Overnight – Nvidia beats, Market retreats as MAG7 hammered

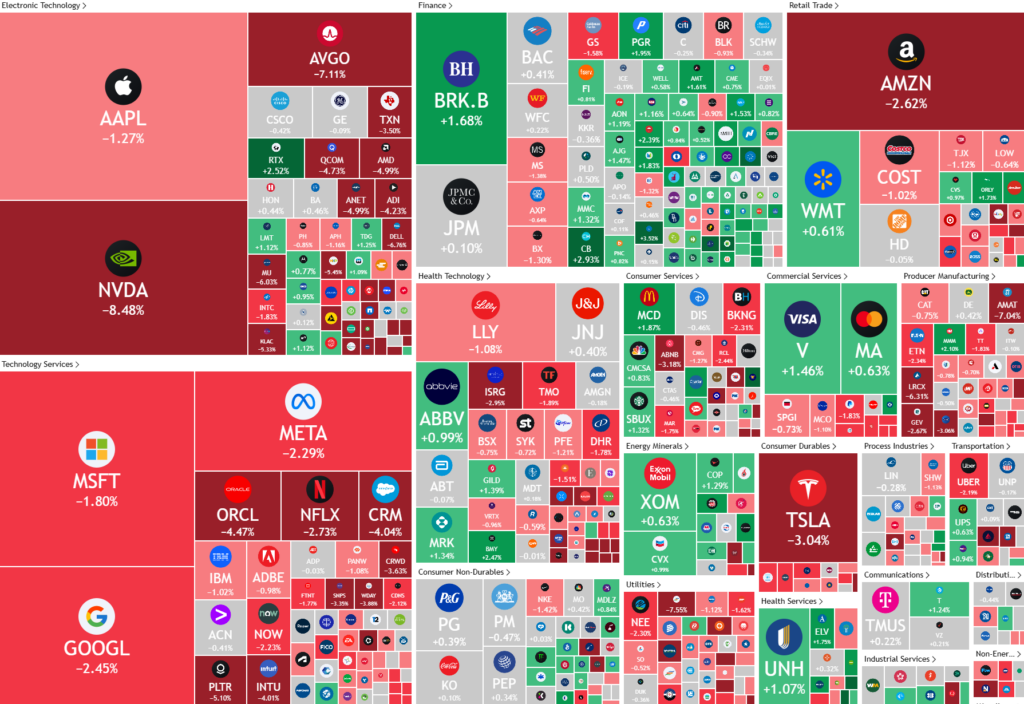

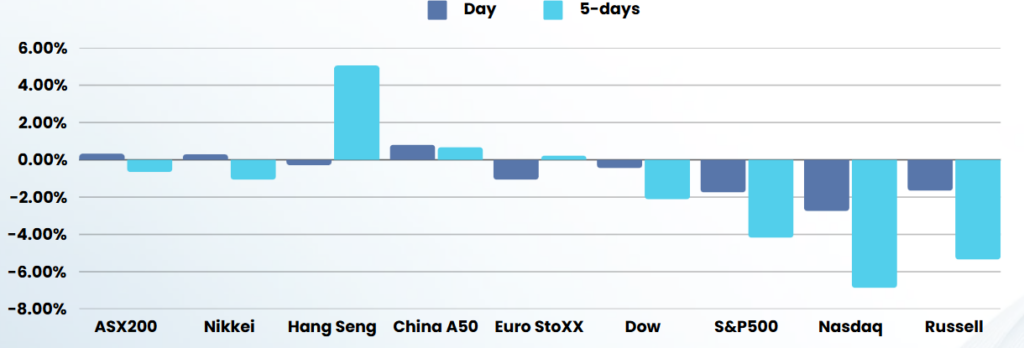

Stocks were hit heavily overnight as profit taking swept through the MAG7 as investors grow weary of high valuations and constant uncertainty around Trump policies

Nvidia fell more than 5% weighing on the broader tech sector as its guidance for Q1 profit margins fell short of estimates, overshadowing Q4 results and revenue guidance for the current quarter that beat analyst expectations. The semiconductor giant noted that its income margins had dropped due in part to an uptick in costs around its new data center gear and larger pay packages for its growing workforce. Blackwell-related gross margin headwinds appear to be “more significant than originally anticipated

President Trump said that his proposed 25% tariffs on Canada and Mexico goods would come into effect on Mar. 4 as scheduled, arguing that drugs are still entering the U.S. from those countries. In a post on his Truth Social platform, Trump also added that China will face an additional 10% surcharge on Mar. 4, adding to the 10% tariff that was imposed on Feb. 4.

“We cannot allow this scourge to continue to harm the USA, and therefore, until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled,” Trump added. “China will likewise be charged an additional 10% Tariff on that date.”

The remarks from Trump cleared up confusion around the tariff deadlines for Mexico and Canada after the president’s comments a day earlier appear to suggest that he may permit another one month delay to Apr. 4.

The second reading of fourth-quarter GDP showed the economy grew a 2.3% in the prior quarter, unchanged from the first reading last month.

On the economic front, the labour market showed small signs of weakness with jobless claims rising to 242,000 in the week ended Feb. 22, above expectations for 222,000 claims.

Price action in the MAG7 stocks over earnings has given a clear signal that investors are taking long-term profits. A high cash balance in portfolios is likely to be advantageous as the risk to the downside is high

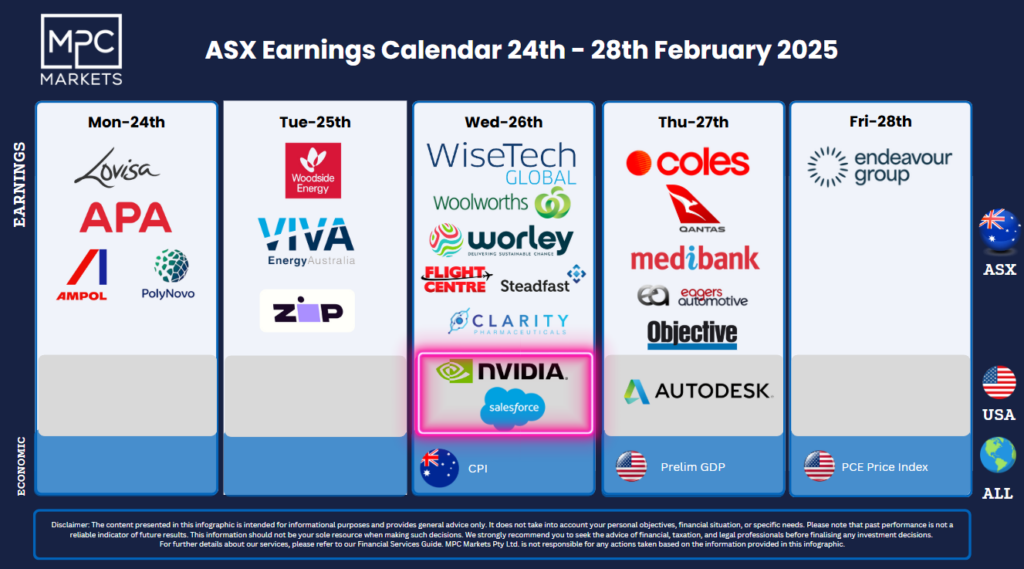

Corporate Earnings

- eBay – plunged more than 6% after the e-commerce giant provided weaker-than-expected revenue guidance for the first quarter, overshadowing a fourth-quarter earnings beat.

- Salesforce – shares fell 2% after the software group unveiled a revenue outlook that came up short analyst estimates.

- Autodesk – jumped 7% in post-market trade as earnings for the fourth quarter came in slightly better than expected. EPS of $2.29, $0.15 better than the analyst estimate of $2.14. Revenue for the quarter came in at $1.64B versus the consensus estimate of $1.63B.

ASX SPI 8177 (-0.80%)

The local market is likely to follow the US weakness on the open and stabilize as panic subsides. Expect tech and growth names to take the brunt of the selling, with Today will see the last of ASX earnings for this cycle with the banks, energy and materials likely to do the heavy lifting in supporting the index

Company Specific

- PEXAposted an interim loss of $32.7 million, down from a loss of $4.6 million, owing to the impairment of a minority investment, even as earnings grew. The property settlement exchange announced Australia CEO Les Vance’s resignation earlier this month.

- Vista Group’s earnings soared 62 per cent in 2024 as the data analytics provider reported a jump in clients transitioning to its cloud solutions. Vista set 2025 revenue guidance in a range of $167 and $173 million.