Overnight – Tech drives market higher as Salesforce rolls out next phase AI

Tech drove the market to its 56th record high for 2024, as AI leaders, Salesforce reported higher uptake of AI agents, giving investors confidence that companies will start to monetize the new technology

Salesforce stock soared 11% after the cloud-based software company beat third-quarter revenue expectations and raised the lower end of its annual revenue forecast, helped by robust spending on its enterprise cloud portfolio. Most importantly, the increased interest by partners and customers in artificial intelligence (AI) and the release of the vendor’s AI readiness index, which underlined that users were already reporting benefits of using AI agents.

“Our research shows that 41% [of the tasks done] within an enterprise are repetitive tasks,” he added. “Imagine if we can unlock that 41% within businesses to help organisations do completely different things – re-engage with customers, connect with people.”

This is the first real world proof of AI monetization, albeit in efficiency, rather than increased revenue

U.S. economic activity has expanded slightly in most regions since early October, with employment growth “subdued” and inflation rising at a modest pace and businesses expressing optimism about the future, the Federal Reserve said on Wednesday in a summary of surveys and interviews from across the country known collectively as the “Beige Book.”

Federal Reserve Chair Jerome Powell said the Fed can take a “little more cautious” approach in cutting rates toward neutral as the economy remains in good shape. “We can afford to be a little more cautious as we as we try to find neutral rate,” Powell said in an interview by Andrew Ross Sorkin at New York Times DealBook Summit on Wednesday.

The Fed chief pointed to a stronger-than-expected economic growth, a robust labour market and slightly higher inflation as reasons for the Fed to take a cautious approach toward finding a neutral – one that neither stimulus nor weighs on economic growth.

“The economy is stronger than we thought it was going to be in September…the labour market is better, and inflation is coming a little higher,” Powell said in what was his final public address ahead of the Fed’s Dec. 17-18 meeting.

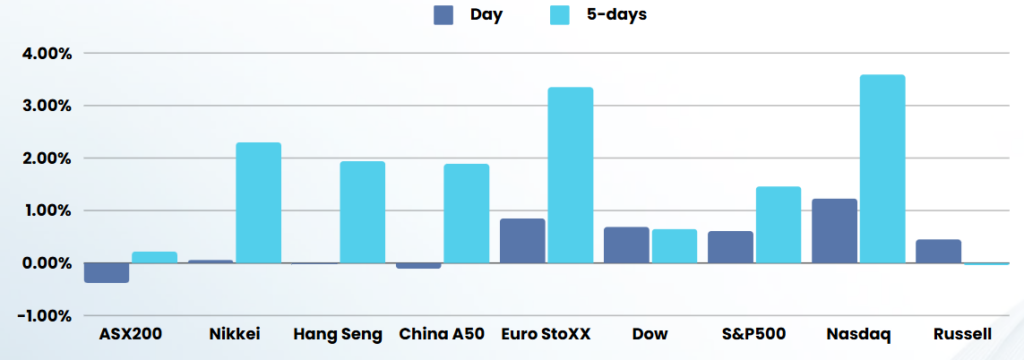

ASX SPI 8495 (+0.11%)

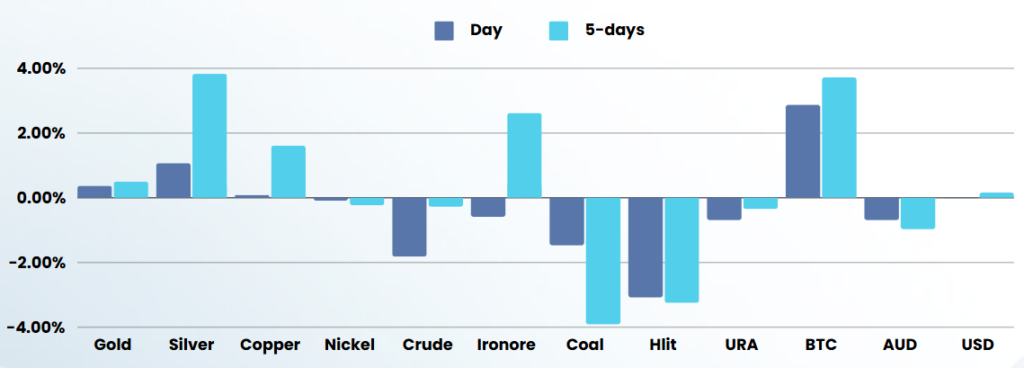

While the ASX will likely have a positive day, the offshore leads were more in the tech space, a small weighting in our index, while Financials, materials and energy were quite soft overnight.

US Payrolls on Friday night is the next catalyst the market will be looking at, until then, we don’t expect the market to move significantly

Company specific

- Fisher & Paykel Healthcare shares trade ex-dividend.

- HMC Capital has entered into agreements to acquire French renewable energy developer Neoen’s Victorian assets for $950 million.