Overnight – Amazon helps equities shrug off weaker jobs data to end higher

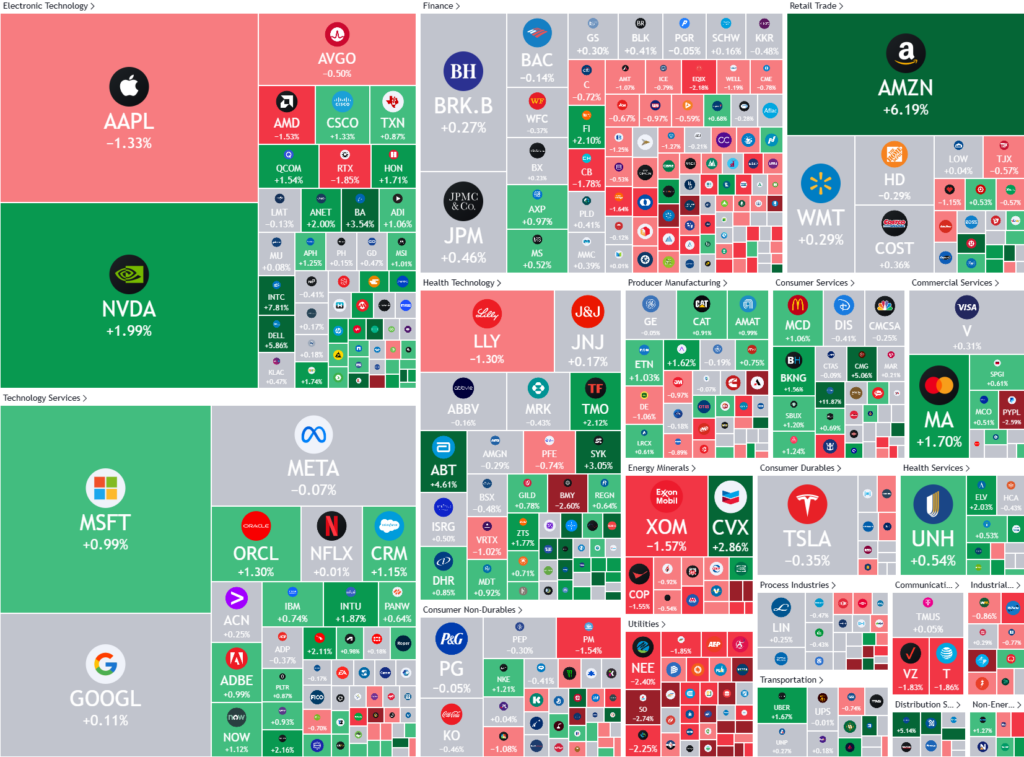

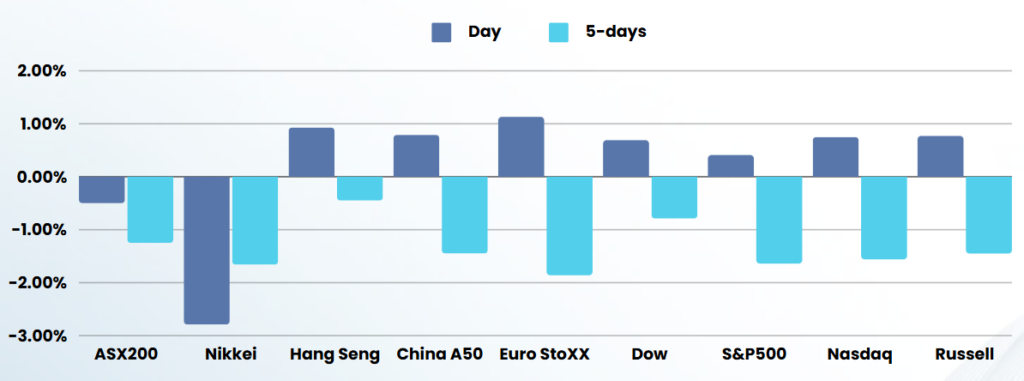

Stocks ended higher on Friday, rebounding from the previous day’s sell-off as Amazon’s strong earnings countered a significant drop in U.S. job growth in October.

Amazon.com rose 6.2% after it reported earnings on Thursday that revealed strong retail sales, boosting profit above Wall Street estimates. Meanwhile, Apple fell 1.2% as investors worried about a decline in its China sales during its most recent quarter. Other so-called Magnificent Seven members Meta Platforms and Microsoft also reported earnings earlier this week and warned on AI-related infrastructure costs, dragging the Nasdaq down on Thursday.

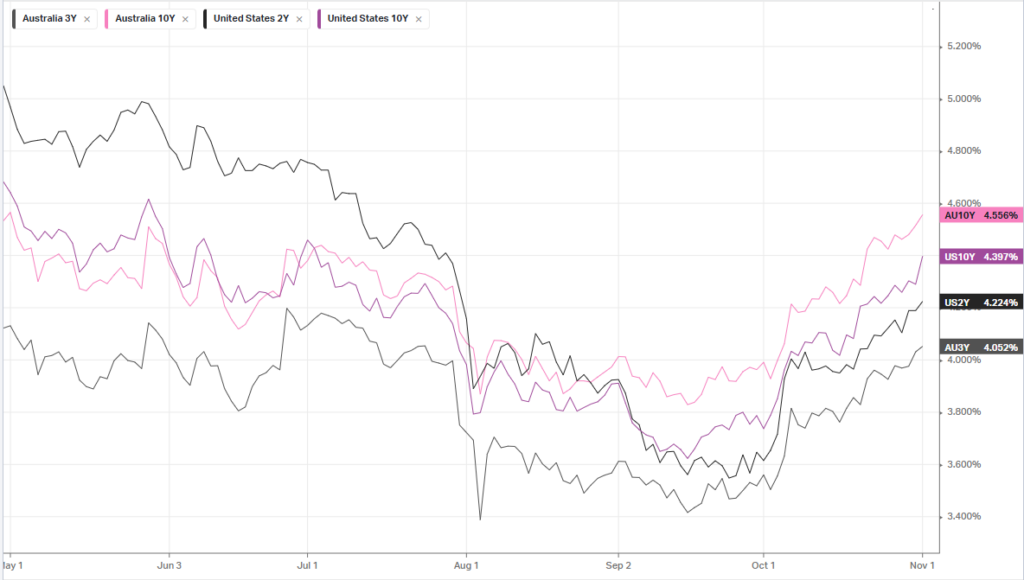

Equity markets brushed off weak U.S. October nonfarm payrolls data, given disruptions from hurricanes and strikes. The data showed an increase of 12,000 jobs, much smaller than economists’ estimate of a 113,000 rise. However, the unemployment rate held steady at 4.1%, reassuring investors the labor market remained on solid ground. After the jobs data was released, investors largely stuck to bets that the central bank would cut rates by 25 basis points in November.

The U.S. election is on investors’ minds, with many analysts predicting a close presidential race and some uncertainty over the final outcome. The Fed’s November meeting kicks off the following day.

Amazon.com’s gains lifted the Consumer Discretionary index 2.4% to a more than two-year high, while utility and real estate stocks were the biggest sectoral decliners.

Stock specific

- Intel – jumped 7.8% after a better-than-expected revenue forecast. An index of chip stocks rose 1%.

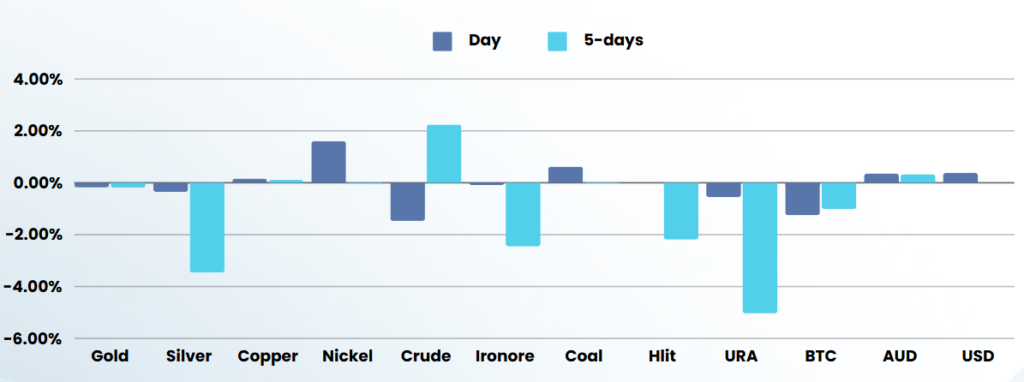

- Chevron= shares rose 2.8% after the company beat third-quarter profit estimates on higher oil output.

ASX SPI 8170 (+0.4%)

We are unlikely to move much today as all eyes are on the US election. Oil prices are likely to find some support this week after OPEC+ announced on Sunday that it is delaying its December production hikes by one month, said ANZ in a note. Westpac Banking reported a net profit of $6.9 billion for FY2024, down 6 per cent from a year ago. Net interest income edged up 2 per cent to $18.7 billion in the year.