Overnight – Fed flags concerns over inflation

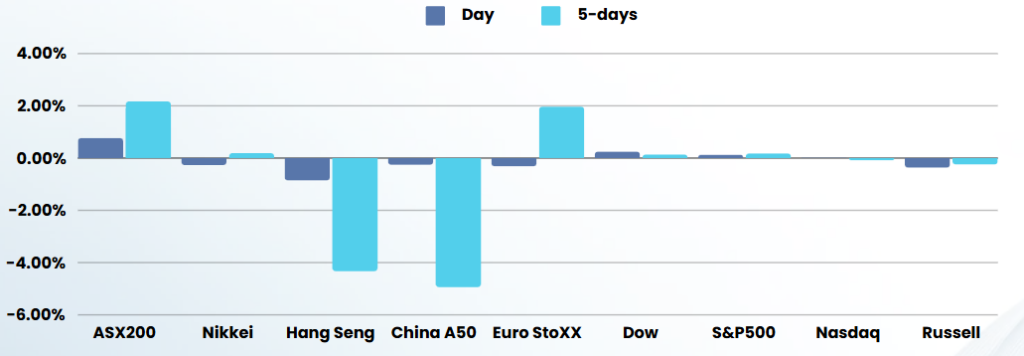

Stocks hovered around the flatline Wednesday as technology continued to pressure the broader market lower, while the Federal Reserve’s December meeting minutes signal a slower pace of rate cuts ahead.

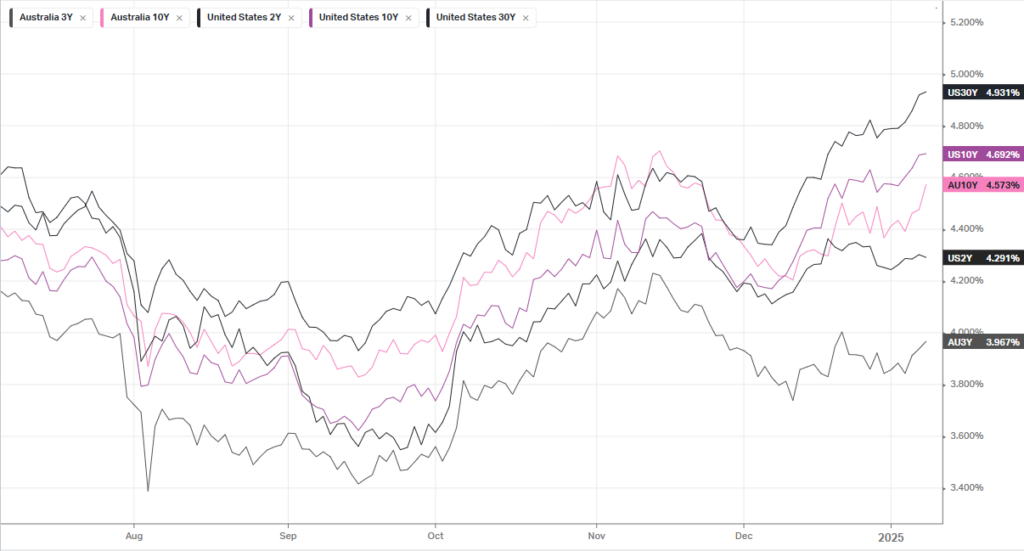

The Federal Reserve’s December meeting minutes revealed a cautious approach to future rate cuts. Policymakers expressed concerns about slowing disinflation progress, suggesting a more gradual pace of monetary policy adjustments. This shift in sentiment was driven by the slower-than-expected progress in bringing inflation down to the 2% target, prompting a more measured stance on future rate reductions.

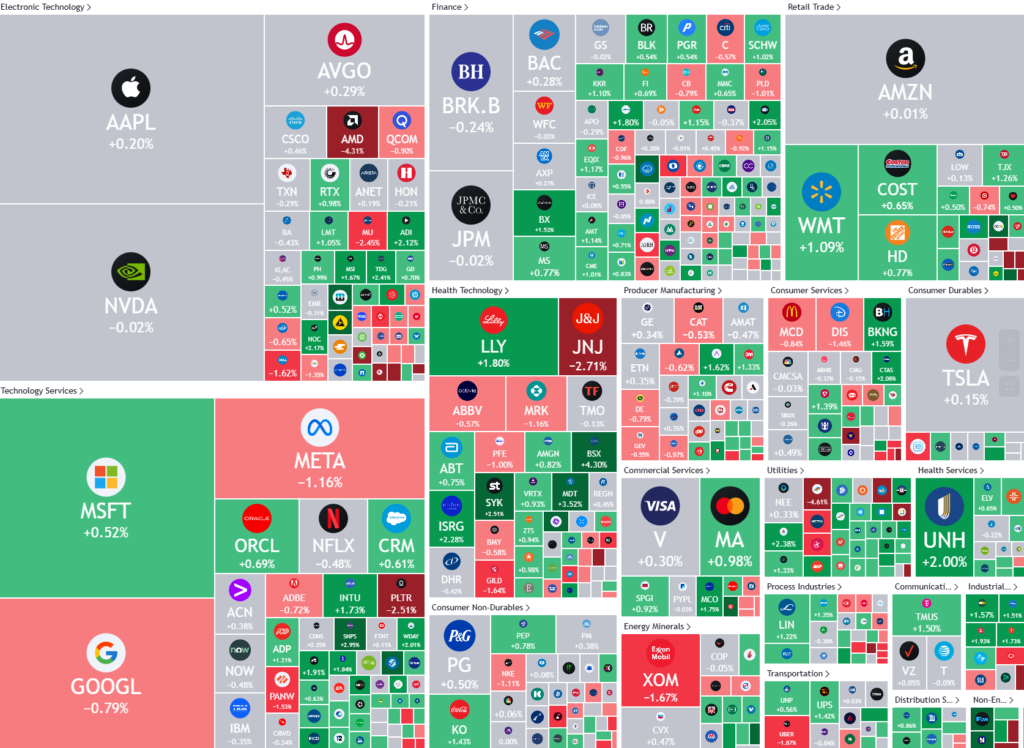

Despite steady Treasury yields and comments from Fed Governor Christopher Waller supporting further rate cuts, tech stocks continued to face pressure. Major tech companies like Apple, Alphabet, and Meta Platforms experienced declines, while Nvidia remained relatively flat. Palantir Technologies saw a significant drop, with its stock falling about 16% from its recent all-time high due to concerns about inflated valuations.

Recent employment data showed unexpected strength in the U.S. labor market. Initial jobless claims decreased to their lowest level since February, while private payrolls increased by 122,000 jobs in December. These positive indicators, combined with earlier reports of increased job openings and persistent inflation, have reinforced expectations that the Federal Reserve may not rush to implement further interest rate cuts in 2025. Investors are now closely monitoring upcoming economic data and Fed communications for additional insights into the central bank’s future policy decisions.

ASX SPI 8312 (-0.37%)

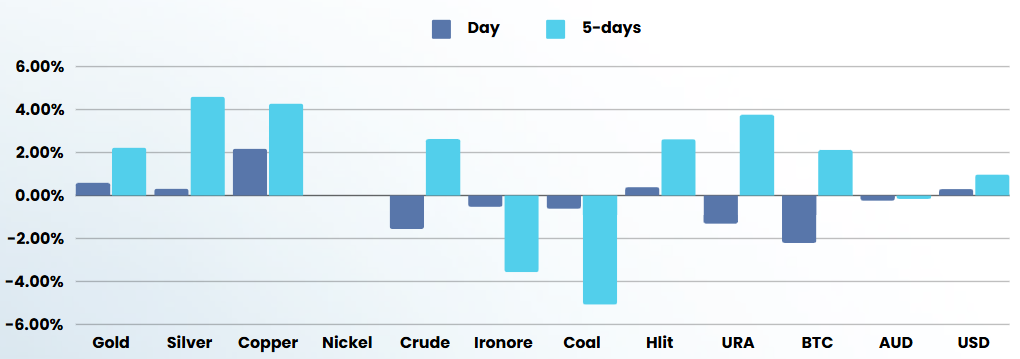

The local market will follow global market lower as the Fed flagged inflation concerns. Despite this commodities were positive over night which should help the materials sector