Overnight – Earnings the only focus for investors as Google “beats the Street”

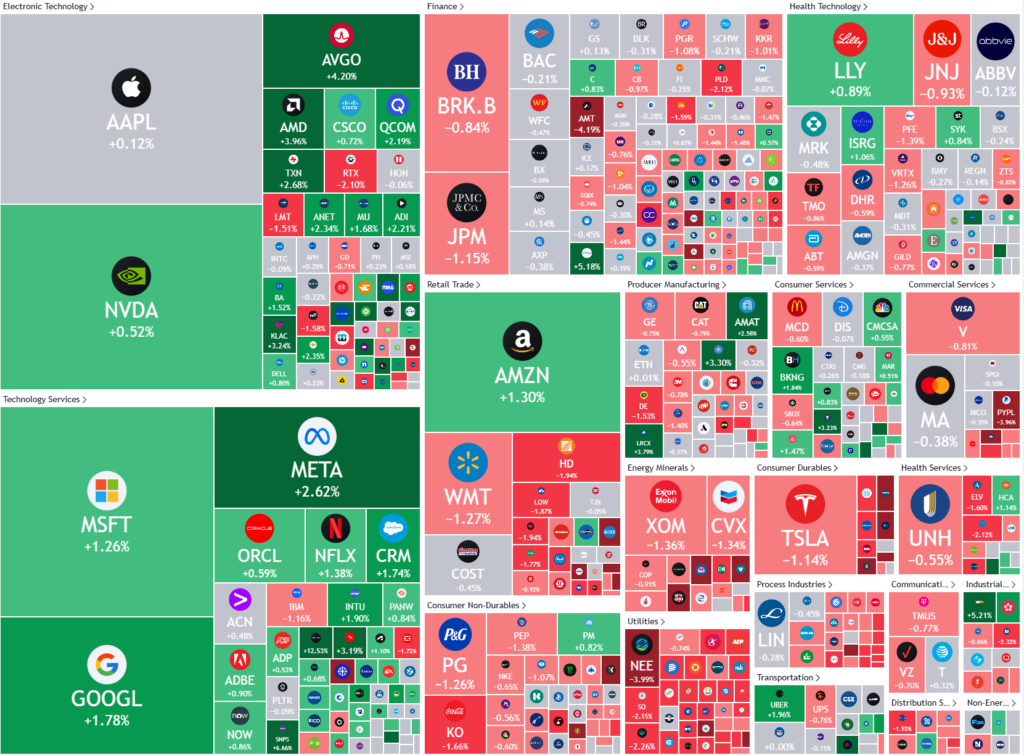

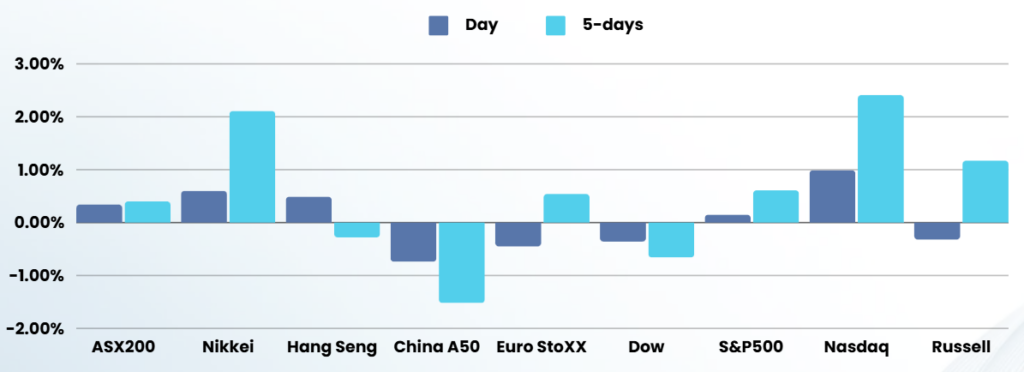

Equities finished higher overnight, shrugging off mixed economic data as tech continued to rack up gains ahead of major earnings, while Google rose 5%+ on earnings after the bell

Big tech led the broader market higher just ahead of Alphabet’s quarterly results due after the market closes. Google shares rose more than 5% in extended trading as the company topped third-quarter revenue expectations on Tuesday, helped by steady growth in its digital advertising business and an AI-driven jump in demand for its cloud services. CEO Sundar Pichai said investments in AI were “paying off” through use and sales in its Search and Cloud businesses.

This will be followed by Meta and Microsoft on Wednesday, while Apple and Amazon will report on Thursday.

This week’s earnings are set to act as a bellwether for the broader market, given the relative market capitalization of the five tech giants. Investors will be watching to see whether Wall Street’s biggest firms were able to generate strong returns on their sizeable investments in artificial intelligence over the past year.

JOLTS job openings data, a measure of labor demand, for September unexpectedly fell, but the “pace of hiring picked up, lending some upside risk to our forecast for October payroll growth. Consumer confidence, meanwhile, jumped to highest since 2021 despite uncertainty about the election outcome.

Further clues on the state of the labour market will continue to dominate attention with the release of the jobless claims and the ADP, or private payrolls, report later this week, before the October jobs report due Friday. Ahead of the nonfarm payrolls report, however, inflation will also garner interest. September’s US core personal consumption expenditures price index – the Fed’s preferred measure of inflation – on Thursday.

The readings come just weeks before a Fed meeting, where the central bank is widely expected to cut interest rates by a smaller 25 basis points (MPC does not)

Stock specific

- Alphabet (Google) – Shares of the company rose more than 3% in extended trading as the company topped third-quarter revenue expectations on Tuesday, helped by steady growth in its digital advertising business and an AI-driven jump in demand for its cloud services. CEO Sundar Pichai said investments in AI were “paying off” through use and sales in its Search and Cloud businesses. YouTube revenue surpassed $50 billion over the past four quarters, he said. Ad sales for the video streaming service rose 12% to $8.92 billion.

Digital advertising sales – the biggest chunk of Google’s total revenue – rose to $65.85 billion from $59.65 billion. Revenue from Google’s cloud platform grew to $11.35 billion, beating analysts’ estimate of $10.86 billion. - Advanced Micro Devices AMD – Fell 6.5% as the chipmaker reported third-quarter earnings that met expectations, but its fourth-quarter revenue guidance fell short of analyst estimates. The chipmaker posted adjusted earnings per share of $0.92 for the third quarter, in line with analyst projections. Revenue came in at $6.82 billion, surpassing the consensus estimate of $6.71 billion and representing a 22% increase YoY. However, AMD’s fourth-quarter revenue forecast of $7.5 billion, plus or minus $300 million, disappointed investors. The midpoint of this guidance range falls slightly below the analyst consensus of $7.55 billion.

- Reddit – Soared 17% as the social media platform reported better-than-expected third-quarter results and provided strong guidance.. The social media platform posted adjusted earnings per share of $0.16, significantly beating analyst estimates of a $0.23 loss. Revenue for the quarter jumped 68% YoY to $348.4 million, surpassing the $312.8 million reported in the same quarter last year and analyst expectations. Reddit’s daily active unique users (DAUs) increased 47% YoY to 97.2 million.

- Ford – stock fell 8% after the automaker tempered its full-year profit forecast, blaming supplier disruptions and warranty costs amid a global price war fuelled by overcapacity. Ford 3Q24 results showed continued pressure from some of the issues that have hit them for a while, namely higher warranty reared its head again

ASX SPI 8268 (-0.01%)

The ASX should have a relatively positive day today as tech earnings drove Nasdaq to record highs after the bell.

Eyes will be firmly fixed on the local inflation data at 1130 AEDST, as stubborn inflation hinders the RBA’s ability to consider rate cuts. A low number would see the market head higher, conversely, a high number would hurt the interest rate sensitive parts of the market particularly

AU CPI expectations

QoQ: 0.3%

YoY: 2.3%

RBA Trimmed Mean QoQ: 0.8%