Overnight – Stocks grind higher despite Trump Tariff threats against neighbours

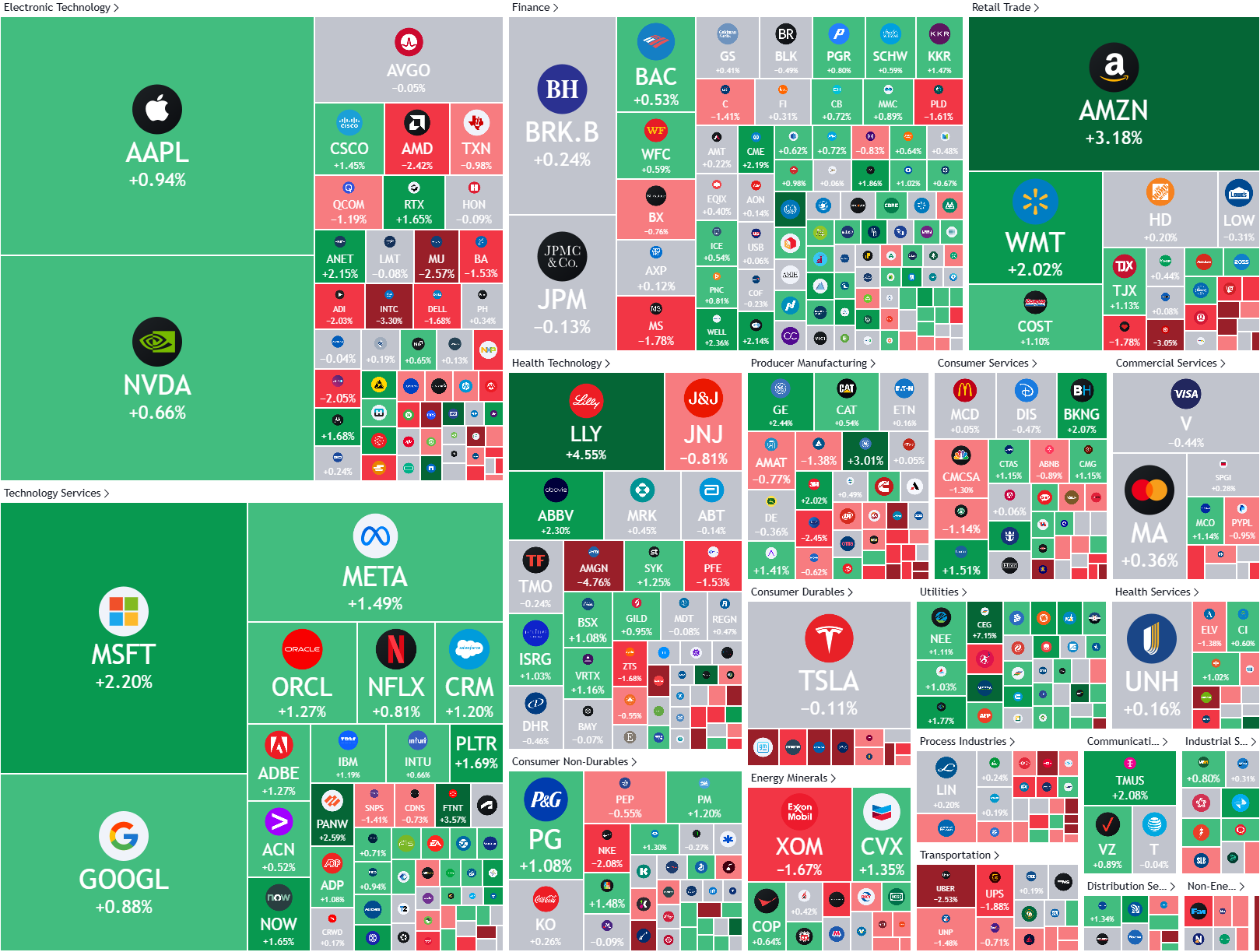

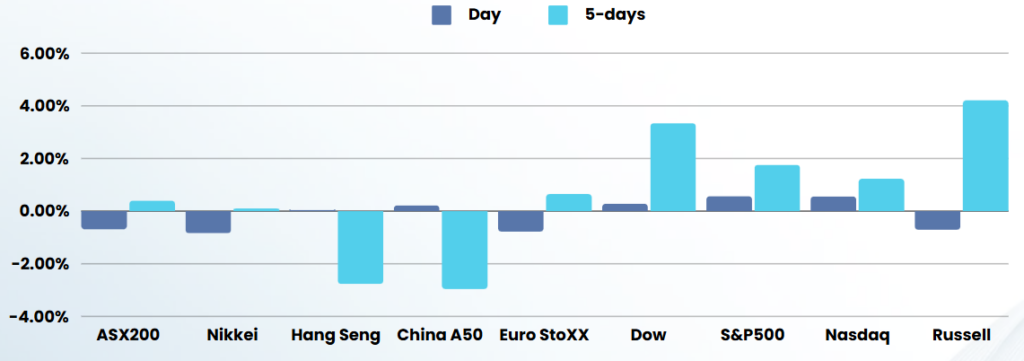

The S&P 500 and Dow closed at a record highs Tuesday, as investors assessed President-elect Donald Trump’s threat to impose higher import tariffs on China, Canada and Mexico.

Trump said in a social media post on Monday that he will impose a 25% tariff on all imports from Canada and Mexico, citing the inflows of allegedly illegal immigrants and drugs into the US through open borders with the two countries.

He added that he will impose an additional 10% tariff on all Chinese imports, lamenting a lack of progress on China’s part towards curbing the flow of illegal drugs into the U.S. His threat follows promises during his campaign that he will impose a 60% tariff on all Chinese goods.

Automakers including General Motors, Ford and Stellantis vulnerable to higher import tariffs fell on Tuesday. Trump’s tariff threats ramped up concerns over a renewed global trade war between the world’s biggest economies – a trend seen through much of his first term. Such a scenario bodes poorly for global trade, especially for countries with heavy trade exposure to the US.

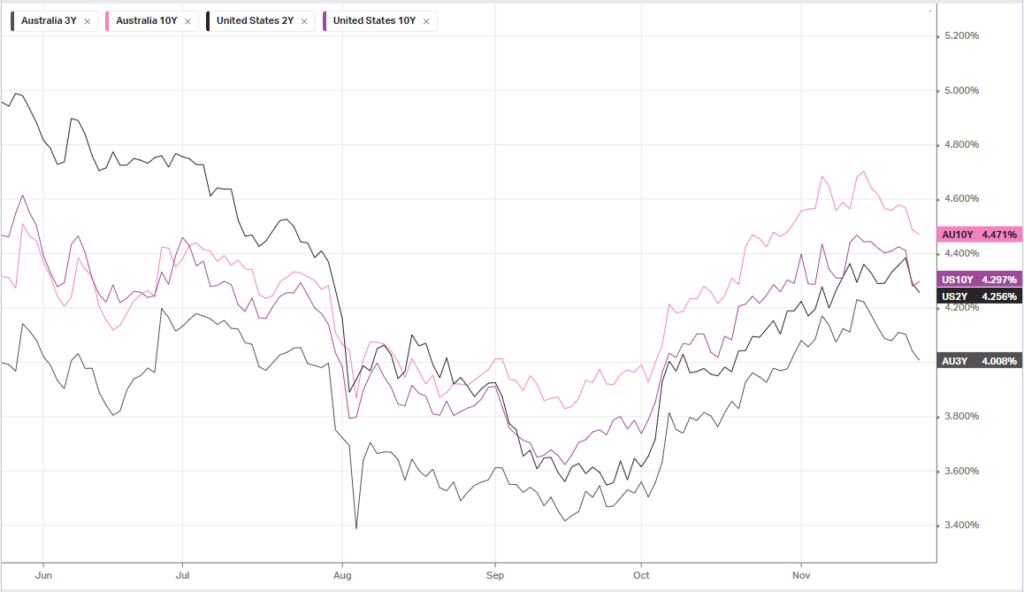

Investors are also waiting for the release of the minutes from the last Federal Reserve policy-setting meeting later in the session, as they look for clues over whether the central bank will continue cutting rates next month.

Fed members continued to support rate cuts should economic data come in as expected, but many Fed members expressed that uncertainty over neutral rate warrants a gradual approach to monetary policy easing, according to the minutes of the Federal Reserve’s Nov. 6-7 meeting, released Tuesday.

A ceasefire between Israel and Hezbollah will take effect at 4am local time on Wednesday (1pm Wednesday AEDT) after both sides accepted an agreement brokered by the United States and France, US President Joe Biden said.

ASX SPI 8425 (+0.45%)

Australian shares are poised to rise, in line with gains on the S&P 500 as it headed towards its 52-record closing high. Local investors will have their eyes on the monthly CPI, which is set to be released at 11.30am AEDT.

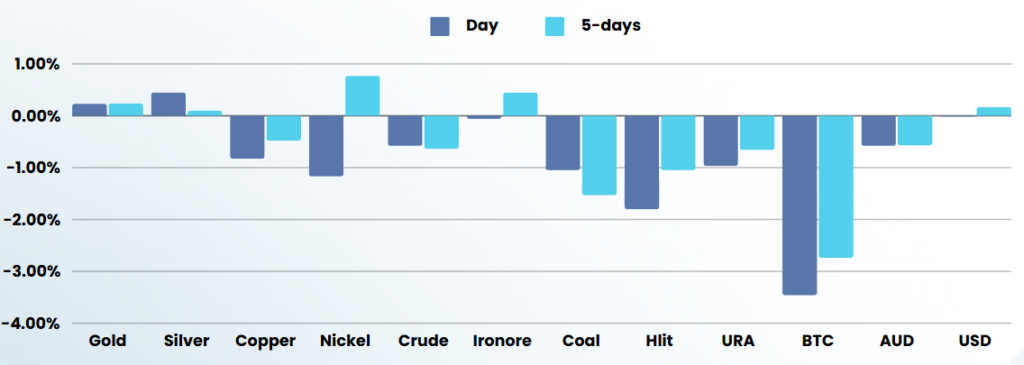

In commodities, oil edged lower after Israeli PM Benjamin Netanyahu said he was ready to implement a ceasefire deal with Lebanon and would “respond forcefully to any violation” by Hezbollah.

Core Lithium, HMC Capital, Harvey Norman, Liontown Resources and Lynas Rare Earths all host AGMs.