Overnight – Tariff and economic concerns threatening long term rally

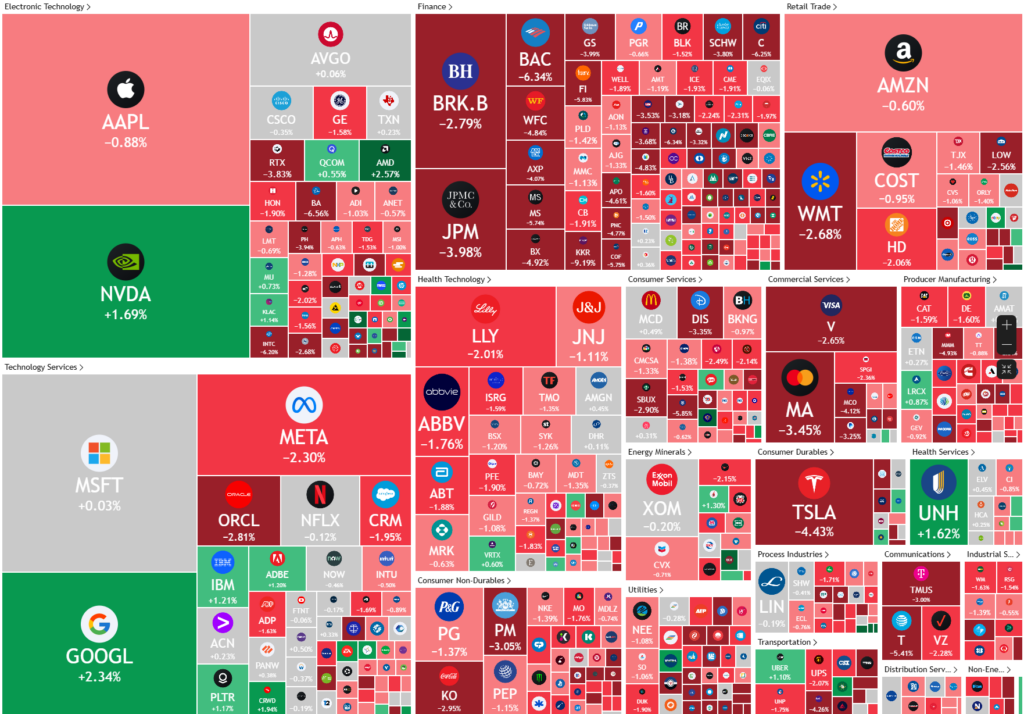

Tariff and economic concerns thwarted an intraday comeback led by Nvidia, as broad based selling emerged as investors start to question the chance of the 2 year bull market continuing

The only positives on the board were NVIDIA up 1.7% and Google +2% kept broader-market losses in check, although they lost half of their gains in the last hour

Retailers reported weak earnings further adding to the economic concerns as Target and Best Buy fell 3% and 13% respectively

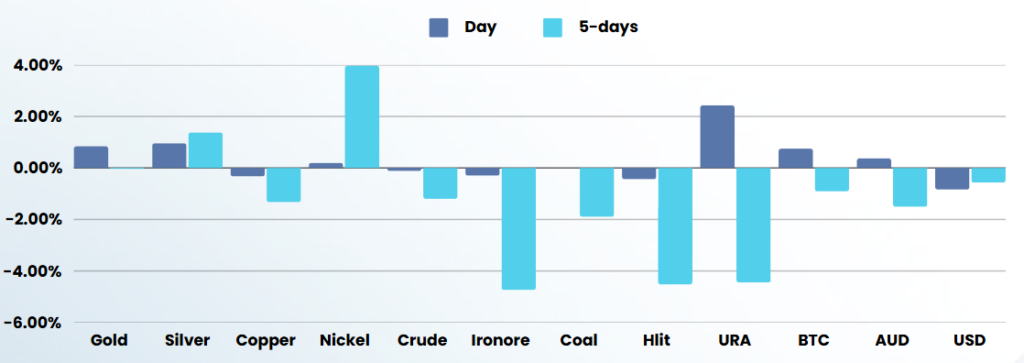

Tariff retaliation from China, Canada and Mexico increased fears of a trade war, as President Donald Trump threatened to retaliate against retaliation against the tariff war he initiated. “Please explain to Governor Trudeau, of Canada, that when he puts on a Retaliatory Tariff on the U.S., our Reciprocal Tariff will immediately increase by a like amount!,” Trump said in a post on Truth Social. Earlier, Canada’s Prime Minister Justin Trudeau had said Ottawa would respond to Trump’s tariffs by introducing its own 25% levy on roughly $20 billion in U.S. goods.

The tariff threats come as 25% on imported goods from Mexico and an additional 10% tariffs on Chinese goods imported to the U.S. also went into effect on Tuesday. In response, China’s finance ministry said it will impose tariffs of 15% on chicken, wheat, corn, and cotton imports from the U.S., while soybeans, sorghum, pork, beef, fruits and vegetables, aquatic products, and dairy will face a 10% tariff. Mexican President Claudia Sheinbaum said Tuesday that there is no justification for the new levies on imports from her country, adding she will announce retaliatory tariffs this weekend.

The current S&P 500 earnings estimates might not fully account for the potential risks associated with these tariffs, Citi strategists said in a note.

Trump is set to deliver his first address Congress later on Tuesday. The president is expected to lay out the thinking behind his domestic and foreign policy plans. Earlier on Tuesday, Reuters reported that Trump could announced that he is signing the minerals rights deal with Ukraine during his address

Company Earnings (retailers)

- Target – stock fell 3% after the big-box retailer unveiled a cautious outlook for sales growth in its current financial year, flagging uncertainty surrounding U.S. President Donald Trump’s trade policy.

- Best Buy – stock dropped 13% despite the retailer posting a surprise rise in quarterly comparable sales for the all-important holiday shopping season, as customers took advantage of promotions to snap up high-end appliances and gaming consoles.

- Nordstrom – stock rose 0.3% after the department store operator beat expectations for quarterly comparable sales and said its Chief Financial Officer Cathy Smith would step down.

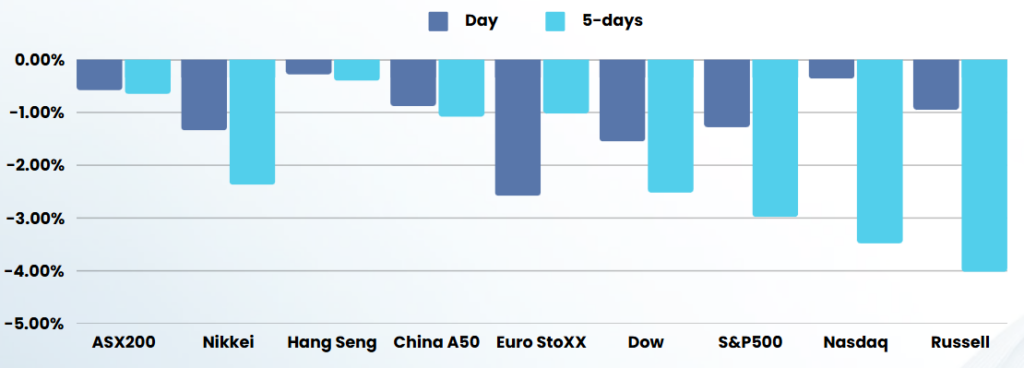

ASX SPI 8022 (-0.96%)

The ASX will continue to fall today as investors begin to realise the Trump era will be full of uncertainty which may create some political uncertainty here in AU. Australia has missed the tariff war from both sides so far, and with China putting specific tariffs on Agricultural products from the US, which would require increased imports from Australia

Company Specific

- Woodside – An activist shareholder group has alleged that Woodside potentially misled investors over oil demand forecasts used to justify its investment in the Trion project in Mexico.

- Rio Tinto investors have told executives that they should abandon plans for a multibillion-dollar share issuance and instead borrow more if it is decided that the mining giant needs more liquidity,