Overnight – China responds to Trump tariff war giving knockout blow for global stocks

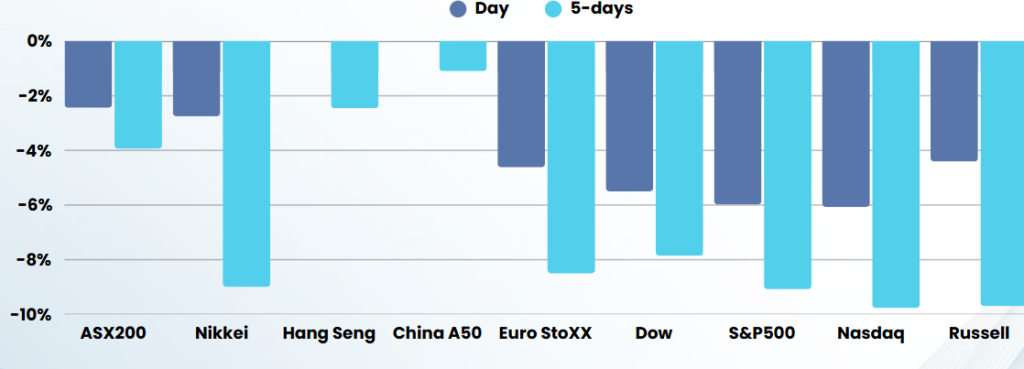

Global equities plummeted for a second straight day on Friday, confirming the Nasdaq was in a bear market and the Dow into correction territory, as China responded to US tariffs, escalating a global trade war, sparking fears of a global recession

Fallout from Trump’s sweeping tariffs stoked fears of a global recession, wiping trillions of dollars of value from U.S. companies. Highlighting growing panic among investors, the CBOE Volatility Index, or Wall Street’s fear gauge, closed at its highest level since April 2020.

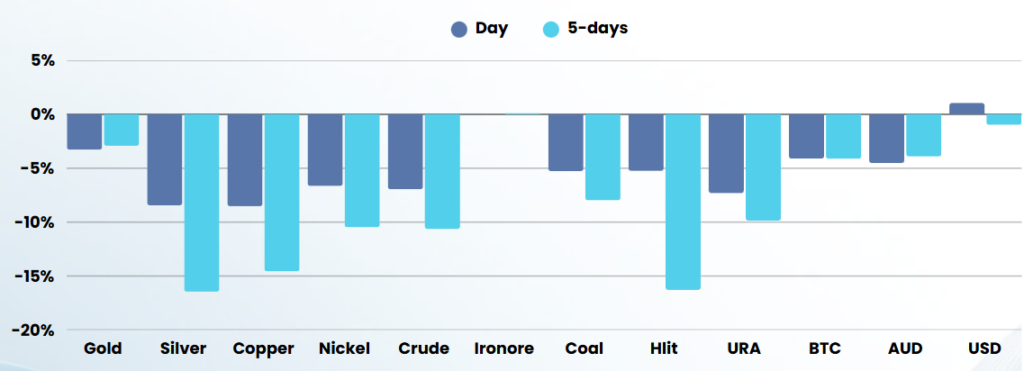

Commodities and energy were not immune with heavy losses across all industrial commodities.

The U.S.-China trade war has escalated significantly, leading to sharp declines in global stock markets and heightened fears of a recession. China announced a 34% tariff on U.S. goods in response to President Donald Trump’s tariffs on Chinese imports. This move marked a substantial escalation, with China also imposing controls on rare earth exports and expanding its “unreliable entity” list. The Nasdaq Composite entered bear market territory, and the Dow Jones Industrial Average experienced a correction, marking its worst week since the pandemic.

The impact on global markets has been profound. Investment bank J.P. Morgan raised its estimate of a global recession by year-end to 60%, citing escalating trade tensions. The International Monetary Fund (IMF) warned that the tariffs pose a significant risk to the global economic outlook. Internationally, Japan’s Prime Minister described the situation as a “national crisis,” while European markets also declined. The EU is divided on how to respond, with some countries urging caution and others advocating for stronger countermeasures.

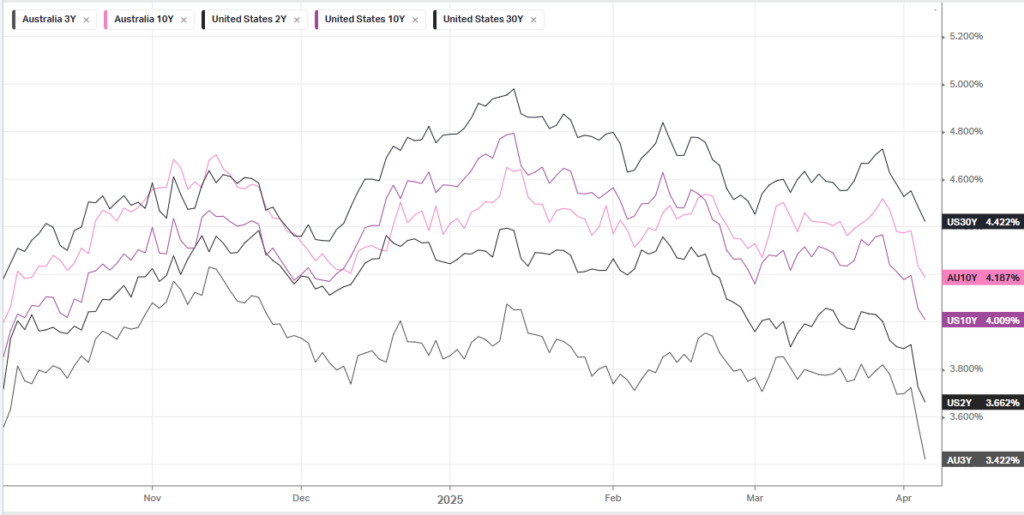

In the U.S., there are political divisions over the trade policies. Republican Senator Ted Cruz warned of the risks to the U.S. economy but expressed hope that the tariffs could be used as leverage. Trump remained defiant, asserting that his policies would ultimately benefit the U.S. economy. Federal Reserve Chair Jerome Powell noted that the tariffs could lead to higher inflation and slower growth, emphasizing the need for careful monetary policy decisions. Despite stronger-than-expected U.S. job data, the tariffs could test labour market resilience in the months ahead.

The situation remains volatile, with ongoing impacts on global markets and economies. Trump’s administration views the market turbulence as a necessary adjustment, but many analysts and policymakers remain sceptical. As the trade war continues, global economic stability hangs in the balance, with investors and policymakers closely watching for any signs of resolution or further escalation.

ASX SPI 7388 (-4.28%)

Today is going to be ugly, very, VERY ugly. For those not in cash, it is best not to look because you are now stuck for the next few months at the very least.

For those in cash, today may be the day to start dollar cost averaging.

Unfortunately, the next few months is unlikely to improve as Trump and China administrations will play chicken with the world economy, both unlikely to want to lose face