Overnight – Stocks Mixed as Lululemon increases full year forecast

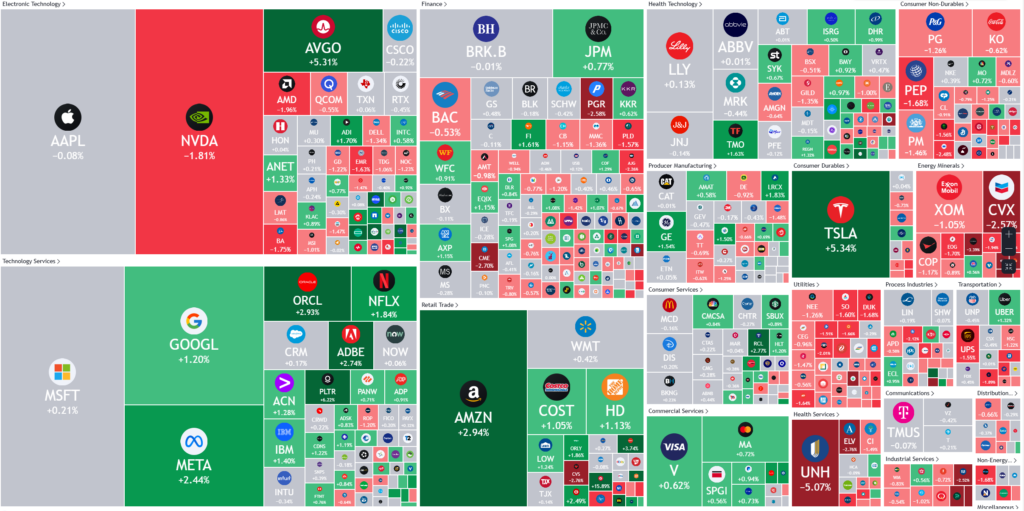

Stocks rose Friday night, as the employment data seemed to make investors more confident in the Goldilocks scenario, and Lululemon surged 16% on full year forecast

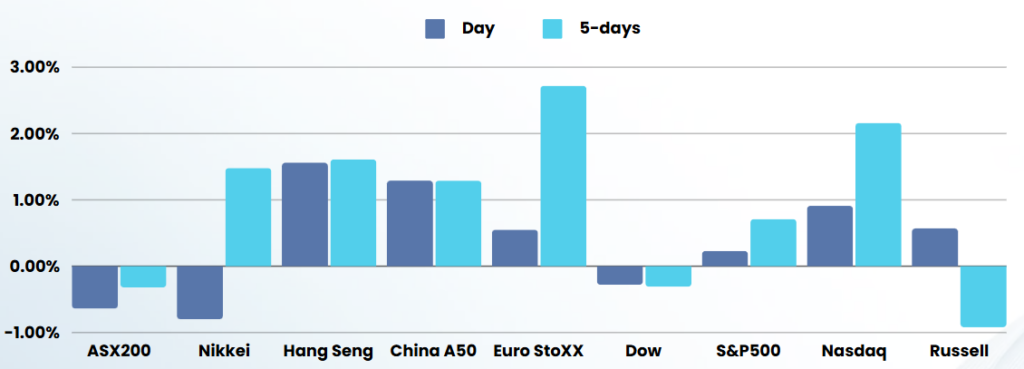

For the week, the Nasdaq gained 3.3%, the S&P 500 rose about 1% and the Dow fell 0.6%.

The U.S. Labor Department report showed job growth surged in November, but an increase in the unemployment rate to 4.2% pointed to an easing labor market. Following the data, U.S. rate futures were pricing in roughly a 90% chance the Fed will lower interest rates by 25 basis points at its Dec. 17-18 policy meeting, according to LSEG calculations which previously saw just a 72% chance. The Fed has lowered rates by 75 basis points since September, when it launched its easing cycle.

Despite this, we don’t see the Fed cutting much further, if at all, but the market seems to be trying to find the pieces of the data that suit the rate cut argument, rather than the small jump in the unemployment rate actually being a justification.

Fed Governor Michelle Bowman said inflation risks remained and urged caution with rate decisions. This is the first real sign that the Fed might be reconsidering an aggressive rate cut cycle.

Lululemon Athletica stock climbed 16% after the sportswear maker increased its full-year forecasts, betting on resilient demand for its athletic wear in the U.S. during the holiday shopping season and continued strength in its international business.

ASX SPI 8420 (-0.29%)

The ASX is likely to start lower and grind higher over the course of the day as we begin the quiet Christmas markets. Australian rate decision tomorrow & employment figures Thursday are likely to be a reason for local investors to wait.

While other central bank decisions and US inflation data later in the week will keep the market in “wait and see” mode