Overnight – Stocks head higher as America goes to the polls

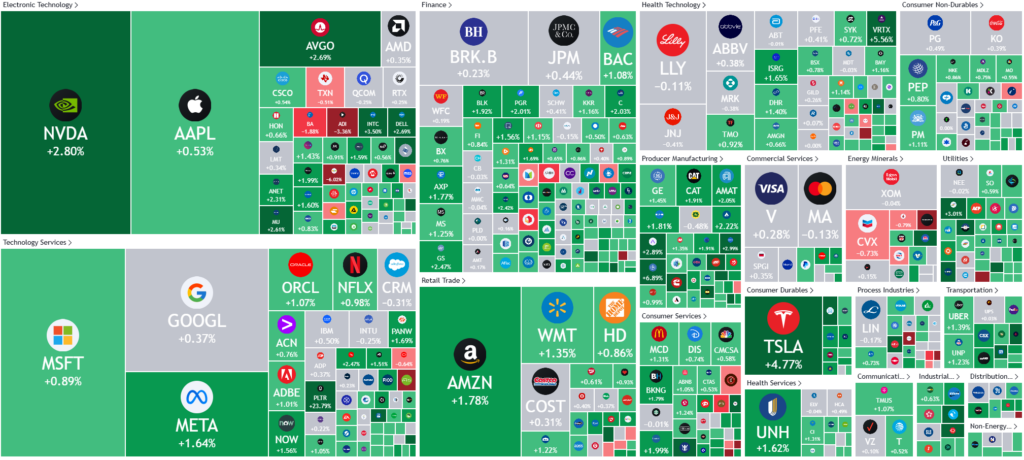

Equities headed higher overnight with bullish bets emerged as voting began in the “Trump vs Harris” show, which has turned out to be more tightly contested presidential election than first thought (at least that what the media would like you to believe)

Investors were on edge as recent polls showed Donald Trump and Kamala Harris were neck-and-neck in the upcoming presidential election, with the results likely to dictate trade and tax policies over the course of the next four years. While earlier polls had shown Trump gaining some ground over Harris, this trend appeared to have reversed going into the election.

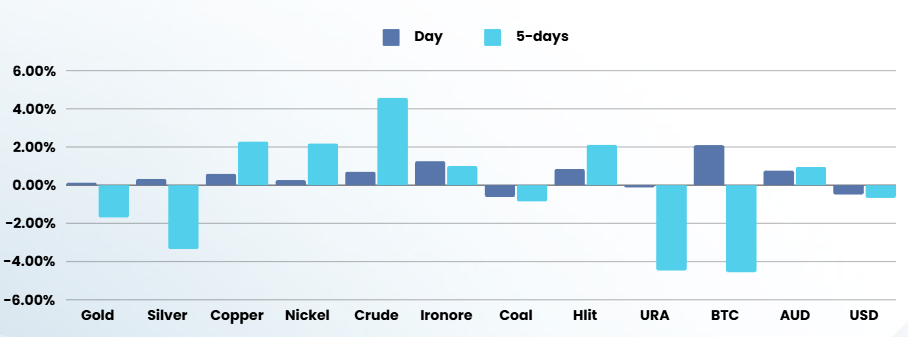

Trump is expected to roll out more inflationary policies and impose tougher trade tariffs on China- a scenario that could bode poorly for the big tech sector, while Harris has proposed increased taxes on high net worth individuals and big businesses, while easing the tax burden on families.

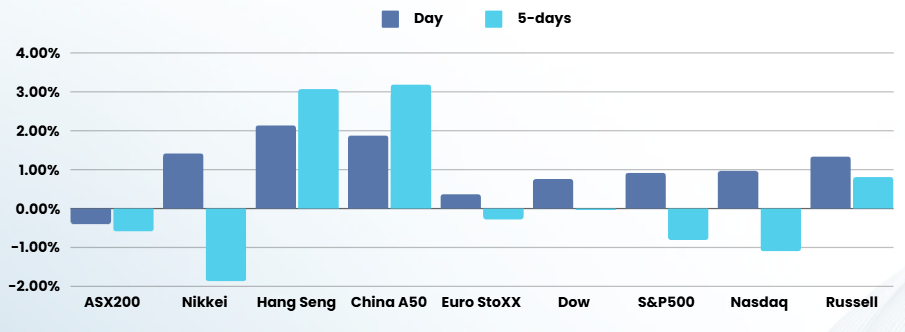

Also limiting activity Tuesday is the proximity to Thursday’s Federal Reserve policy-setting meeting, with the central bank widely expected to cut rates by 25 basis points, after a 50 bps cut in September. Recent data showing sticky inflation and strength in the U.S. economy have cast some doubts over just how much interest rates will fall in the coming months, given that the Fed has signalled a data-driven approach to any further easing. Still, weak nonfarm payrolls data released on Friday showed the labour market was cooling, which could keep the Fed biased towards more easing.

Focus will be squarely on an address by Chair Jerome Powell on the bank’s plans for future rate cuts.

Results are expected to start flowing through around midday AEDST

A clear result will be the most bullish scenario for the equity market, as any uncertainty will see the market get nervous

Donald Trump is currently a $1.61 favourite with the bookmakers (the most reliable source of exit polls)

ASX SPI 8188 (+0.50%)

Today is likely to be very whippy, with exit poll results from the US trickling through the day, potentially moving global markets sharply back and forth.

Yesterdays RBA meeting and subsequent, non-movement of policy may affect retailers and real estate stocks, as Gov Bullock was clear that the strength in the labour market and consumer spending means there will be no rate cut here for a while. The Gov was smart enough not to make predicting comments on timing, the folly that cost her predecessor his job, but stated that, Australia didn’t hike as far as the rest of the world to protect the labour market, and doesn’t have to cut as quickly as some counties.