Closing Bell

3 Things Affecting Markets

- Speculation of China Stimulus

- Fed may be close to “peak rates”

- AU Consumer and Business confidence remain weak

ASX Today

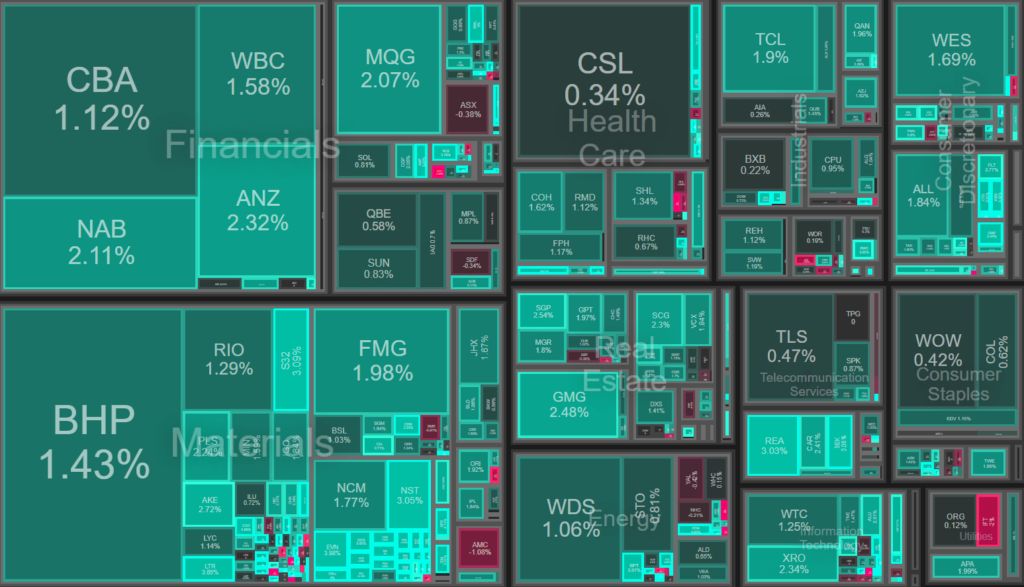

Shares rebounded by over 1 per cent on Tuesday, marking their first positive day in five. This upturn was driven by strong performances in banking, real estate businesses, and the mining sector, who outpaced the market after a dismal start to the week. This downturn on Monday was triggered by a slowing Chinese economy.

There was a reversal of this negative trend, fueled by speculation that policy makers would introduce stimulus measures. Top state-run financial newspapers ran reports on Tuesday, suggesting that more property-supportive policies were likely to be adopted, coupled with measures to boost business confidence.

Top performers in this turnaround include:

Megaport (MP1): Megaport, an internet connectivity company, upgraded its normalised EBITDA (operating income) guidance for the fiscal year 2023 to between $19 million and $21 million. This is a significant increase from their prior guidance, which was between $16 million and $21 million. This announcement resulted in a 15 per cent increase in shares, reaching a value of $7.73.

Bellevue Gold: Bellevue Gold also performed well as gold prices solidified overnight to $US1931 an ounce and the US dollar experienced a slight retreat this week.

Lithium Miners: Several lithium miners, including Allkem, Core Lithium, and Pilbara Minerals, also saw advancements.

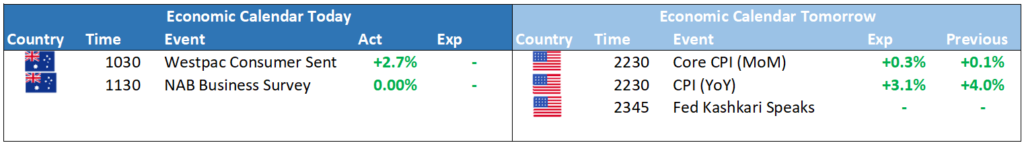

Turning to the economic front, the Westpac/Melbourne Institute’s consumer confidence survey increased by 2.7 per cent in July. However, this measure still resides at “deeply pessimistic” levels. Concurrently, National Australia Bank’s business confidence survey remained significantly below its long-term average.

Interestingly, business conditions remained steady at +9 in June. Although this figure is above the long-term average, it is a substantial drop from the highs seen in mid to late last year when conditions were exceeding +20.

Leaders & Laggards

Winners

Megaport has upgraded its normalised EBITDA (operating income) guidance for financial 2023 to between $19 million and $21 million, versus prior guidance between $16 million and $21 million. Megaport added it expects its financial 2024 EBITDA guidance to be higher than the previous guidance of $41 million to $46 million, with more details to be provided when it posts its results in August.

Bellevue Gold as gold prices firmed overnight to $US1931 an ounce and the US dollar extended a small retreat this week.

Karlawinda mine delivers record gold production

Speculation of PLS takeover bid continues

Broad litium positivity and executive chairman signed new contract

Losers

Disappointment around the DRP price

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Calendar

Economic