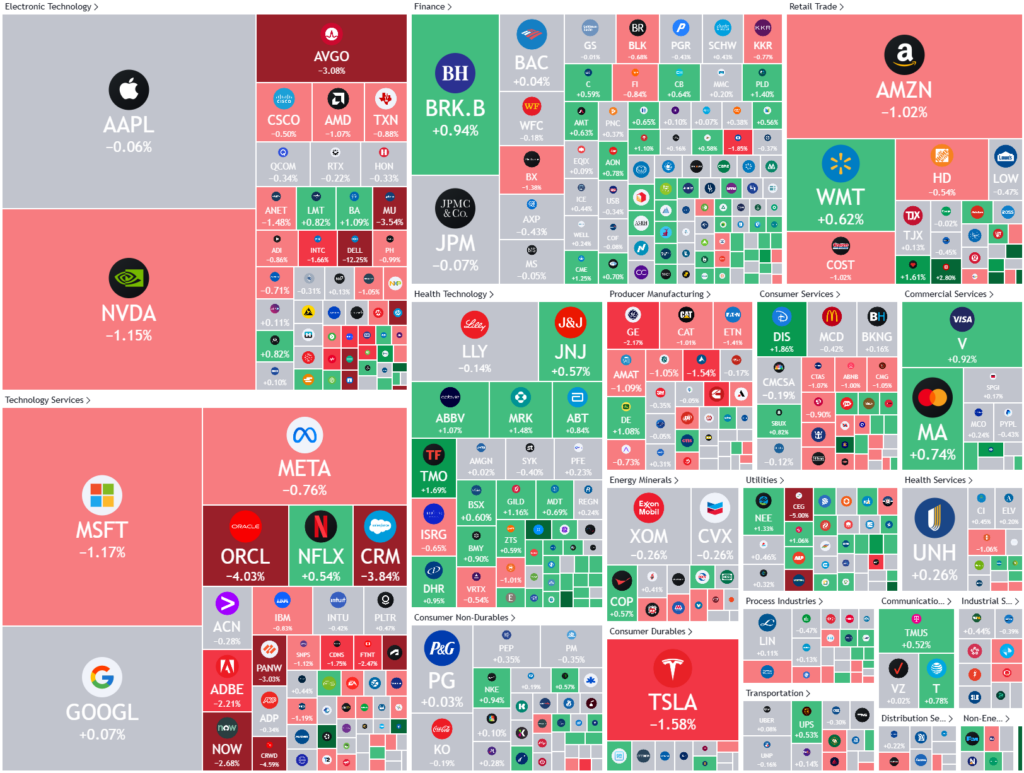

Overnight – Stocks drift lower on light volume into Thanksgiving

Stocks drifted lower on light volume overnight, as stronger inflation data made investors cautious ahead of the Thanksgiving holiday.

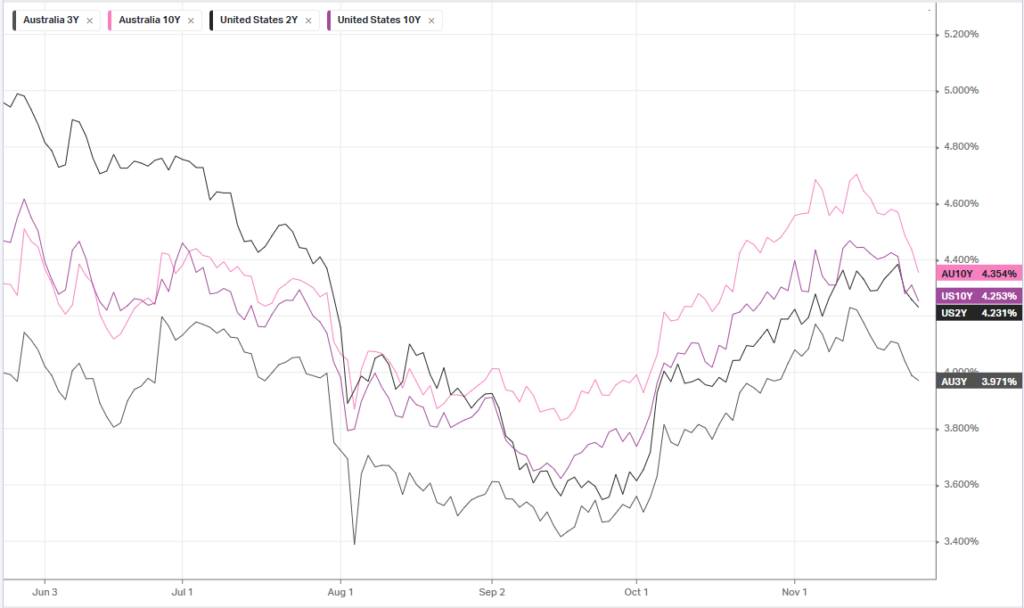

The PCE price index for October came in as expected, with the annual figure climbing 2.3%, while the core PCE price index, the Fed’s preferred inflation gauge, rose 2.8% in October, considerably above the Fed’s 2% annual target.

Recent signs of sticky US inflation have sparked some doubts over just how much the Fed will cut interest rates further, and markets have begun questioning the prospect of a 25 basis point cut in December.

These doubts were furthered by the release of strong economic numbers earlier Wednesday, suggesting that the US economy was in a healthy enough sate to cope with interest rates at current levels.

Weekly jobless claims for “first-time” unemployment benefits dipped to 213,000 from a revised lower 215,000 in the prior week, with claims steadily retreating from the near 1-1/2-year high seen in early October, while the US economy grew at a unrevised 2.8% annualized rate in the third quarter, well above what Federal Reserve officials regard as the non-inflationary growth rate of around 1.8%.

Oil prices settled close to flat after a large, surprise build in U.S. gasoline stockpiles and worries about the outlook for U.S. interest rates in 2025 countered easing supply concerns from a ceasefire deal between Israel and Hezbollah.

Trading volumes are likely to be muted for the rest of the week as the Thanksgiving holiday for markets tonight & the early close on Black Friday is one of the quietest periods for markets each year

Stock Specific

- Hewlett Packard HP – the computer manufacturer slid 12% after the information technology company issued disappointing guidance for 2025.

- Dell Technologies – like HP, tumbled over 10% after the PC manufacturer offered up a disappointing revenue outlook for the current quarter despite bullish commentary from the company on AI sales growth.

- Workday – fell 5% as the cloud-based business applications company issued disappointing subscription revenue guidance, hit by weaker client spending on its human capital management software.

AFTER THE BELL – The U.S. Federal Trade Commission launched a broad antitrust investigation into Microsoft, spanning several areas of the tech giant’s business including cloud computing and artificial intelligence

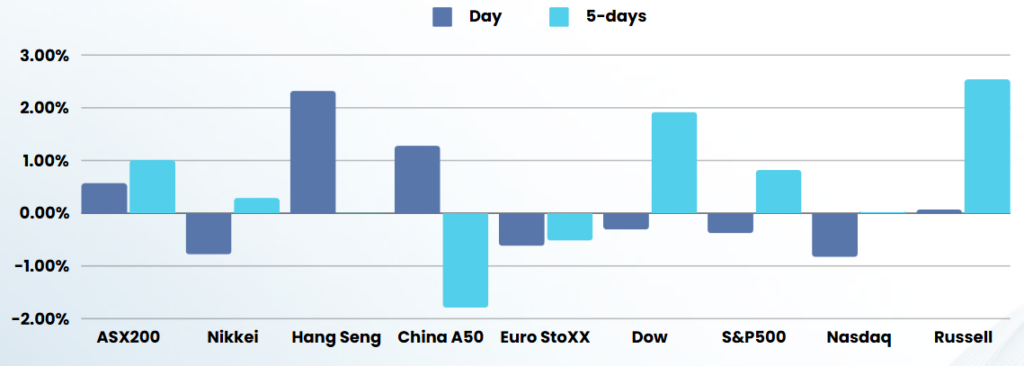

ASX SPI 8459 (+0.24%)

The local market will likely be quiet until Tuesday next week as the Thanksgiving holiday sucks global flows out of the market. This period is not one to be reactionary with existing holdings as light volumes could mean sharp temporary moves in some stocks.

Fisher & Paykel Healthcare release earnings. Sayona Mining and Star Entertainment both host AGMs.