Overnight – Google sinks on AI Capex concerns

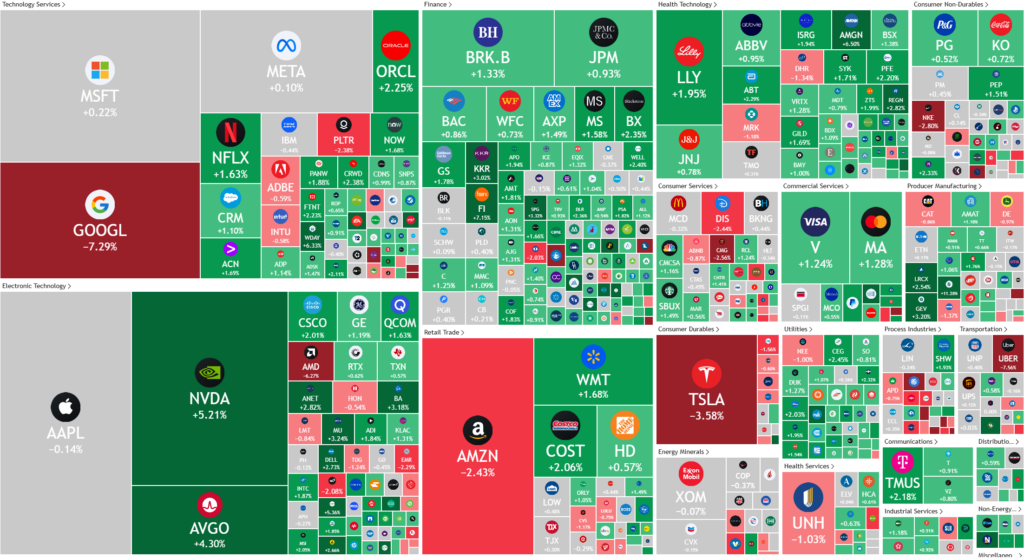

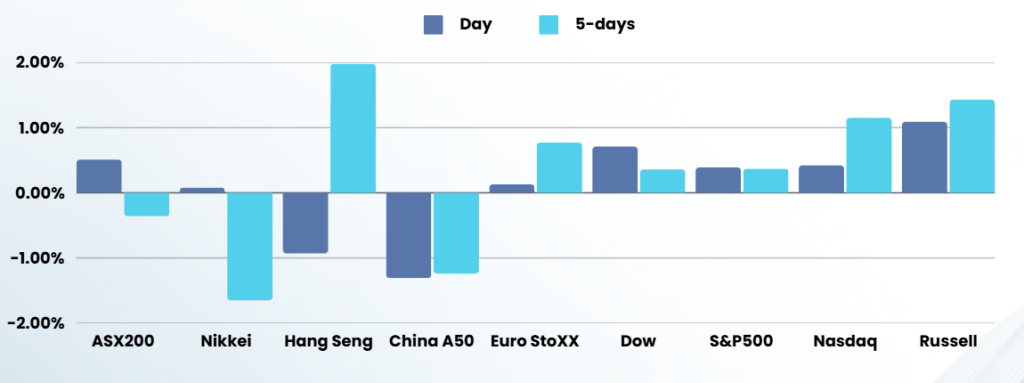

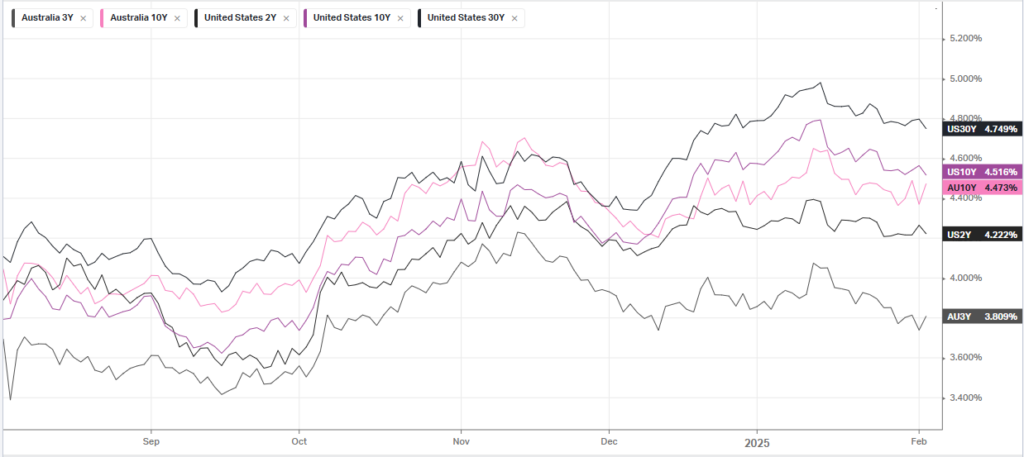

Stocks were mixed and benchmark Treasury yields slid overnight as disappointing earnings from Google and mixed economic data counterbalanced easing jitters of a spreading global trade war.

Markets appeared to look past U.S. President Donald Trump’s declaration on Tuesday that the United States would take over the Gaza Strip, a move that underscored the likelihood of market volatility under the new administration. On the economic front, a stronger-than-expected pick-up in ADP’s private payrolls data was offset by a surprise deceleration in the services sector, while record high imports pushed the U.S. trade deficit sharply wider.

Also overnight, Federal Reserve officials pointed to the large policy uncertainty around tariffs and other issues arising from the early days of President Donald Trump’s administration as among the top challenges in figuring out where to take U.S. monetary policy in the months ahead.

Chicago Fed President Austan Goolsbee warned that ignoring the potential inflationary impact of tariffs would be a mistake, whereas Richmond Fed President Thomas Barkin said it remains impossible at this early stage to know where cost increases from any tariffs might be absorbed or passed along to consumers.

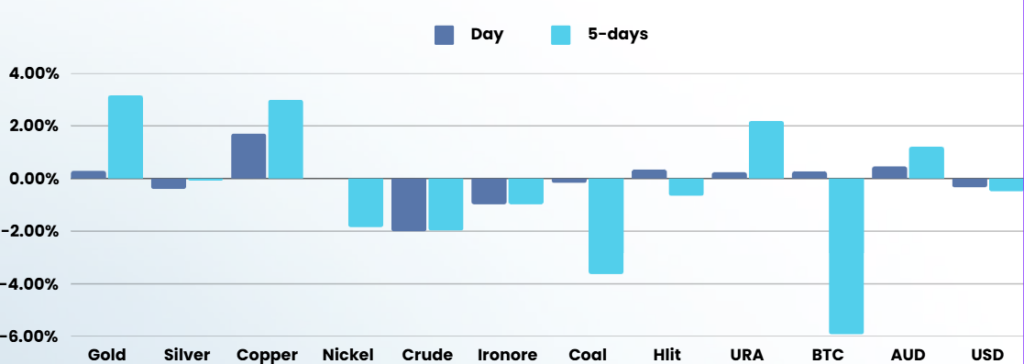

In commodities and energy, crude fell 2.30% to $71.03 per barrel on the day, while gold resumed its rally as trade war jitters continue to attract investors to the safe-haven metal, sending it to fresh record highs.

Corporate Earnings

- Google – slid 7.5% as the company outlined plans to increase capital expenditures this year by far more than Wall Street analysts had expected, while its cloud unit revenue disappointed Wall Street estimates, exacerbating investor fears around profitability. Shares in Alphabet sank by more than 8% in early U.S. trading on Wednesday.

Alphabet said it expects capital spending to amount to $75 billion in 2025, well above the $58 billion pencilled in by analysts and $52.5 billion last year. Concerns have swirled around heavy AI spending by Big Tech names like Alphabet, especially in the wake of the emergence of a low-cost AI model from Chinese start-up DeepSeek last week.

- Apple – slipped 1.2% as Bloomberg News reported that China’s antitrust regulator was preparing for a possible investigation of the iPhone maker.

- Uber Technologies – dropped 7.2% after the ride-hailing company forecast current-quarter bookings below estimates.

ASX SPI 8463 (+0.50%)