Overnight – Stocks surge as Trump & Republicans sweep US election

Equities surged to fresh record highs after Republicans and Donald Trump executed a comprehensive victory in the 2024 US election which Polls indicated would be a very tight race easing concerns the process could be drawn out before a victor was declared.

While news agencies globally were calling “a close race”, this was more about News channel ratings, than anything else.

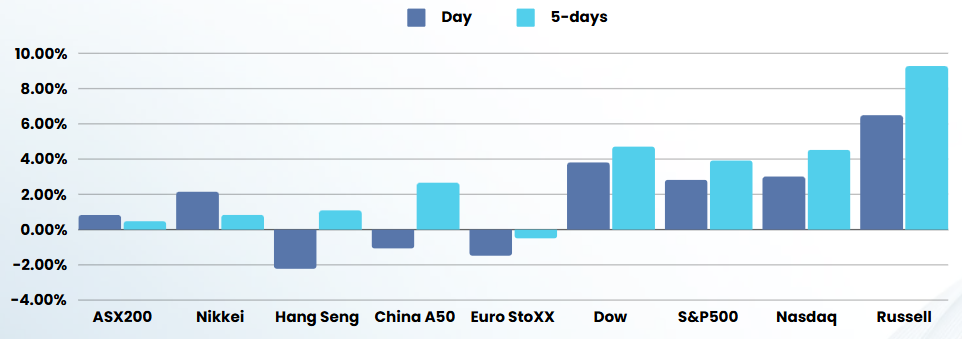

All the major indices hit record highs with investors expecting lower taxes, deregulation and a U.S. president who is not shy to weigh in on everything from the stock market to the dollar, although fresh tariffs could bring challenges in the form of a higher deficit and inflation.

While Trump was a factor, the clean result is what gave investors most confidence, with the Executive branch & the Senate in the hands of republicans. The House, which was assumed to remain in the Democrats hands, is also looking like swaying to the Republicans, giving Trump and the Republicans the power to apply their mandate

The reality is that recent elections globally have shown a consistent swing to the Right versus polling. Basically people are afraid of the backlash of voicing their support for right leaning governments during polling due to “cancel culture”, but, in private, vote more conservatively

Financials, up nearly 6%, were the best performing of the 11 major S&P 500 sectors. Banks, expected to benefit from loosening regulations under Trump, powered the gains, with the S&P 500 bank index up about 10%, its biggest daily jump in two years.

The small-cap Russell 2000 rallied more than 5% to a three-year high, with the domestically concentrated stocks seen as likely to benefit from easier regulations, lower taxes and less exposure to import tariffs. However, rising Treasury yields could hurt smaller companies, which tend to rely heavily on borrowing and are more sensitive to higher interest rates.

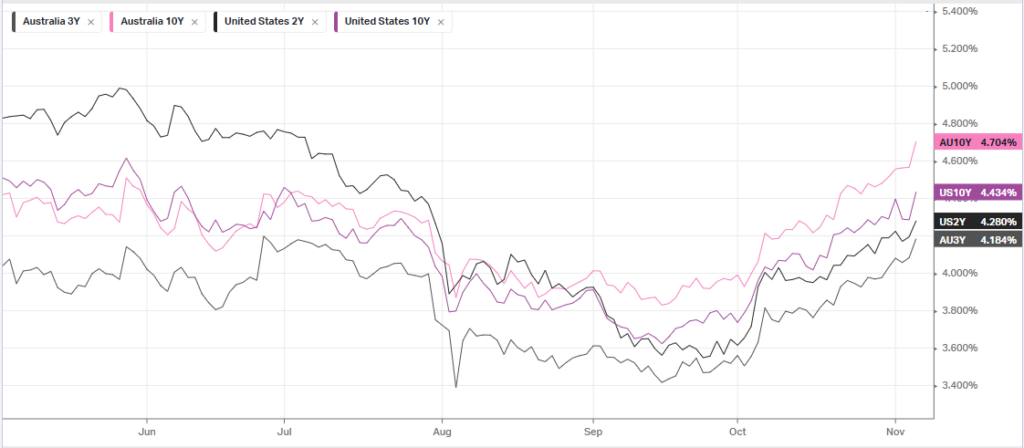

The rate-sensitive real estate and utilities sectors were among the day’s few decliners as investors assessed the chances of Trump’s policies boosting inflation and altering the Federal Reserve’s path of interest rates, which has been a key component of Wall Street’s recent rally.

The central bank is widely expected to ease the benchmark interest rate by 25 basis points at its policy-setting meeting ending on Thursday. However, traders have begun to trim bets for a cut in December and the number of reductions expected next year, according to CME’s FedWatch Tool.

Stock specific

- Tesla – Billionaire Elon Musk stands to benefit greatly from his ties with U.S. President-elect Donald Trump after the Tesla CEO became one of Trump’s most important supporters during the 2024 campaign. Tesla shares jumped 14% on Wednesday after Trump defeated Vice President Kamala Harris. Musk donated millions of dollars to Trump’s campaign. Trump has said he would establish a government efficiency commission headed by Musk to cut federal spending

ASX SPI 8229 (+0.25%)

Australian stocks will not enjoy the same surge of positivity and certainty with the Trump win. A number of friendly deals done between Left leaning governments like the inflation reduction act, AUKUS in the last few years may be in jeopardy. Add to those concerns about a trade war with China and increased tariffs

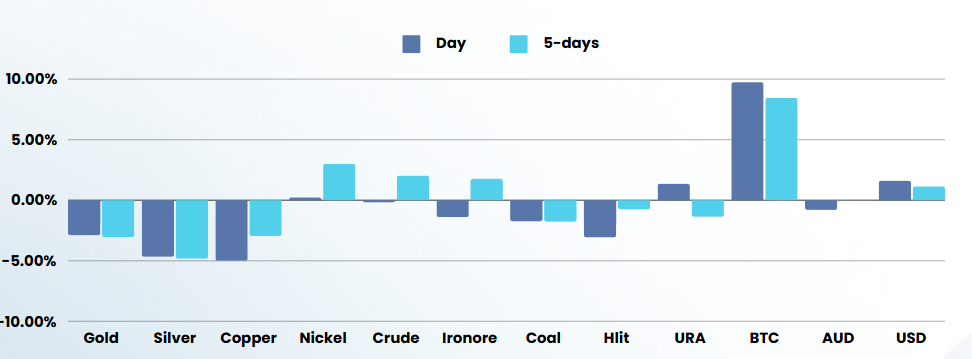

The policy uncertainty wont be helpful for the materials sector, nor will the strength in the USD, denting gold and other commodities