WHOLESALE INVESTORS ONLY

Structured Investment - IndexPro

Date: 20/01/2025

IndexPro Portfolio Strategy:

The IndexPro Strategy is a sophisticated investment approach designed to provide targeted exposure to Australian equities and floating rate notes over a 5-year term. It comprises two distinct components: an ASX200 Structured Investment providing growth exposure (80% allocation) and an Active Fixed Income component (20% allocation).

The structured investment offers 130% participation (1.3x) to positive ASX200 price movements, while limiting downside risk to a maximum loss of 15% at maturity (subject to issuer risk). The fixed income component, is exposed to Coolabah Floating-Rate High Yield Fund, which aims to provide regular income and additional downside protection from investment grade floating rate notes.

How It Works

Component 1: ASX200 Structured Investment (80% Allocation)

- Enhanced growth exposure: Provides 130% (1.3x) to positive ASX200 price movements.

- Limited downside: 85% Capital Protection (Maximum loss capped at 15% at maturity).

- 5-year investment term.

- Please refer to Term Sheet for detailed risks, including but not limited to, the credit risk of the issuer.

Component 2: Active Fixed Income (20% Allocation)

- Investment in the Coolabah Floating-Rate High Yield Fund (APIR: ETL6855AU)

- Aims to provide regular income by actively investing in a portfolio of investment-grade Australian Floating-Rate Notes (FRNs).

- The Fund currently has a target running yield and yield to maturity of 9% p.a. and 11% p.a. respectively after fees and expenses.

- Please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

By combining both components together, it provides investors the opportunity for amplified returns in positive markets with a defined risk profile, and potentially a more favourable risk-return profile compared to direct investment in the index.

Important Considerations

- The strategy is made up of two (2) separate investments.

- Past performance is not a reliable indicator for future performance.

- Each component does not provide guarantee of investment outcomes.

- Please refer to Key Documents, including Investment Presentation, Term Sheet, IM and or Fund Documentation for key risks and terms.

COMPONENT 1: INDEX PRODUCT

of IndexPro is a structured investment product offering exposure to the ASX 200 index (excluding dividends), with additional features aimed at both downside protection and leveraged upside.

Investment Structure

- Principal Protection (85%)

- Guarantees 85% of the initial investment at maturity (subject to issuer credit risk).

- Maximum loss is therefore capped at 15% of the initial investment, regardless of the index’s performance over the 5-year term.

- Leveraged Upside Participation (130%)

- Provides 1.3X leverage on any positive performance of the ASX 200 index.

- For every 1% increase in the ASX 200, the product returns 1.3% to the investor.

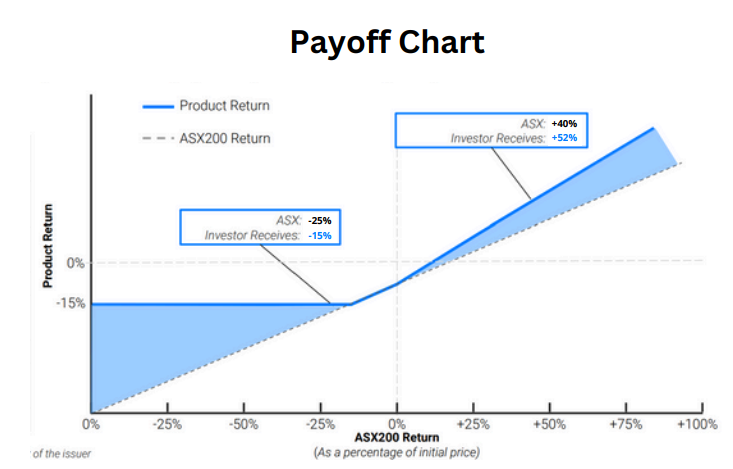

Payoff Structure

- Positive Market Performance

- Scenario: If the ASX 200 index rises over the 5-year term.

- Calculation: Maturity Value = Initial Investment + (Initial Investment × ASX 200 Performance × 130%)

- Example: If the ASX 200 rises by 40% over 5 years:

- $100,000+($100,000×40%×130%)=$152,000

- Negative Market Performance

- Scenario: If the ASX 200 index declines over the 5-year term.

- Outcome:

- Losses are limited to a maximum of 15% of the initial investment.

- At maturity, investors receive at least 85% of their initial investment.

- Example: If the ASX 200 falls by 30% over 5 years:

- $85,000(minimum payout on a $100,000 investment)

Key Features

- Investment Term: 5 years

- Principal Protection: 85% (subject to issuer credit risk)

- Upside Leverage: 130%

- Maximum Return: Uncapped

- Reference Asset: ASX 200 index

COMPONENT 2: ACTIVE FIXED INCOME

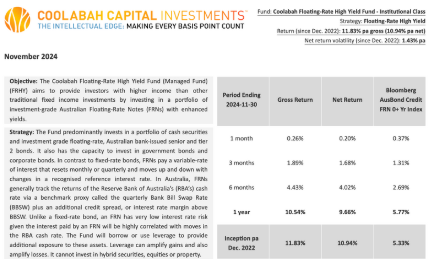

Coolabah Floating-Rate High Yield Fund

This component of the strategy aims to provide enhanced income and additional downside protection through active management of a portfolio of investment-grade Australian Floating-Rate Notes (FRNs).

Key features include:

- Investment Focus: Primarily invests in cash securities and investment-grade floating-rate Australian bank-issued senior and tier 2 bonds.

- Interest Rate Sensitivity: Very low interest rate risk due to the variable nature of FRN payments, which reset monthly or quarterly.

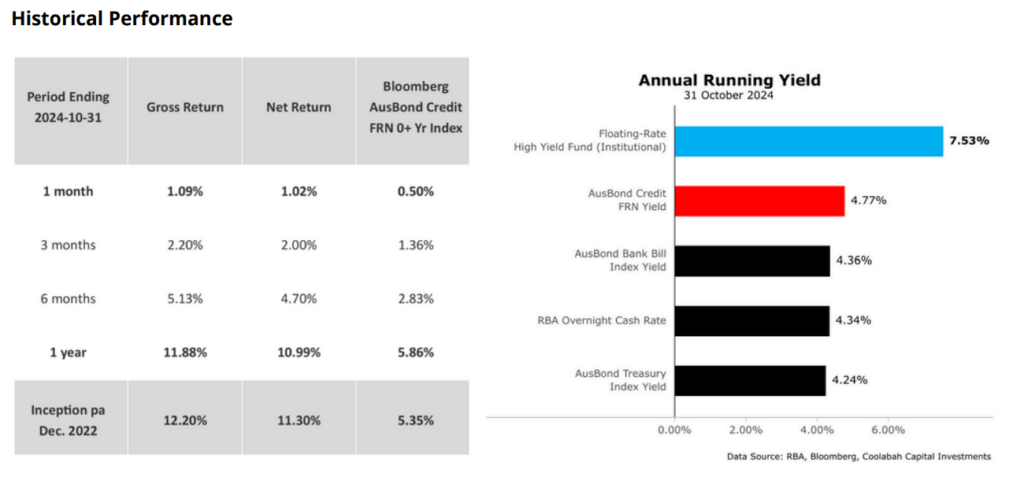

- Yield Profile: As of October 2024, the fund had a running yield of 7.53% pa.

- Credit Quality: Maintains a weighted-average credit rating of A+.

- Performance: Since inception in December 2022, the fund has returned 12.20% pa gross (11.30% pa net) with a volatility of 1.44% pa.

The fund’s structure provides several benefits to the overall portfolio strategy:

- Income Generation: Offers potential for regular income, complementing the capital growth focus of Component 1.

- Downside Protection: Acts as a buffer during negative market performance, helping to reduce overall portfolio volatility.

- Low Correlation: Performance is independent of Component 1, enhancing diversification.

- Liquidity: Daily pricing and withdrawal requests, providing flexibility.

THIS INVESTMENT IS FOR WHOLESALE INVESTORS ONLY (S708)

Our Commitment – recommendations, managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith. Our evaluations and projections are grounded in the known facts at the time of creation and aim to provide a comprehensive view of the anticipated financial landscape in 2024. However, readers should be aware that these projections are estimates and may not fully materialize.

Scope and Application – The insights within MPC Markets are crafted for a broad audience and do not specifically cater to individual investment objectives, financial situations, or needs. Readers should consider the suitability of the advice in relation to their personal circumstances before making any investment decisions.

Research Integrity and Use – The research and content of MPC Markets are intended solely for our readers and should not be copied, distributed, or shared without proper attribution. While we strive to ensure accuracy and relevance, MPC Markets cannot guarantee the continuous updating or correction of the information or opinions expressed within the publication.

Disclaimer of Liability – MPC Markets, in its capacity as a Corporate Authorised Representative of LemSec, disclaims any responsibility for losses or damages arising from reliance on the opinions, advice, recommendations, or information—whether direct or implied—contained in this document, notwithstanding any errors, omissions, or instances of negligence.

Analyst Objectivity – All research analysts contributing to the MPC Markets affirm that the views expressed represent their personal opinions regarding the subject companies and financial products covered in the publication.

Copyright and Usage Rights – The content of this document is the property of MPC Markets Pty Ltd, either through ownership or licensing agreements. Unauthorized reproduction, adaptation, linkage, framing, broadcasting, distribution, or transmission of this material is prohibited without express written permission from MPC Markets, except for personal use or as allowed by applicable laws.

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.