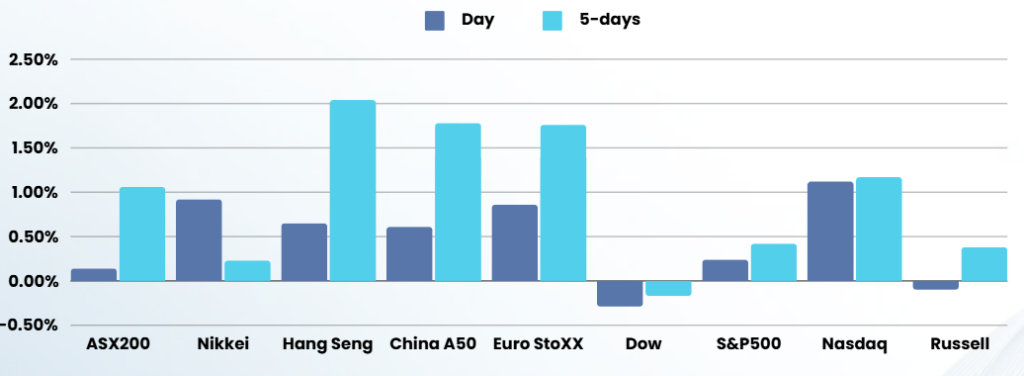

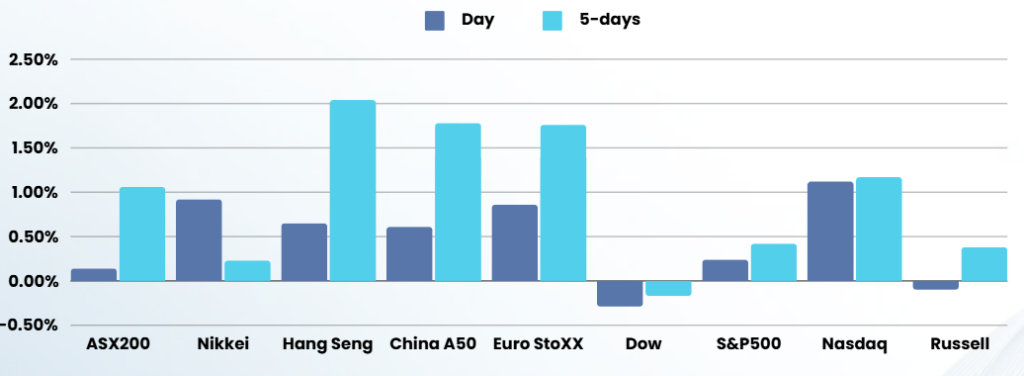

Tech stocks led the market higher overnight underpinned by an intel-led rise in chip stocks and an ongoing rally in Tesla.

A tri of tech stocks pulled the market higher as Intel jumped more than 3% after announcing that chief executive Pat Gelsinger had resigned following a rocky tenure that saw the chipmaker’s shares plunged as it fell further behind in the AI race. Super Micro Computer rose more than 28%, providing a further lift to chip stocks after the AI server maker said that a special committee had found no evidence of misconduct among the company’s leadership. Tesla jumped 3%, adding to its recent gains after Roth MTM upgraded the stock to buy from neutral on expectations that the EV maker CEO Elon Musk’s close relationship with President-elect Donald Trump will benefit the company.

Investors are digesting tariff-related comments from President-elect Donald Trump, who stated over the weekend that he would impose 100% tariffs on BRICS nations—including China, Russia, and India—if they pursue a new currency to rival the U.S. dollar. This added a geopolitical edge to market concerns.

Trump on Sunday threatened to impose “100% tariffs” on the BRICS* bloc of countries, which includes China.

Trump criticized the bloc’s attempts to form its own currency and shift away from the U.S. dollar, threatening to cut the bloc off from U.S. trade over the move. He called for commitments to the dollar from the bloc.

Trump’s latest comments come after he had last week threatened higher import tariffs against China, Mexico and Canada, rattling global markets with the prospect of more protectionist policies in the U.S.

Investors also feared retaliatory measures from U.S. trading partners, especially China, which could spark a renewed trade war between the world’s biggest economies.

Trumps tough talk is what the Romans would call “bread and circuses” a rallying call to the masses to sure up support while he is President elect, the real test will come in January

Ahead of a speech by Chair Jerome Powell on Wednesday, remarks from Fed officials continued to be closely watched for fresh clues on monetary policy.

Atlanta Fed president Raphael Bostic said Monday that he continues to expect that inflation is slowing toward the Fed’s 2% target, though added that further incoming data would need to assess for whether it would be appropriate to cut rates at the Fed’s Dec. 17-18 meeting.

Nonfarm payrolls data for November will likely play a key role in cementing to cooling bets on a rate cut later this month

*BRICS – Brazil, Russia, India, China & South Africa. Other members include Iran, Egypt, Ethiopia and UAE

ASX SPI 8528 (+0.73%)

The local market is likely to notch its own record high today after but the rally will be mixed as tech and materials drag the market up and the heavy banking sector in the US overnight drags the financials down.

Improving Chinese PMI data and the unfolding Trump/BRICS feud could be good for the Australian miners, as we remain relatively neutral and a key source of imports

Economic data is released at 1130AEDST – balance of payments, net exports and government spending Q3 data releases.

Company wise, Collins Foods issues earnings and the Bank of Queensland hosts an annual general meeting. Incitec Pivot shares trade ex-dividend.