Overnight – Tech shrugs off rising bond yields into MAG7 earnings

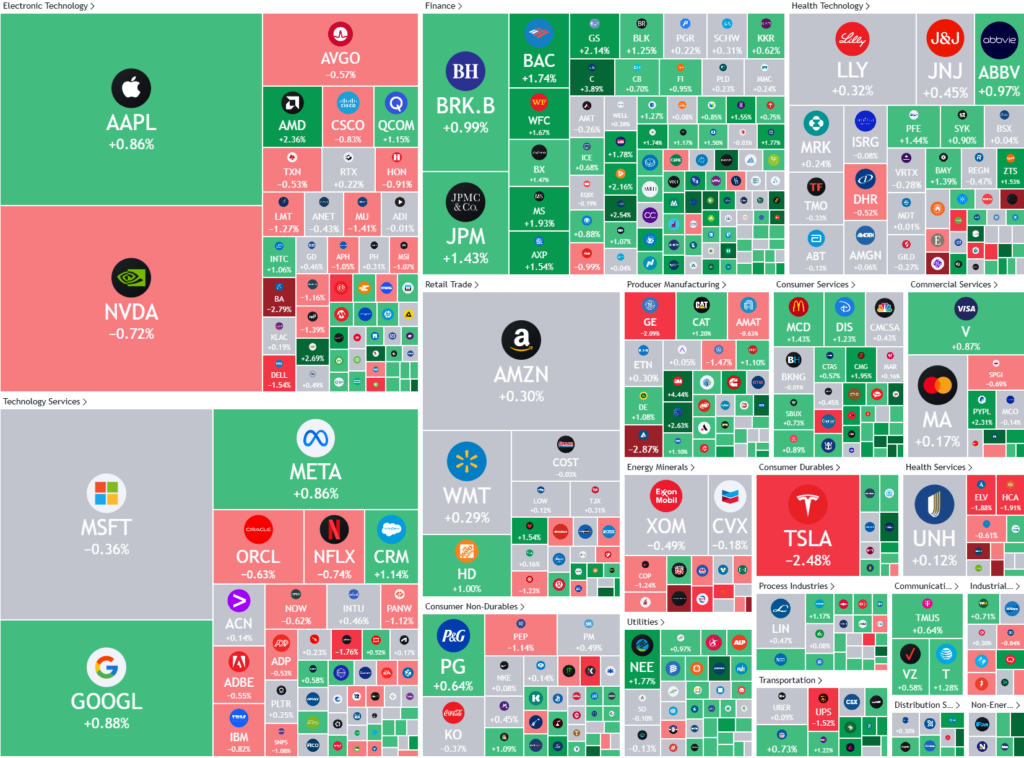

Investors ignored multi-month highs in US treasuries, with their eyes firmly fixed on the approaching MAG7 earnings and a busy week of top-tier economic data and quarter earnings including from big tech.

Positioning in technology stocks have ramped up before a string of key technology earnings this week, with the Nasdaq hitting a record intraday high, ahead of earnings from five of Wall Street’s “Magnificent Seven” in the coming days. The five firms make up a large chunk of market valuations on Wall Street, with their earnings likely to act as a bellwether for the broader market. This week’s earnings are also expected to show whether the artificial intelligence trade remained in play, as major companies ramped up capital spending on the new technology. Elsewhere in tech, Taiwan Semiconductor Manufacturing fell more than 3% after Reuters reported, citing sources, that the chipmaker had stopped shipments to China-based firm Sophgo after a chip it made was found on a Huawei AIU processor.

Alphabet will report on Tuesday, Meta and Microsoft on Wednesday, before Apple) and Amazon on Thursday.

Beyond the major earnings, the focus this week will also be on a string of key economic readings, headed up by Friday’s monthly jobs report. Friday’s employment report is expected to show that jobs growth slowed to a more modest 111,000 in October, reflecting the impact of strikes and weather-related disruptions from Hurricane Helene and Milton. The unemployment rate is forecast to remain unchanged at 4.1%.

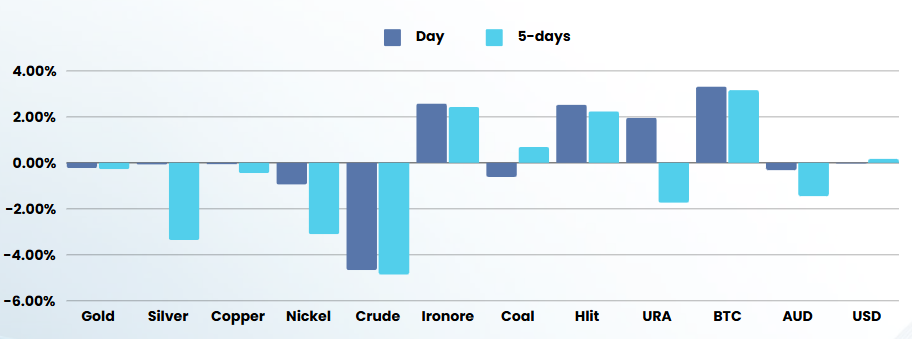

In commodities and geopolitics, Crude prices fell sharply, after Israel launched a retaliatory strike against Iran over the weekend, but avoided hitting key nuclear and oil facilities. Iran also signaled limited damage from the attack, drumming up hopes that a bigger conflict will not break out in the Middle East, which could potentially have dragged the US into the war.

Republican presidential candidate Donald Trump and his Democratic rival, Vice President Kamala Harris are tied in national and swing state polling, but former president Trump has improved his margins in recent weeks. The former president is also a slight favourite in election prediction markets.

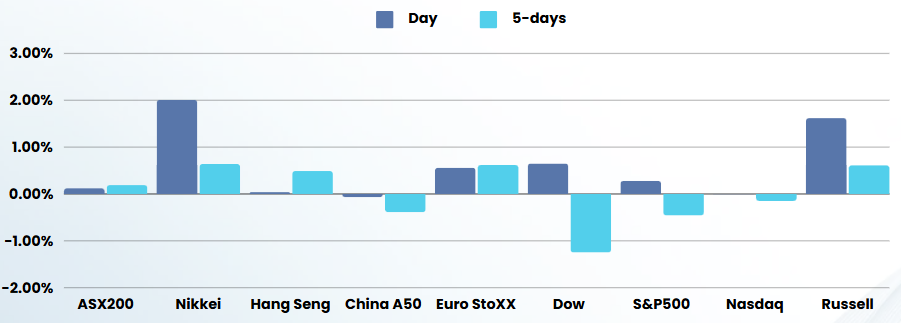

ASX SPI 8285 (+0.42%)

We should grind higher today as we wait for MAG7 earnings, US employment numbers and the US election result next week.

Gold and Oil stocks may see some selling as Middle East tensions ease

WTC and MIN might see some buying as Fairfax newspapers have no new scandals on the front pages today