Overnight – MAG7 recovers from “deep panic” over DeepSeek

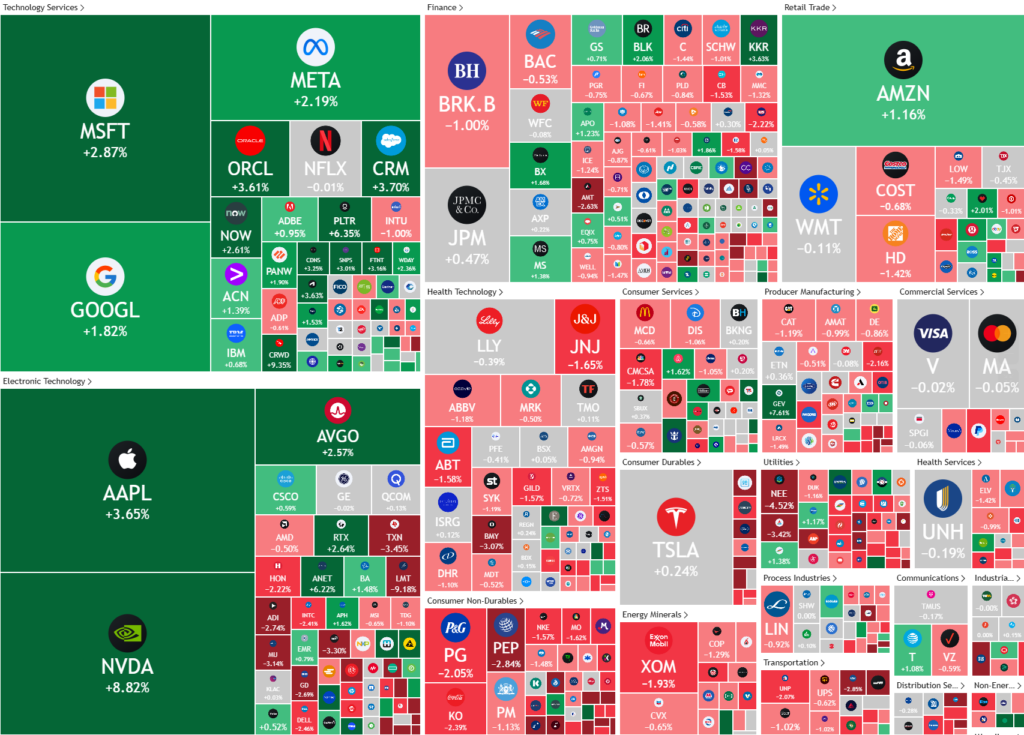

The DeekSeek panic subsided overnight, seeing a rebound in MAG7 stocks as focus shifts to the Federal Reserve decision due in the early hours of tomorrow morning AEDST .

Tech held the market up, with AI chip leader Nvidia edging higher, a day after $593 billion was wiped off its market value in the biggest single-session loss for any company. Fears about Chinese AI startup Deepseek posing a risk to the AI dominance of U.S. corporates was downplayed by some on Wall Street, who suggested that cheaper AI solutions are likely to lead to wider option.

After the initial panic subsided, investors started to realise that whatever the ultimate impact on AI hardware revenue might be, cheaper access to AI services can help reduce costs for AI users and promote earlier adoption, which is a win for everyone, except the incumbent, high margin AI companies

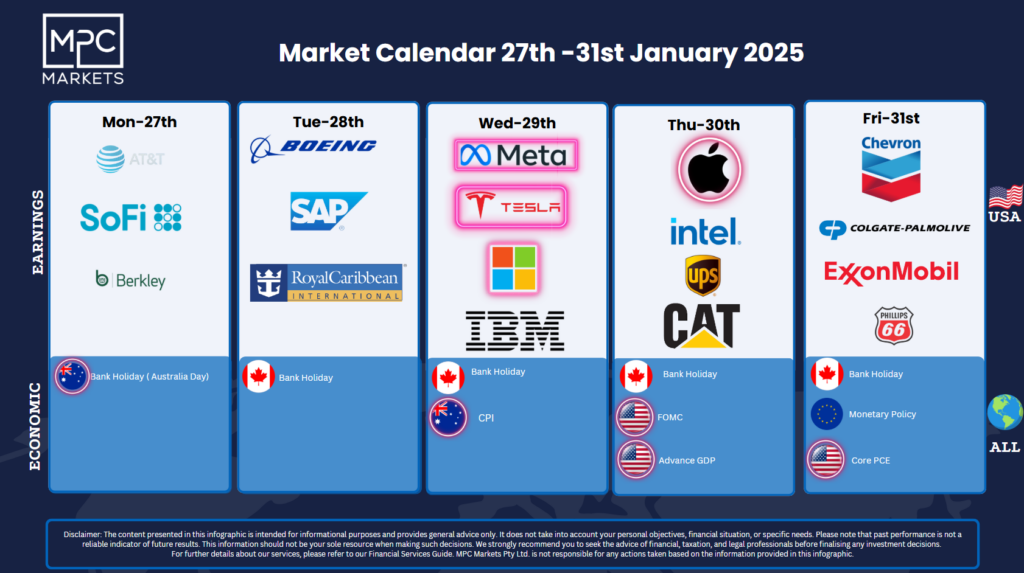

The rebound amid big week for big tech with the “Magnificent 7” members including Microsoft, Facebook-parent Meta Platforms, Apple and Tesla set to report quarter earnings later this week.

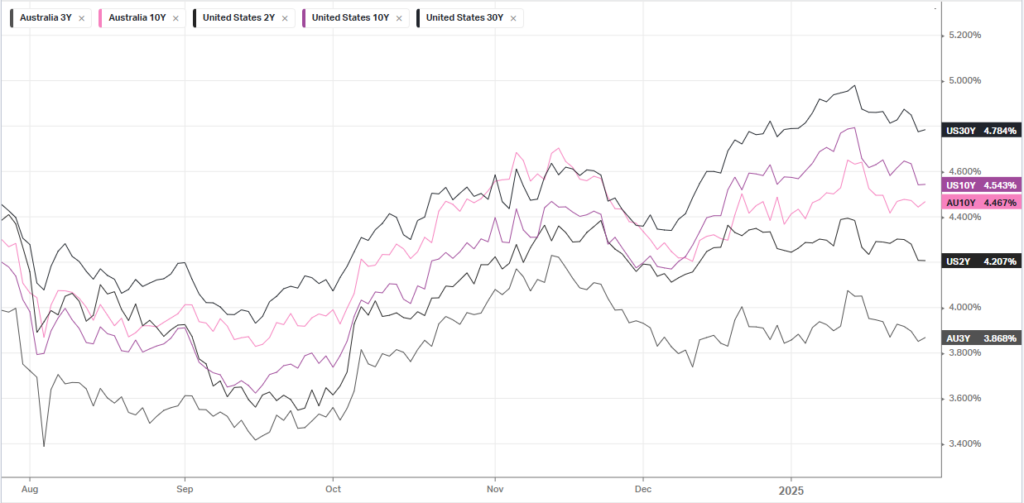

From a macro standpoint, the focus this week is squarely on the Federal Reserve’s upcoming two-day policy meeting. The Fed is widely expected to keep borrowing costs unchanged at the end of its meeting on Wednesday, following a string of reductions late last year that left the all-important benchmark rate at a range of 4.25% to 4.50%.

Fed’s preferred gauge of inflation – PCE price index data, and advance GDP estimates for the fourth quarter are also due this week.

Corporate Earnings

- General Motors – stock fell nearly 9% after the auto giant swung to a loss in the fourth quarter on huge charges related to China.

- Royal Caribbean – stock rose 12% after the cruise operator reported better-than-expected fourth quarter earnings and provided a robust outlook for 2025.

- JetBlue Airways – stock slumped nearly 26% after the carrier reported a hefty loss for the fourth quarter of 2024, with unit revenue guidance weaker than expected.

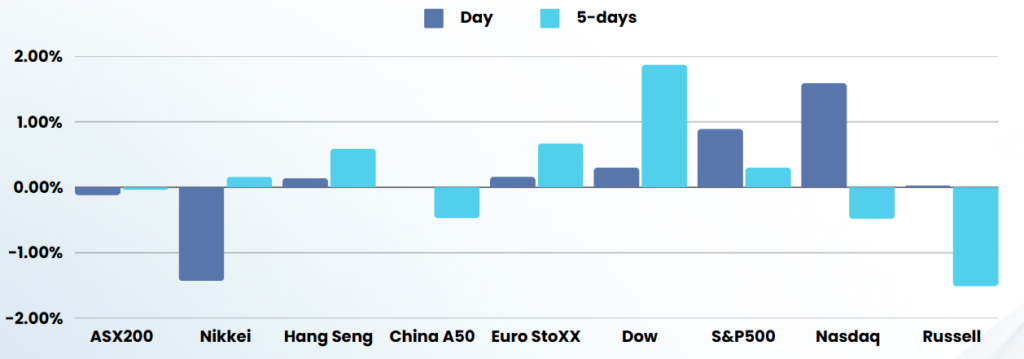

ASX SPI 8401 (+0.43%)

The unjustified weakness on the ASX yesterday will be re-couped today, however the CPI data at 1130 could cause investors to pause until lunchtime, especially in interest rate sensitive stocks

Company Specific

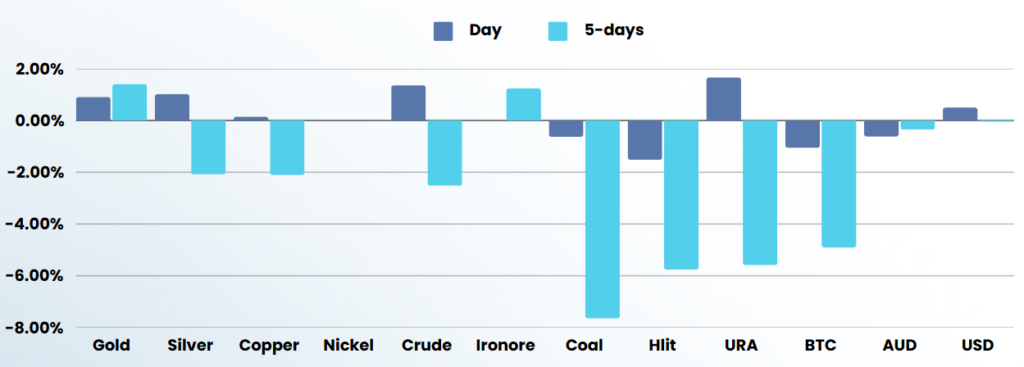

- Quarterly reports are expected from Perseus Mining, Whitehaven Coal, 29Metals, Atlas Arteria, BCI Minerals and Boss Energy.