Overnight – Stocks bounce from panicked Asian session lows

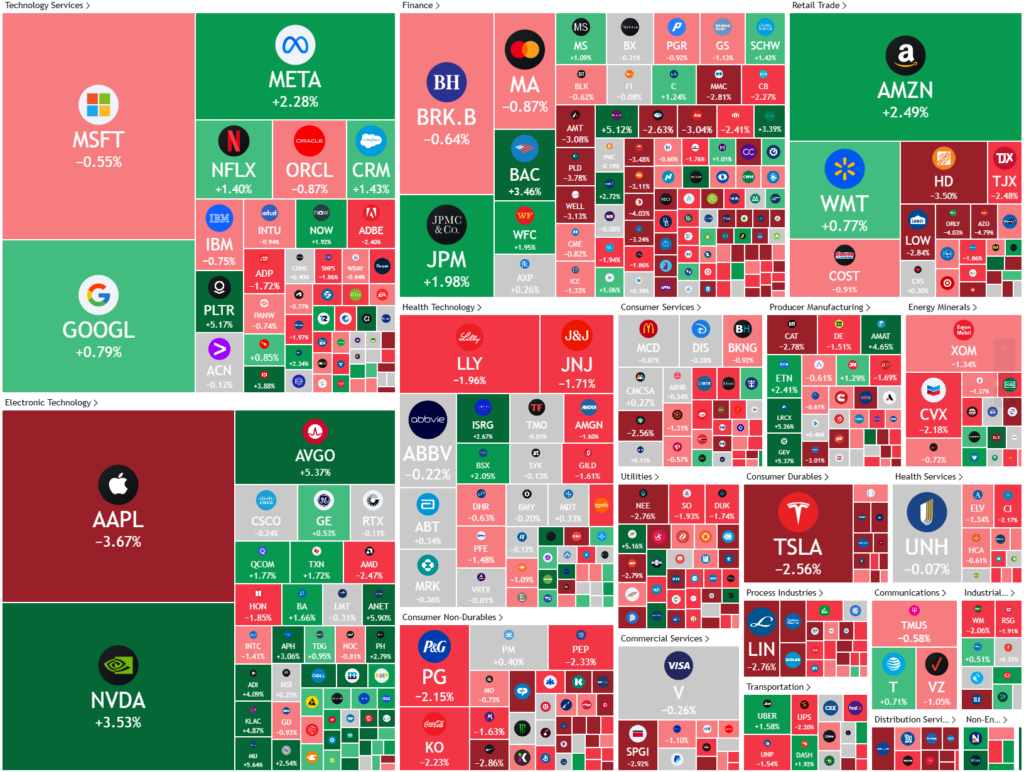

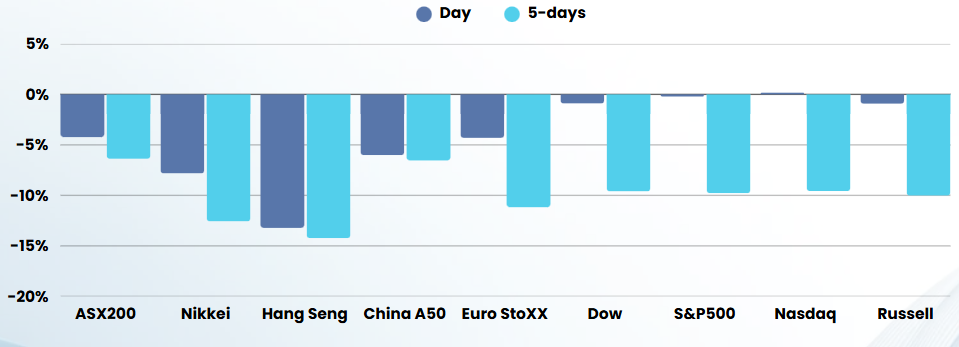

US stocks rebounded to near unchanged from the most spectacular “Monday Asia Panic” move since the GFC, where US equity futures were down over 6% during Asian hours.

The Monday Asia Panic isn’t uncommon, with most extreme Asian session overreactions unwinding within the US session when it opens Monday

While the press and market pundits are enjoying the constant flow of headlines, all of them are merely speculating, with enough volatility to use a market move as evidence for their argument. Markets are currently moving savagely on rumours, inuendo and loose interpretations, making it hard to give Pre-Market Pulse readers a balanced summary of the market.

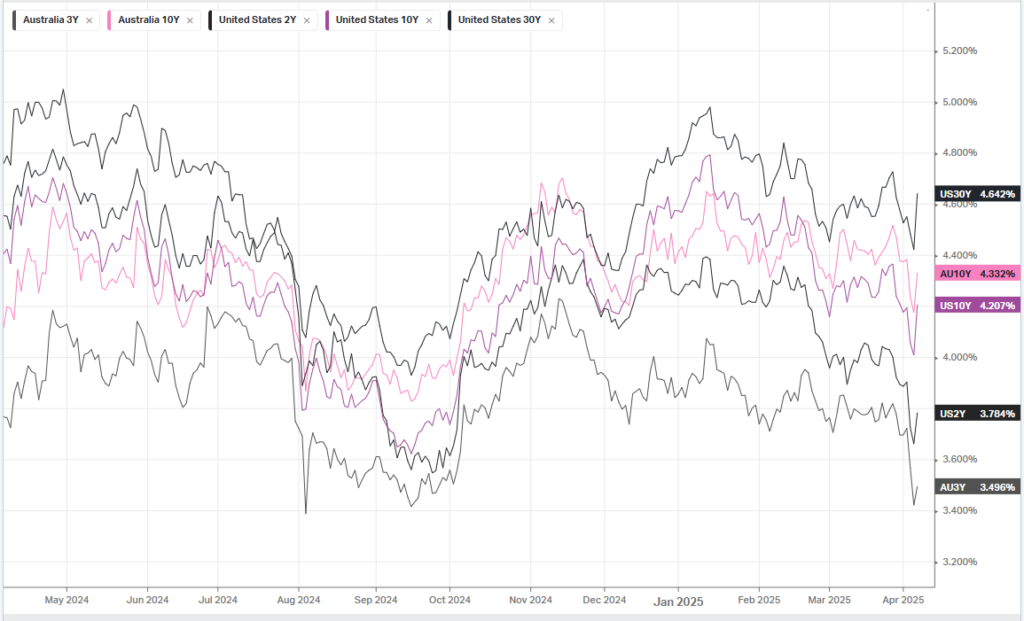

Bottom line is, the headlines are a distraction from the softening of US economic numbers, as uncertainty has made it impossible for businesses to plan ahead which will mean reductions in hiring, capex and growth, with the likely effect being softer earnings results in quarterly updates that begin this week with the banks.

Trump Tariff Tracker

- Trump’s Tariff Ultimatum to China: Trump threatened to impose an additional 50% tariff on Chinese goods if China does not withdraw its 34% retaliatory tariffs by April 8, 2025. This would bring total U.S. tariffs on Chinese goods to 104%.

- Market Volatility: Stocks briefly rallied on unconfirmed reports of a potential 90-day tariff pause, but the White House denied these claims. Markets remain volatile due to ongoing trade tensions.

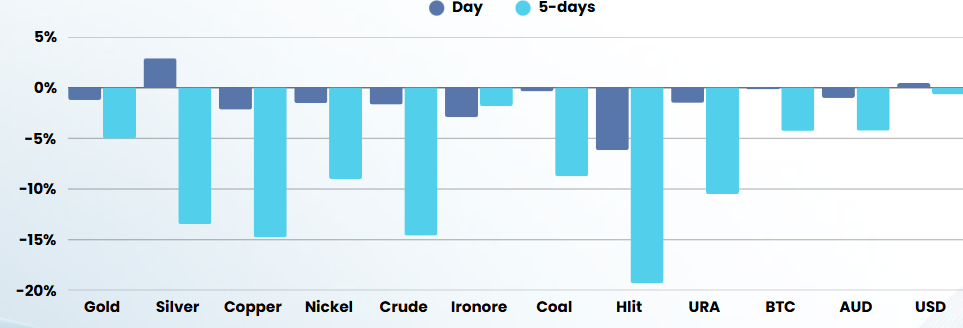

- Global Trade War Escalation: The U.S. has imposed a 10% baseline tariff on all imports, with higher rates for major trading partners. China has retaliated with 34% tariffs on U.S. goods, and the EU is considering coordinated responses.

- Negotiation Efforts: Despite tensions, Treasury Secretary Scott Bessent has been instructed to open talks on tariffs. Fifty countries have approached the U.S. for negotiations.

- Economic Concerns: The tariffs have sparked fears of inflation, recession, and a global trade war, impacting international commerce and economic stability

Investors are showing signs of extreme nervousness, with the CBOE Volatility Index (VIX)- the most well-known measure of market sentiment – surged above 60 intraday and settled at 50. To provide some context, a 50 reading in volatility (VIX) is a 1 in 16,000+ probability

ASX SPI 7392 (+0.75%)

We should see a good bounce today, given we are 4% higher in the futures. Who knows whether it will be sustained or reverse, the market is an hour-by-hour prospect at the moment and any attempt by me (or anyone else) to call a direction for the next week is a fools errand

After being in 50-60% cash and 10% gold since late January, we started to dollar cost average yesterday, allocation around a 1/5th of reserves