Overnight – MAG7 savaged as Trump confirms tariffs to begin

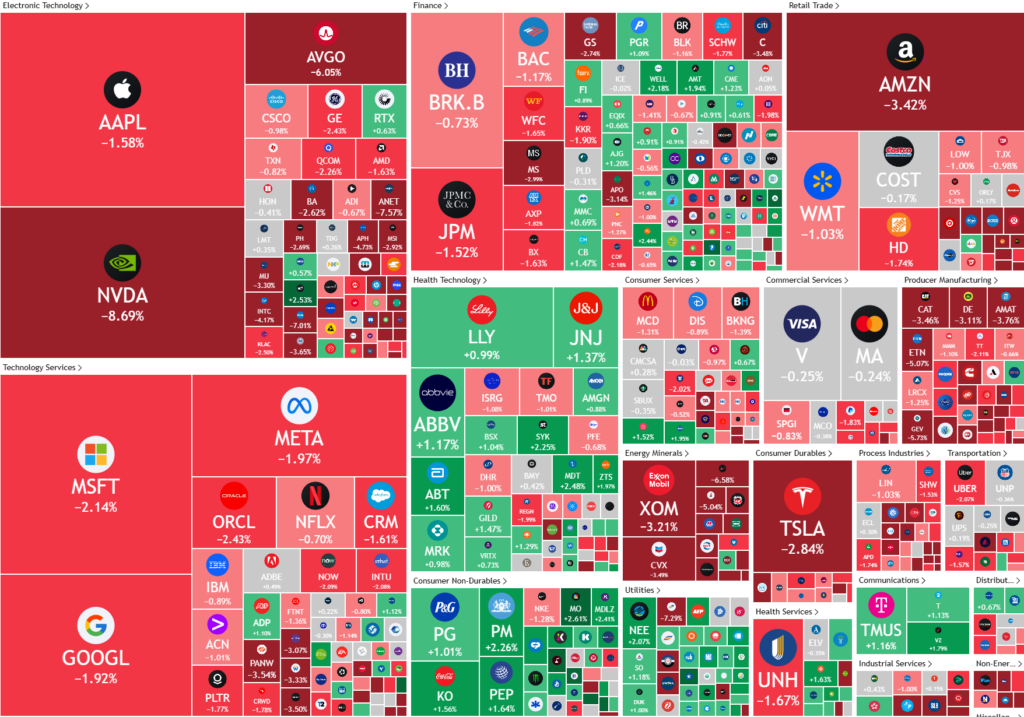

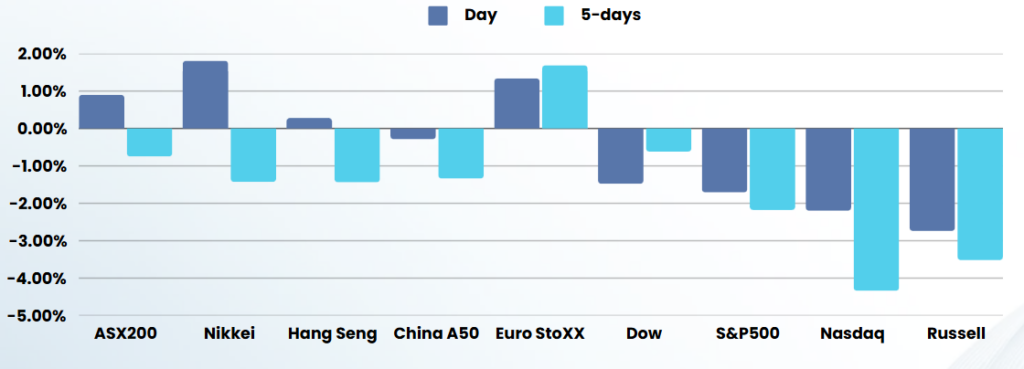

Stocks were savaged overnight, as President Donald confirmed that tariffs on Mexico and Canada will begin on Tuesday, stoking further jitters about the economy just as data continue to surprise to the downside.

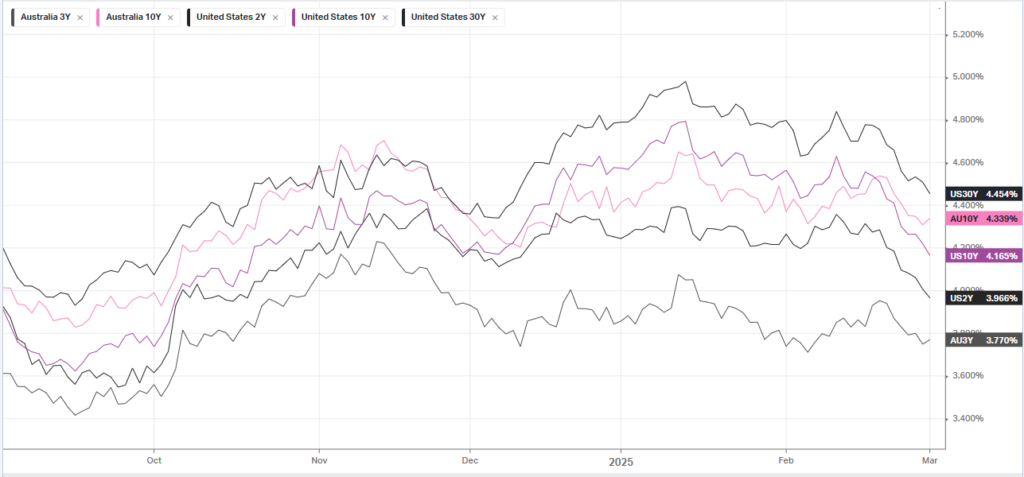

The Institute for Supply Management’s manufacturing purchasing managers’ index increased by 50.3 last month, down from 50.9 in January, Economists had predicted a reading of 50.6. U.S. manufacturing activity expanded marginally for the second month in a row in February after 26 consecutive months of contraction. The data comes ahead of a busy economic calendar, with a crucial nonfarm payrolls report for February set to round off the week.

NVIDIA Corporation fell more than 9%, dragging the broader chip sector lower after The Wall Street Journal reported Sunday that Chinese buyers are navigating around U.S. export bans to order the company’s Blackwell chips. Intel Corporation gave up earlier gains which had followed a Reuters report that Nvidia and Broadcom are running manufacturing tests with Intel.

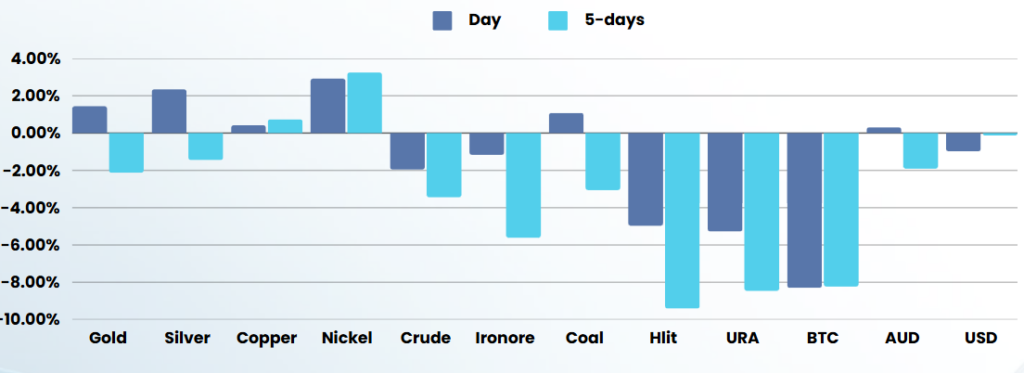

Bitcoin gave up intraday gains to trade more than 8% lower despite optimism over a U.S. crypto strategic reserve.

Trump on Sunday repeated his plans for a Crypto Strategic Reserve, stating that he had directed an executive group to proceed with the project. He claimed that Bitcoin, Ether, XRP, Solana, and Cardano will comprise the reserve.

ASX SPI 8155 (-0.86%)

The ASX will be in for a rough day with Iron ore falling after the 4pm close yesterday and the horrible US lead. Defensive sectors will do better than most, while the high PE stocks and tech sector will likely receive the brunt of the selling

In Australia, the Reserve Bank of Australia is releasing minutes from its February policy meeting at 11.30am AEDT. The Australian Bureau of Statistics’ January retail sales data and fourth-quarter net exports of GDP are also set to be published on Tuesday.