Overnight – Hotter than expected Inflation data derail’s Fed’s “goldilocks” scenario

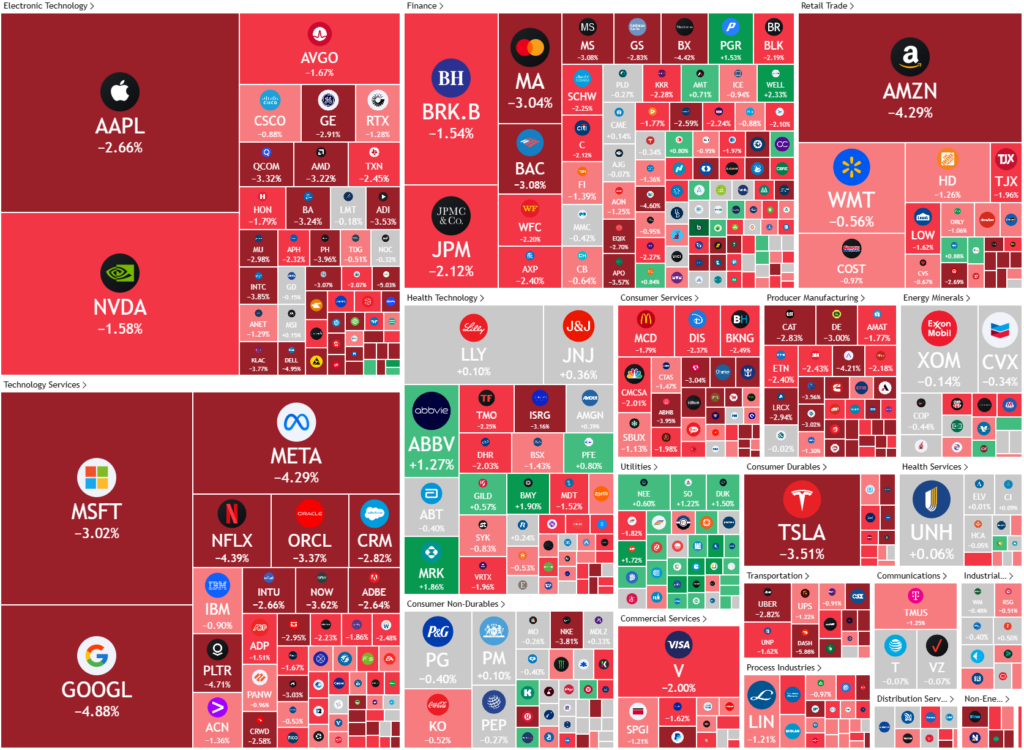

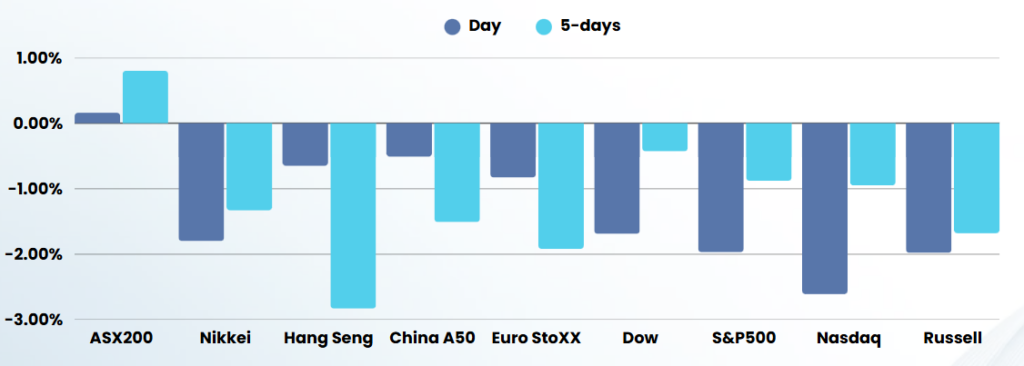

Stocks had their 3rd broadest sell off of the year, with the fall sealing the worst week for 2025 after widely-watched inflation data came in slightly hotter than expected, denting hopes of the Fed’s “goldilocks” scenario of sooner rate cuts as investors wrestle with ongoing trade tariff uncertainty.

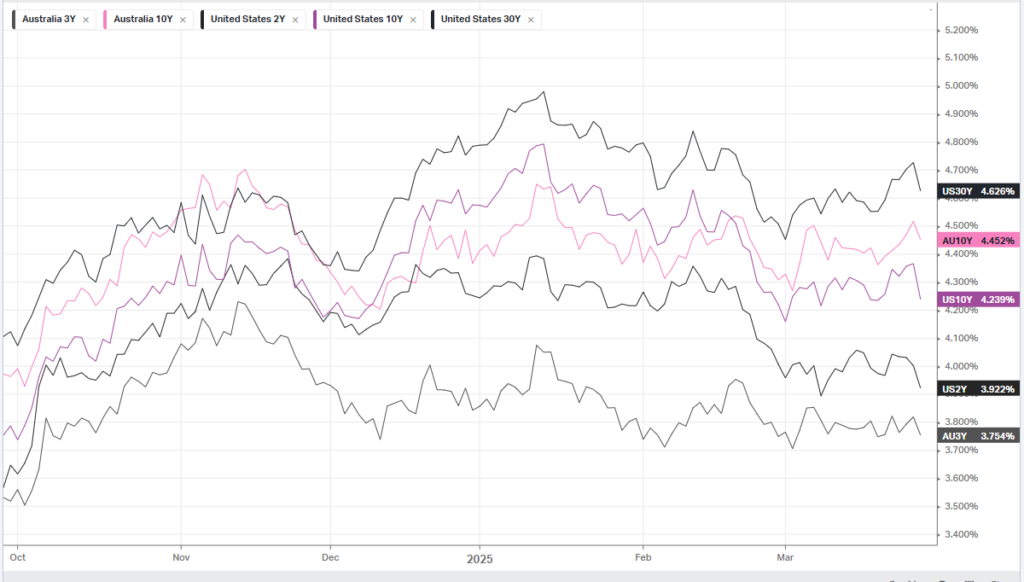

Risk sentiment remains weak on Wall Street, particularly after the “core” personal consumption expenditures price index, an inflation metric closely monitored by the Federal Reserve, edged higher in February, providing the U.S. central bank with more reason for caution with rate cuts in the upcoming year. The headline PCE price index grew 2.5% on an annual basis during the month, unchanged from January’s reading, but the widely-watched so-called “core” metric, which strips out more volatile items like food and fuel, came in at 2.8% annually, slightly above January’s revised higher 2.7%. The figure was expected to be unchanged. The acceleration in core inflation, however, calls into question that “goldilocks” scenario the Fed has been calling.

U.S. consumer sentiment, meanwhile, fell to a more than two-year low just as long-term inflation expectations jumped to a 32-year high as worries about the impact of tariffs persist.

The numbers come as fears are growing that U.S. President Donald Trump’s aggressive trade agenda, which includes levies on both friends and adversaries alike, could refuel inflationary pressures and weigh on broader economic activity. Also, over the weekend President Trump expressed anger saying he was “pissed off” at Russia’s Putin about a resolution of The Ukraine situation, saying he would impose further trade penalties on Russian oil.

Company Specific

- Athleisure wear company, Lululemon Athletica shares slumped 14% as weak guidance from the athletic apparel brand overshadowed better-than-expected financial results for the holiday quarter.

- Additionally, the Financial Times reported that the European Union is set to impose minimal fines on Apple and Meta Platforms under its Digital Markets Act next week in a bid to avoid worsening tensions with U.S. President Donald Trump.

ASX SPI 7929 (-1.13%)

The ASX is in for a rough start to the week with the US locking in its worst week of 2025 and political uncertainty around the local election and Trumps April 2nd deadline for tariff announcements he is calling “Liberation Day” unlikely to inspire investors to be buying the dip.

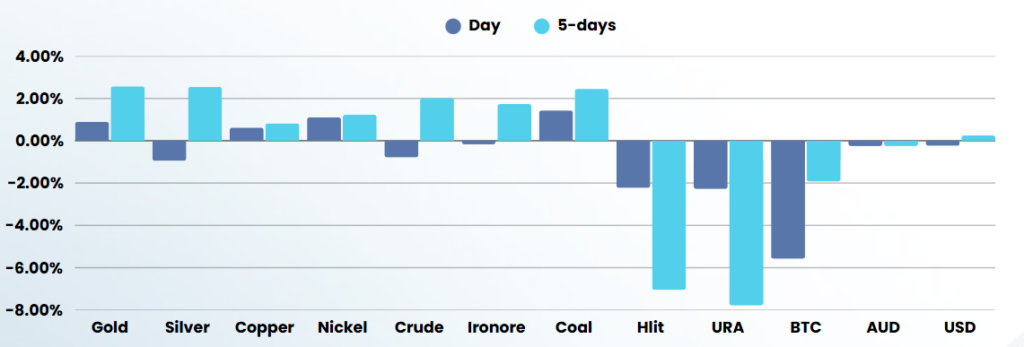

Defensive sectors like consumer staples and healthcare sectors are unlikely to fare best while materials should fare ok as the switch to real assets at cheap valuations will look attractive.