Overnight – Markets drift into election and central bank decisions

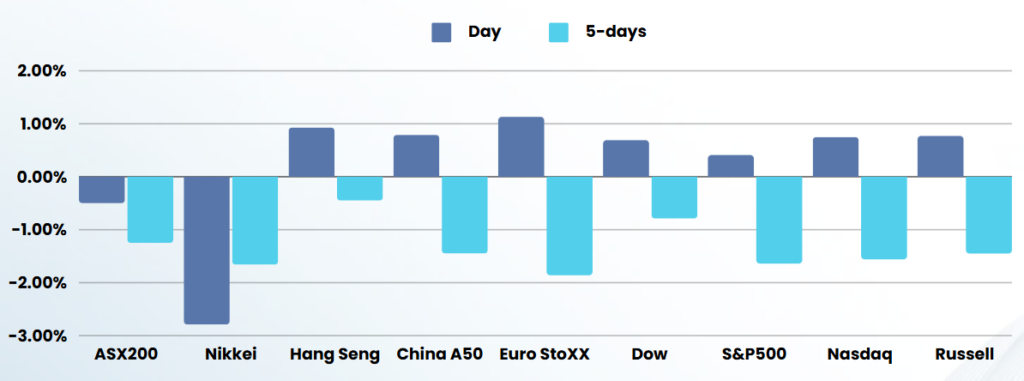

Equities drifted lower overnight as investors opted for caution ahead of the presidential election and the Federal Reserve’s two meeting.

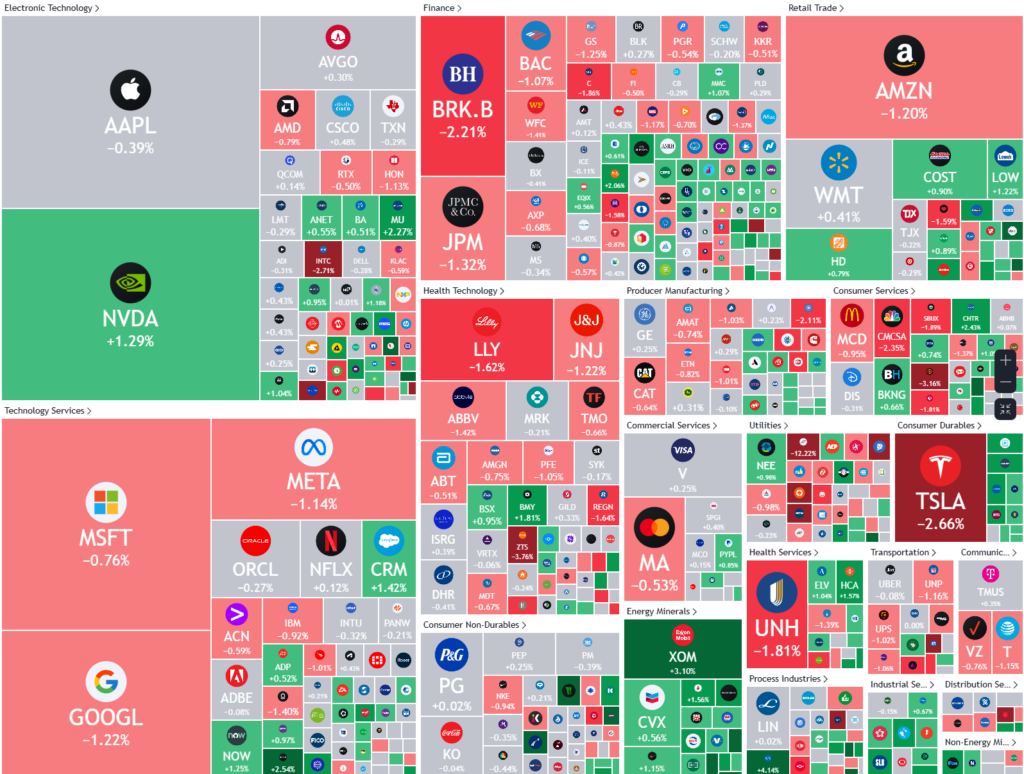

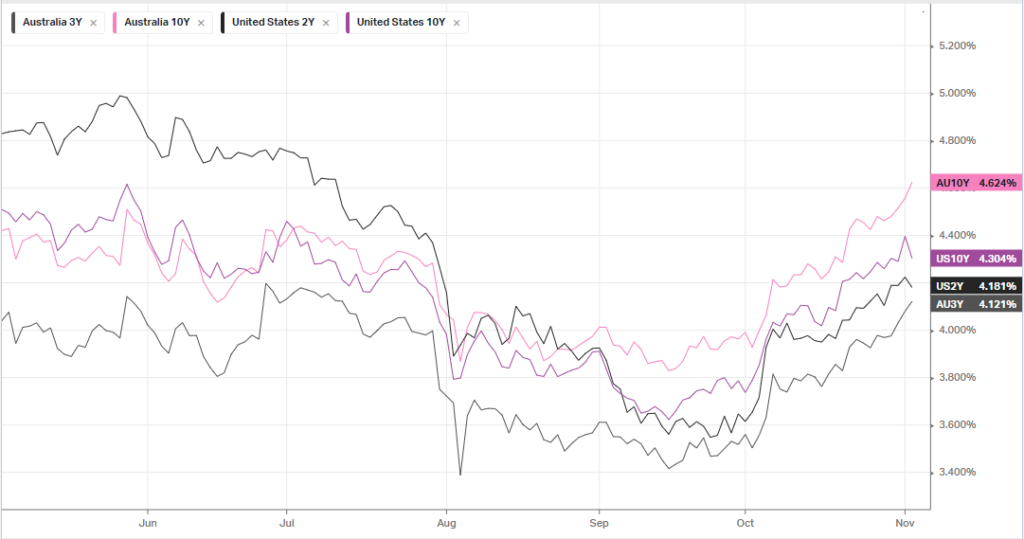

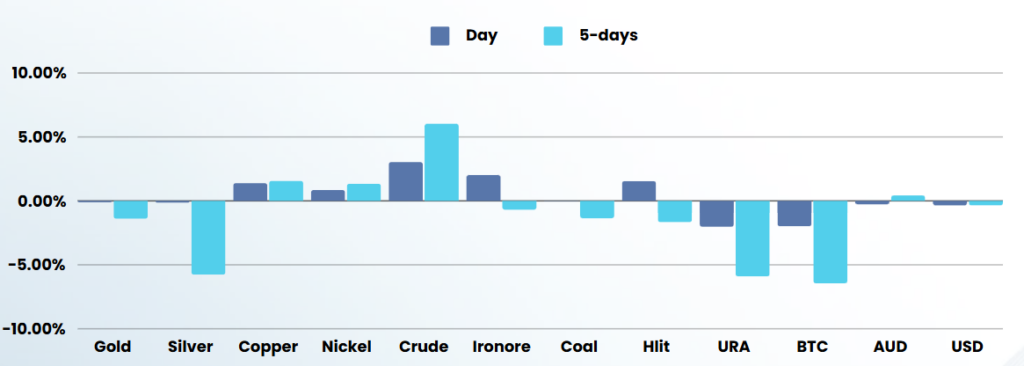

Investors were largely on edge before presidential elections on Tuesday, with recent polls showing Donald Trump and Kamala Harris were set for a tight race. Recent increases in the dollar and Treasury yields showed some investors were positioning for a Trump victory, which is expected to result in more inflationary policies. Analysts indicating that the outcome could significantly impact the market performance, especially the Big Tech sector.

NVIDIA gained as the chipmaker is set to join the Dow Jones Industrial Average on Friday, replacing struggling chipmaker intel.

The quarterly earnings season is set to continue, with around a fifth of the companies in the benchmark S&P 500 due to unveil their latest quarterly earnings this week.

The U.S. dollar slipped on Monday as investors pulled out of Trump trades, which have benefited in recent weeks from speculation that Republican former President Donald Trump is more likely to win the presidential election. Harris has experienced improving momentum on election gambling sites and has a slight lead on PredictIt, while Polymarket continues to show Trump as favourite.

Stock specific

- Berkshire Hathaway – had weaker than expected Q3 operating earnings totalled of $10.1B in the third quarter missed analyst forecasts, sending the stock more than 2% lower. This isn’t surprising as Warren Buffets fund has a record amount of $325B in cash, as he offloaded Bank of America and Apple shares

ASX SPI 8157 (-0.37%)

Markets are on election & Central bank watch worldwide, as the US election dominate the headlines, a number of central banks meeting this week and some horse race in Melbourne.

Half an hour before that horse race in Melbourne, the RBA will deliver it’s rate decision at 230pm AEDST. We are not expecting the RBA to deliver any move in rates, however the recent strong consumer spending may prompt a hawkish outlook to calm down consumers into Christmas