Overnight – Market mixed as investors digest a feast of earnings

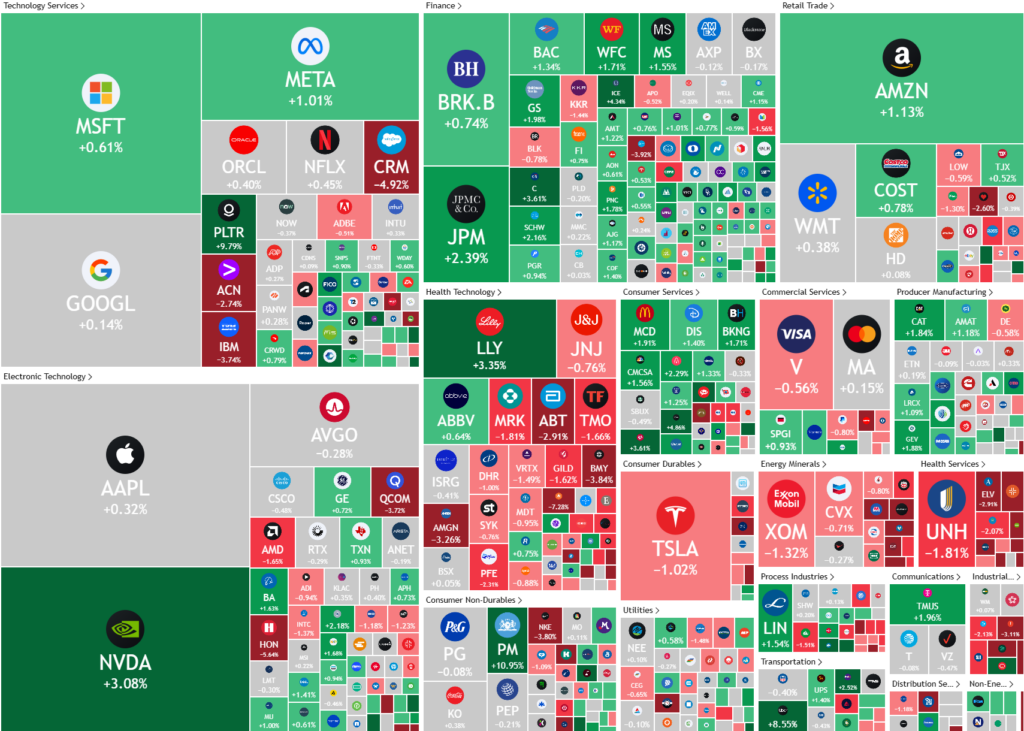

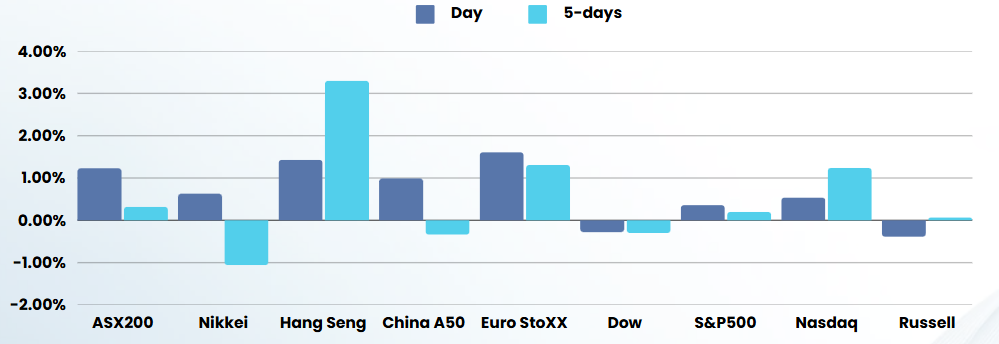

Stocks were mixed overnight as investors assessed a deluge of corporate earnings as well as more labor market data ahead of the crucial monthly jobs report due Friday.

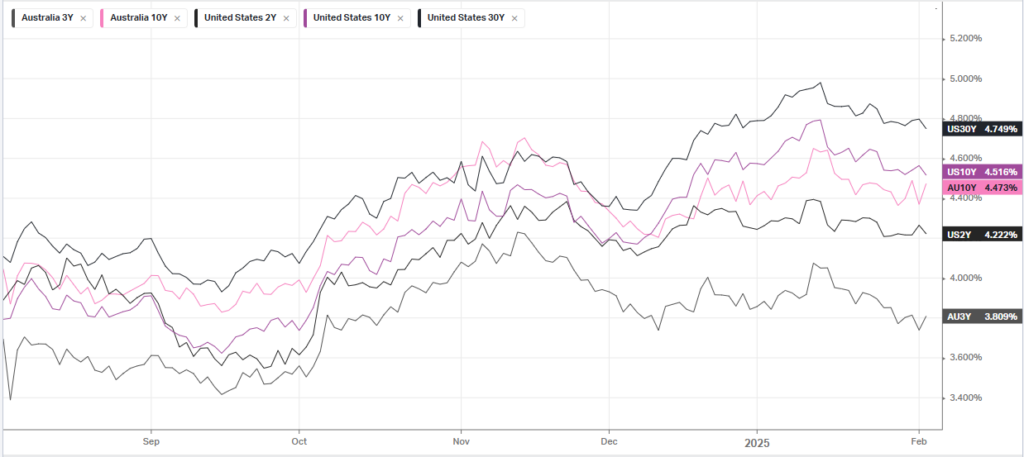

Initial jobless claims came in at 219,000 in the week ended on Feb. 1. The prior week’s figure was slightly revised higher by 1,000 to 208,000, while economists had expected a reading of 214,000. The data comes ahead of the release of the all-important nonfarm payrolls report for January on Friday, which should provide a glimpse into labour demand that is closely monitored by Federal Reserve policymakers. Economists are predicting that the US economy added 169,000 jobs last month, down from 256,000 in December.

Earlier in the session, the Bank of England cut its key rate amid concerns about a re-acceleration in inflation and slowing growth. Money markets are now favouring three more 25-basis-point reductions this year

Corporate Earnings

- com Inc – fell more than 3% in afterhours trading following the report. reported softer revenue guidance for the current quarter on Thursday, offsetting fourth-quarter results that beat analysts’ forecasts as the tech giant’s cloud growth met expectations and growth in North America improved. Amazon Web Services, its fast-growing cloud revenue segment, grew to 19% to $28.8 billion in-line with analyst expectations.

- Qualcomm – stock slid more than 4% after the chipmaker forecast no revenue growth for its lucrative patent licensing business in 2025 after its license with China’s Huawei expired. The segment was expected to represent another leg of growth for the company.

- Arm Holdings – sank over 4% after its earnings outlook for the current quarter was in line with expectations, denting hopes that AI demand will spur outsized sales for the chip designer.

- Skyworks Solutions – which makes chips for consumer electronics such as smartphones, fell 24% after warning that it expects Apple (NASDAQ:AAPL) to reduce demand for its parts to be used in the upcoming iPhone 17 cycle.

- Eli Lilly – stock rose 3.4% after the drugmaker posted a surge in fourth-quarter revenue thanks in part to a spike in demand for its obesity treatment Zepbound.

- Yum! Brands – stock soared over 9% after the fast food holding company surpassed estimates for fourth-quarter comparable sales, as value offerings from Taco Bell attracted budget-conscious US consumers to the popular Tex-Mex chain.

- Ford – stock fell over 7% after the auto giant forecast weaker annual profit at a time when the threat of US tariffs on Canada and Mexico, which have been temporarily paused, continues to stoke uncertainty.

ASX SPI 8466 (-0.21%)

Australian shares are poised to open lower in line with cautious trading on Wall Street, as investors await January’s US jobs data to assess the potential for further interest rate cuts by the Federal Reserve.

Despite the ASX’s predicted fall, Goldman Sachs’ revised expectations that the iron ore price will average $US95 a tonne in 2025, a prediction that makes Australian iron ore miners, look very cheap

Company Specific

- Nick Scali – profits fell by one third in the half-year to December compared to the prior year, owing to losses in the company’s UK division. The company reported a 30.2 per cent decrease in profit after tax to $30 million, after its inclusion of UK operations in its reporting for the first time saw the loss-making division weigh on Nick Scali’s profit result. That also saw revenues increase 10.8 per cent. For the company’s Australian and New Zealand operations, however, net profit after tax hit $36 million – above guidance of a range between $30 million and $33 million. Nick Scali declared an interim dividend of 30¢ a share, fully franked.