Overnight – Gold hits fresh record as Trump policies pose risks

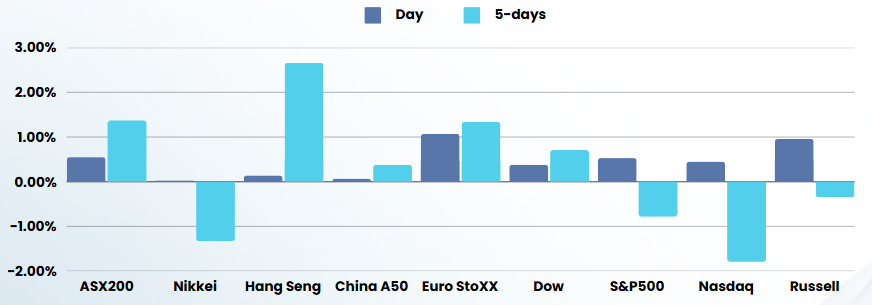

Stocks clawed back session losses to finish slightly higher, as investors cheered updates from Meta and Tesla , while the dollar dipped on increasingly erratic tax/tariff policy threats , boosting gold prices to fresh records

The market has been engaged in a push and pull of continued strong earnings against a backdrop of a less accommodating Federal Reserve and persistent inflation, added to that, President Donald Trump’s random policy announcements got another soundbite, saying the U.S. would put a 25% tariff on imports from Mexico and Canada.

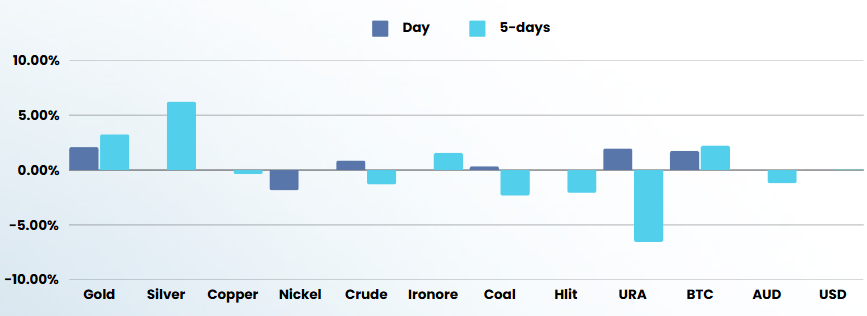

Gold prices have risen sharply this week, partly driven by nervousness over Trump’s tariff plans and the possibility – albeit distant – of him imposing duties on precious metals imports.

Tesla shares rose 3.3% and were among the biggest boosts to the S&P 500. CEO Elon Musk vowed to launch long-awaited cheaper models in the first half of 2025 and start testing an autonomous ride-hailing service in June. The comments overshadowed its quarterly results that fell short of expectations.

Also helping the S&P 500, Meta shares gained 1.4% after the company beat Wall Street’s fourth-quarter revenue estimates but said current-quarter sales may not meet forecasts. IBM shares jumped 12.2% after the company surpassed fourth-quarter profit expectations. Shares of Microsoft fell 6.1% after the company forecast disappointing growth in its cloud computing business.

Investors also took in comments from the CEOs of Meta and Microsoft defending their heavy investments in artificial intelligence, days after Chinese startup DeepSeek unveiled a breakthrough in cheap AI models that rattled Wall Street and triggered a sell-off in AI-linked stocks.

In economic news, the US economy grew by 2.3% in the fourth quarter, easing at an annualized rate from a pace of 3.1% in the July-September quarter, according to advance data from the Commerce Department on Thursday.

Economists had expected the reading to decelerate to 2.7%.

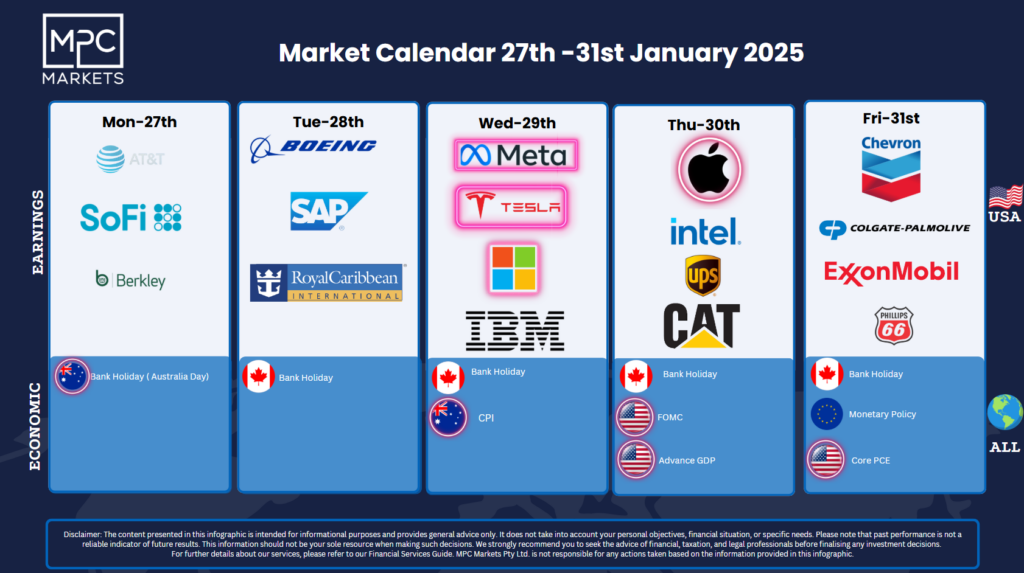

Corporate Earnings

- Microsoft – shares fell 6% despite reporting quarterly results that beat estimates, as its cloud revenue and AI spending disappointed. But tech bull Wedbush said that the “AI piece of the MSFT story was robust and ahead of Street estimates as $13 billion AI ARR was $1 billion above our estimate.” This speaks to the “massive momentum Redmond is seeing in the field as more enterprises head down this path,” it added.

- Meta – gained more than 1% on better-than-estimated fourth-quarter revenue, although it flagged that current-quarter sales may not meet expectations.

- Tesla – shares rose nearly 3% after the electric vehicle giant noted that it was driving to slash costs and roll out a cheaper EV model.

- Caterpillar – fell more than 4% after construction equipment maker reported fourth-quarter revenue that fell short of estimates and forecast lower sales for 2025 owing to shrinking dealer inventories.

- United Parcel Service – fell 14% after the courier company reported soft revenue guidance for 2025 and announced that it would slash deliveries for Amazon by more than 50%. UPS guided revenue of $89B for 2025, down from $91.1B seen in 2024 and missing consensus of $94.9B.

ASX SPI 8,421 (+0.21%)

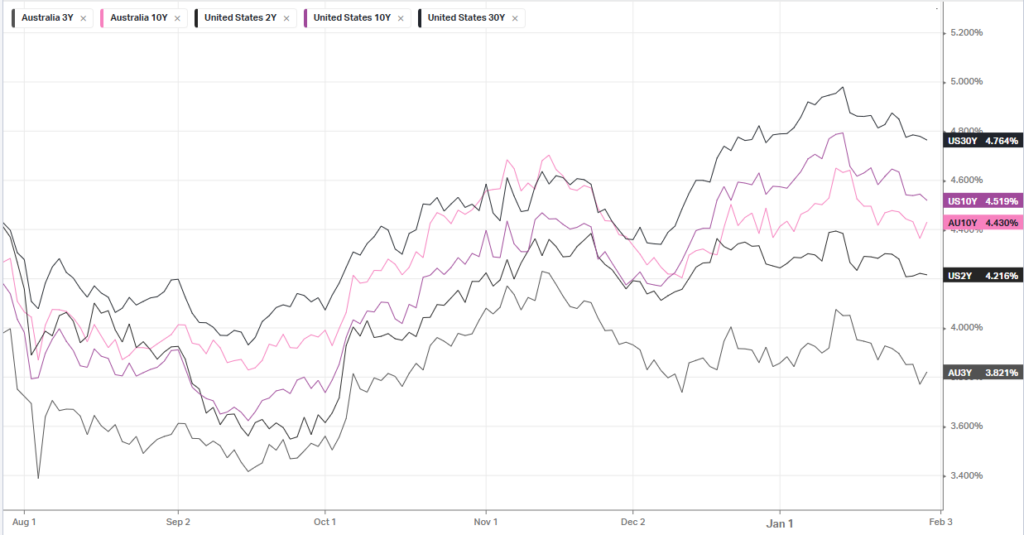

Australian shares are poised to reset a record high at the open, spurred by a broad rally on Wall Street overnight and hopes for an imminent interest rate cut in Australia. Gold stocks will be lifted by the fresh record in gold

Company Specific

- Capricorn Metalshas acquired iron ore miner Top Iron’s Mummaloo mining project and assets in a $3.5 million deal.

- Insurance giant IAGwill release $200 million of the $380 million provision it had initially set aside against a class action after the Federal Court declassed the proceedings.

- Genesis’ takeover vehicle has extended its offer period for a $311 million bid for ASX-listed Pacific Smilesto February 11. The period was set to end on Thursday.