Overnight – New AI Tech, DeepSeek, causes DEEP sell off in AI incumbents

AI related stocks fell sharply on Monday, led by Nvidia and other chipmakers as popularity of a low-cost Chinese artificial intelligence model raised investor worries about the outlooks for current AI leaders in the United States.

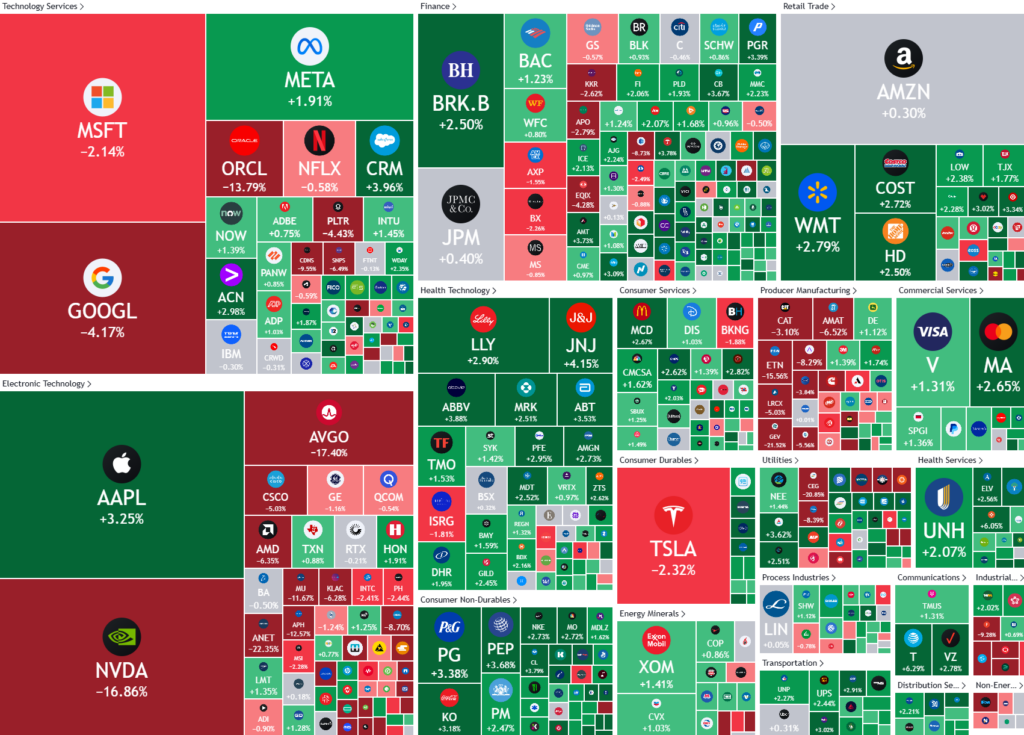

Nvidia’s shares were down 17%, while an index of semiconductor stocks slid 10% and was on track for its biggest single-day percentage fall since March 2020. Nvidia was on track to lose roughly $600 billion in stock market value, the deepest ever one-day loss for a company on Wall Street, according to LSEG data. It was more than double the previous one-day record loss, set by Nvidia last September.

Chinese startup DeepSeek has rolled out a free assistant it says uses cheaper chips and less data, raising questions about investor expectations that AI will drive demand along a supply chain from chipmakers to data centers.

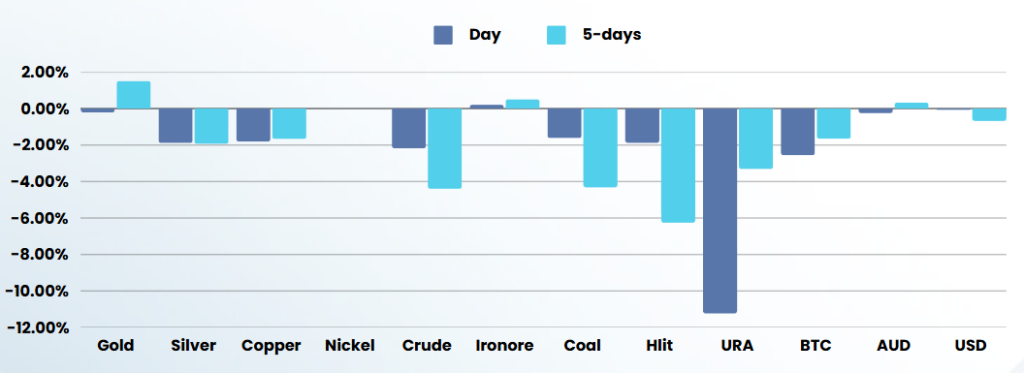

DeepSeek’s AI Assistant on Monday overtook rival ChatGPT to become the top-rated free application available on Apple’s App Store in the United States. Despite the massive sell-off, NVIDIA praised DeepSeek, calling it an “excellent AI advancement and a perfect example of Test Time Scaling.” Among other big tech-related companies, Microsoft was down 2.5% and Google-parent Alphabet was down 4%, while AI server maker Dell Technologies was down 11.7%. Data center operators and energy producers like uranium, also tanked, with Digital Realty sliding 10.6% and the Uranium ETF falling 11%

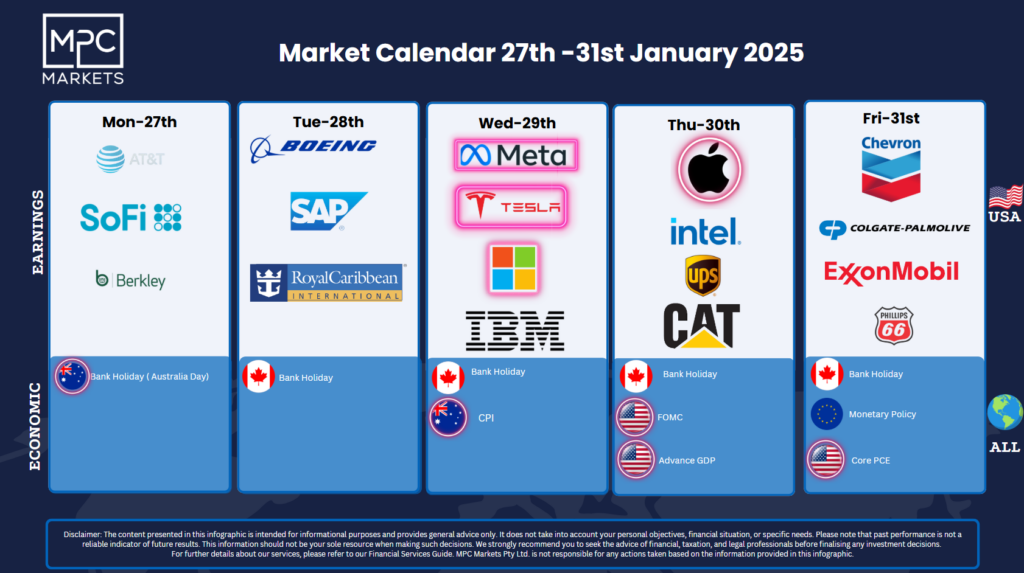

Despite the AI rout, the rest of the market fared well as earnings from some big technology companies are due this week, including from Microsoft, Tesla, Meta, Apple, Exxon, ServiceNow

Confidence had also been hit by President Donald Trump’s threat of tariffs on Colombia after the Latin American country refused to allow two US repatriation flights carrying deported individuals to land, a directive attributed to Colombia’s President Gustavo Petro. While Colombia quickly relented, this incident has reminded investors that the threat the Trump administration will levy economic sanctions on economic rivals remains live. Trump had earlier announced that tariffs on Mexico, Canada, China, and the European Union could be announced on Feb. 1.

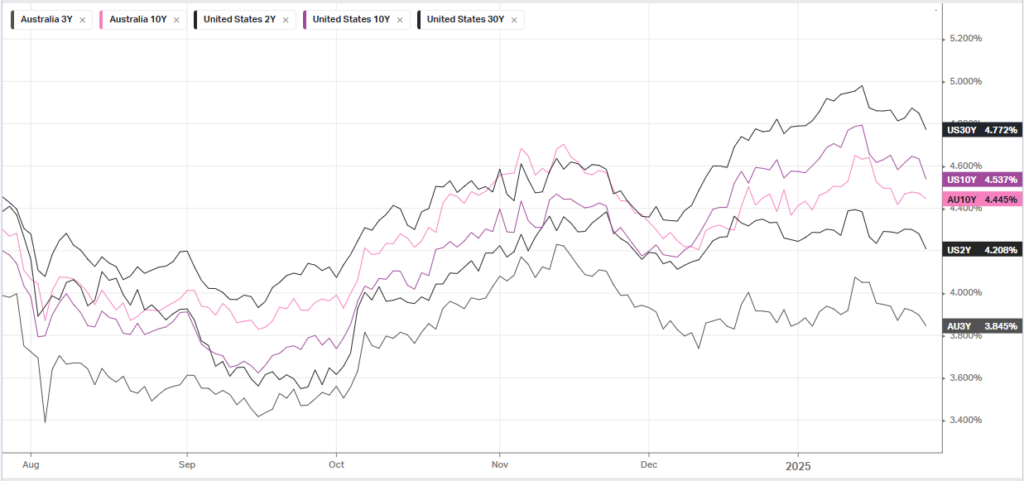

Investors also are keen to hear from the Federal Reserve, which is widely expected to hold its lending rate steady in its first interest-rate decision of the year due on Thursday

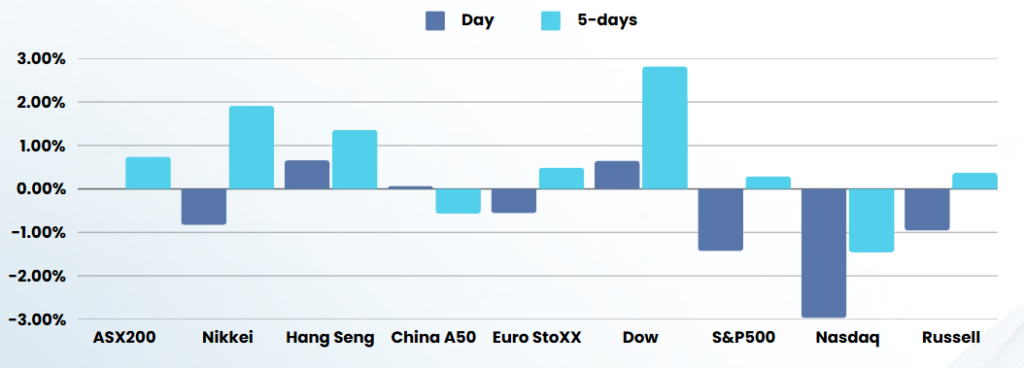

ASX SPI 8386 (+0.16%)

The ASX movements today will be somewhat a sideshow to the US AI rout, as the significant advancement will significantly reduce the cost and power demands of AI

The energy sector will suffer, particularly uranium, while commodities may drift lower while investors readjust their models for how much demand there will be for Data centre infrastructure.

While the initial move will be ugly, we believe this new, low cost model will actually push more demand for data centers as the old pricing models for AI, which were out of reach for most companies, will now become affordable