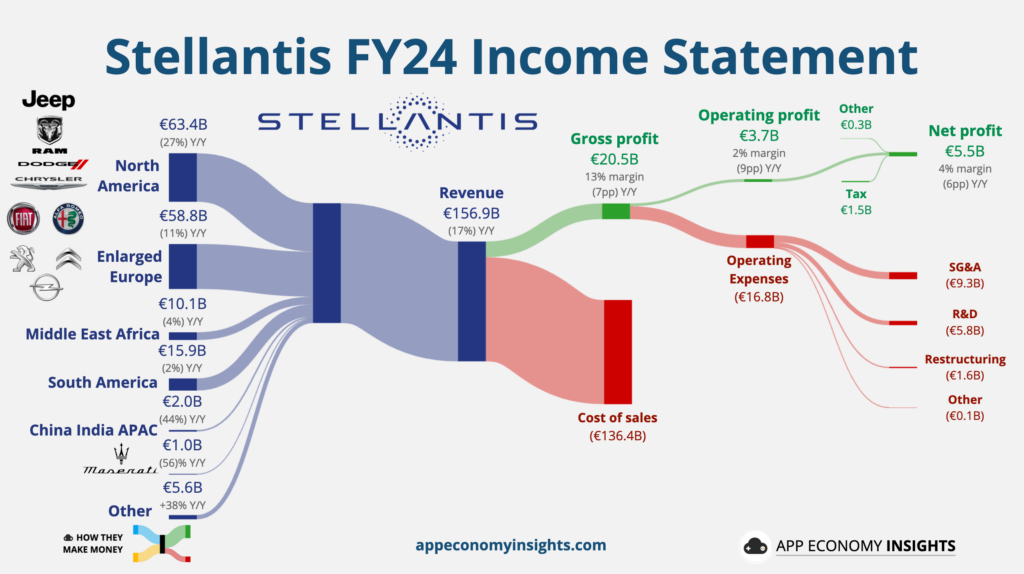

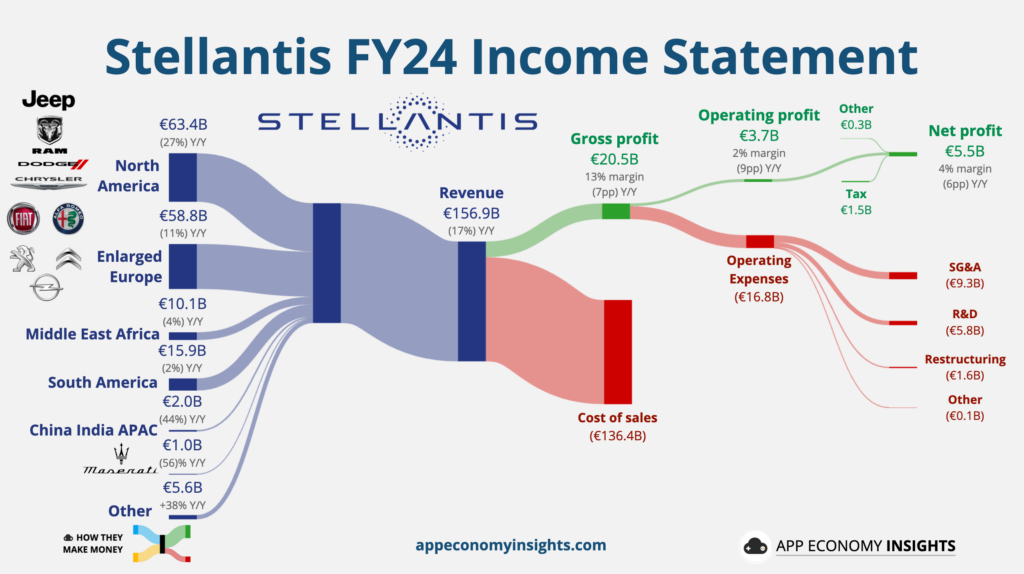

Even vehicles assembled in the US rely on imported parts. Stellantis (STLA) has already paused production in Mexico and Canada due to tariff uncertainty.

Analysts estimate tariffs could raise the price of some vehicles by $2,500–$5,000.

Luxury imports could see sticker shock of up to $20,000.

🛍️ Online Marketplaces & Platforms

Amazon (AMZN) relies heavily on third-party sellers importing goods from China and Southeast Asia. If those sellers raise prices—or exit the platform—Amazon’s marketplace revenue takes a hit. But remember, AWS represents the majority of Amazon’s operating profit, and the cloud infrastructure segment is only indirectly impacted by tariffs.

IPO hopefuls like Klarna and StubHub have delayed listings amid uncertainty.

Shopify (SHOP), Block (XYZ), and other commerce enablers are vulnerable. If sellers see lower volumes, so do payment processors.

💻 Ad-Driven Platforms

Meta (META), Google (GOOGL), and Amazon (AMZN) thrive on digital ad dollars, much of which comes from e-commerce brands pushing low-cost products. If tariffs squeeze margins or reduce product variety, ad budgets may shrink—especially for direct-to-consumer goods.

And it’s not just ad spend. They source hardware from China—whether it’s for smart devices or the infrastructure behind their data centers. Tariffs could raise input costs across the board.

🏗️ Industrial & Enterprise Players

Oracle (ORCL) and Dell (DELL) rely on global hardware supply chains. Tariffs on components can increase costs or delay deliveries—especially in data centers and enterprise hardware.

DuPont (DD) was specifically targeted by China’s retaliation. The chemical giant is now facing an antitrust probe and export restrictions from Beijing.

⏳ Who’s Not Sweating (Yet)

Not every business is in the blast zone. Some sectors are largely insulated—at least for now:

Pharmaceuticals: Currently exempt from both US and Chinese tariff lists. Generic and specialty drugmakers are breathing easy—for now.

Technology Services: Companies like Adobe, ServiceNow, and Atlassian deliver cloud-based software with minimal hardware or cross-border logistics. Tariffs barely touch their business models.

Defense & Energy: Domestic focus and long government contracts shield many defense contractors and energy firms from short-term trade friction.

But this is just the beginning. More companies will surface as second- and third-order effects ripple through supply chains and consumer demand. Retaliatory tariffs could also impact Big Tech.

Got a question about this article? Ask the Author

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.