Overnight – Fed Holds Rates Steady as Tech Earnings Mixed

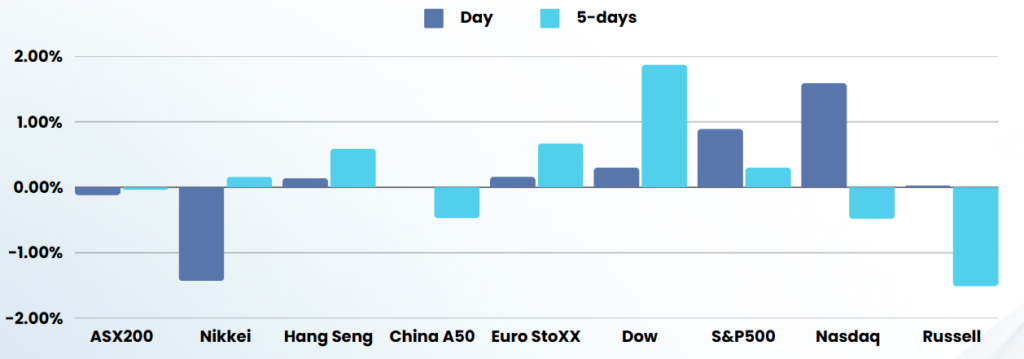

The global markets experienced a mixed session overnight, with several key events and corporate earnings reports shaping investor sentiment. The Federal Reserve’s decision to hold interest rates steady and comments from Chairman Jerome Powell influenced market movements. Meanwhile, tech giants’ earnings reports provided a mixed bag of results, impacting stock performance.

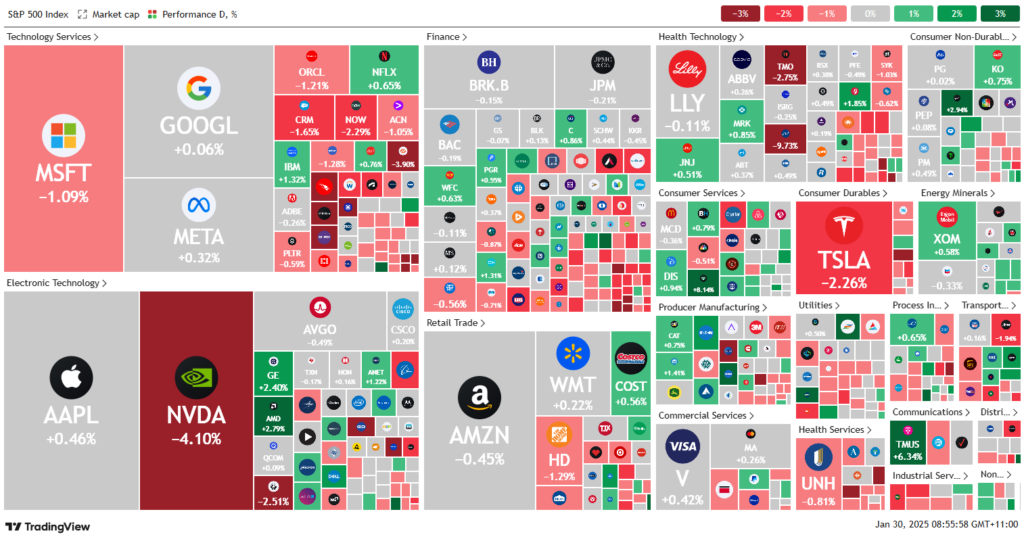

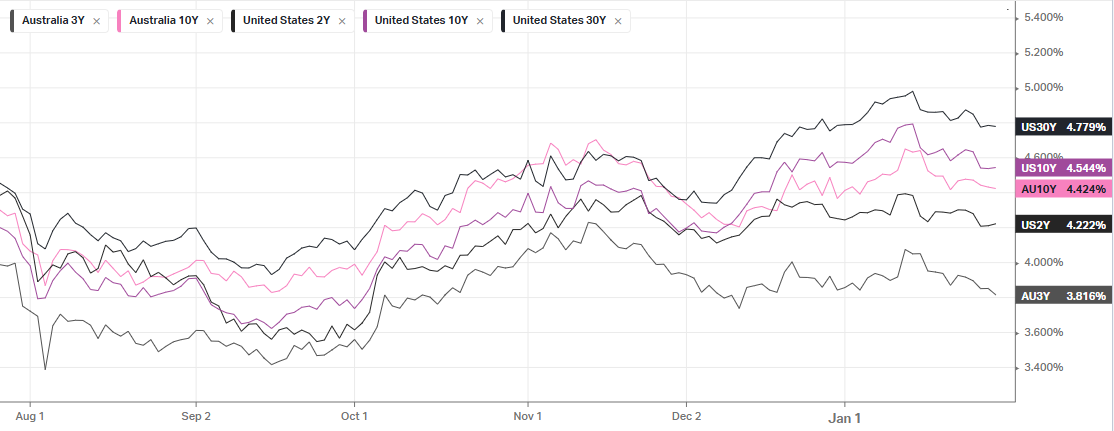

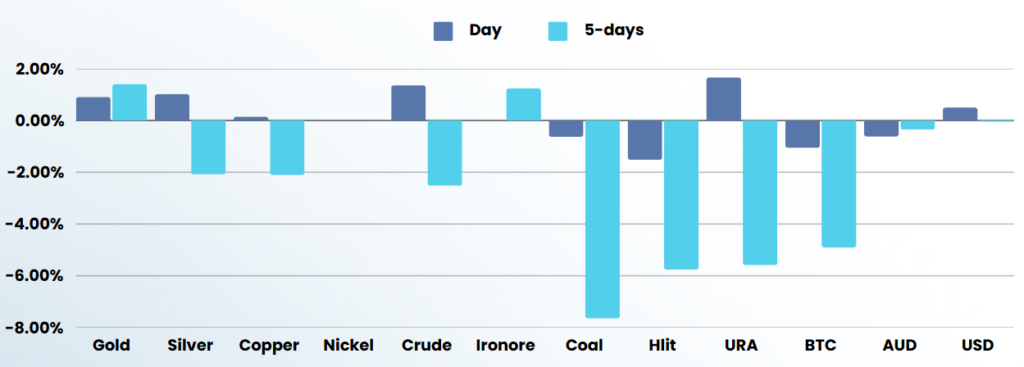

Wall Street saw volatility during Powell’s press conference, with markets fluctuating between losses and gains. The Federal Reserve maintained its funds rate at the 4.25% to 4.5% range.In the currency market, the Australian dollar weakened to US62.29¢, affected by the potential delay in future U.S. rate cuts. The U.S. 10-year Treasury yield remained relatively stable. Commodities saw mixed performance, with Brent crude falling 0.8% to $US76.85 per barrel, while iron ore gained 1% to $US104.70 per tonne. Notably, Nvidia’s stock closed 4% lower amid reports of potential tightening of chip sales restrictions to Chinese customers. Bitcoin, on the other hand, gained 1% amidst U.S. equity volatility.

Corporate Earnings

Tesla

Tesla’s Q4 2024 earnings fell short of expectations:

- Revenue: $25.71 billion (2% YoY growth), missing estimates of $27.21 billion5

- Adjusted EPS: $0.73, below the expected $0.75

- Operating income: $1.58 billion, significantly under the expected $2.68 billion

- Full-year 2024 adjusted net income dropped 23% compared to 2023

Tesla’s stock dropped about 3% in after-hours trading following the announcement.

Microsoft

Microsoft beat expectations on revenue and EPS but missed on cloud revenue:

- Revenue: $69.63 billion (12.3% YoY growth), surpassing estimates of $68.89 billion

- GAAP EPS: $3.23, beating estimates of $3.10

- Intelligent Cloud Revenue: $25.54 billion, slightly missing estimates of $25.76 billion

- Azure constant currency revenue growth: 31% YoY, slightly below expectations of 32-33%

Microsoft’s stock dropped over 4% after the earnings release due to the cloud revenue miss.

Meta

Meta reported strong Q4 2024 results, exceeding expectations:

- Revenue: $48.39 billion (21% YoY growth)

- Net income: $20.84 billion (49% YoY increase)

- Diluted EPS: $8.02

- Operating margin improved to 48% from 41% in Q4 2023

ASX SPI 8,416 (-0.06%)

The Federal Reserve’s decision to hold interest rates steady and Chairman Powell’s comments on inflation progress. The Australian market is likely to open relatively flat with a slight negative bias. ASX futures slipped 5 points just before 8:30 AM AEDT, indicating a cautious start to the trading day. The market may experience some volatility, influenced by several factors: