Overnight – Chip Stocks hit as Microsoft walks away from more Datacenter leases

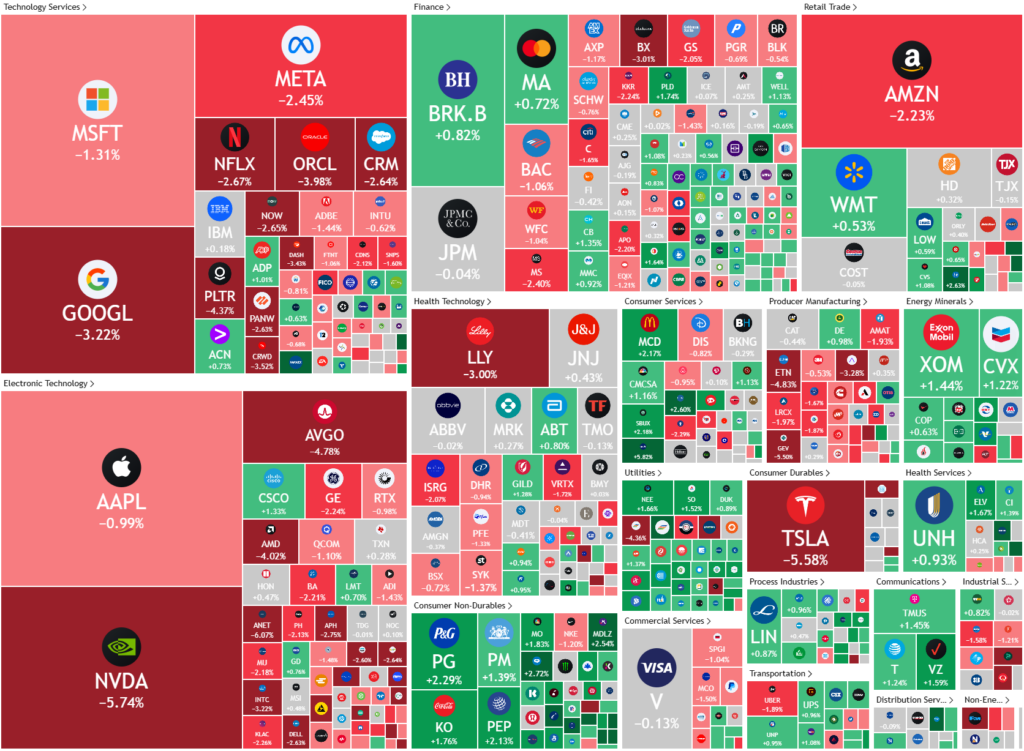

Stocks gave up ground overnight as tariff concerns weighed down the broader market and chip stocks were hit on Investor concerns around Microsoft walking away from data center leases

Sentiment in the chip stocks continue to pullback over concerns that Microsoft walked away from +2GW of capacity in both the U.S. and Europe in the last six months, driven by the decision not to support incremental Open AI training workloads. On a positive note, competitor Google is stepping in to backfill the capacity that Microsoft walked away from in international markets. In the U.S., Meta is backfilling the capacity.

Across the AI sector, AI chip makers NVIDIA and Broadcom are each down 5%, while AI server makers Dell Technologies and Super Micro are down 3% and 9%, respectively.

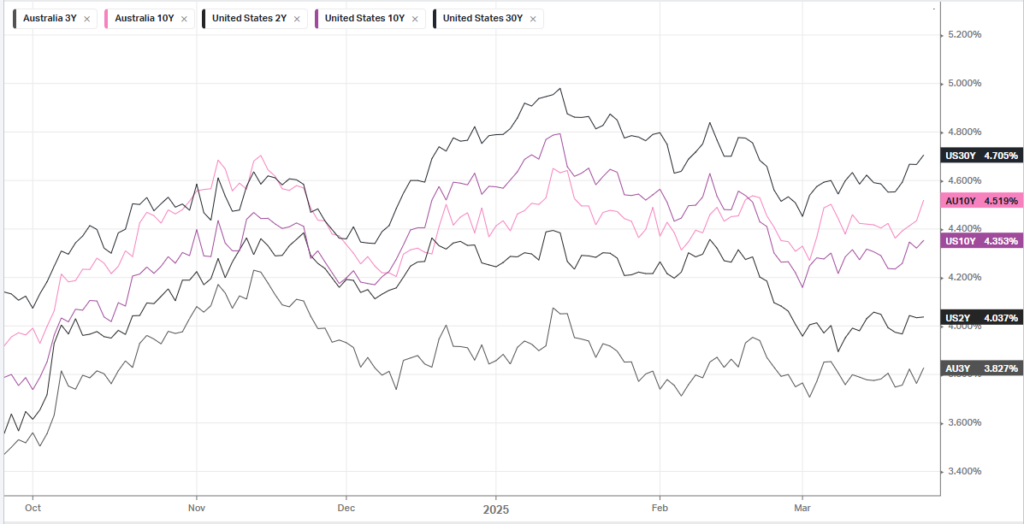

In economic data, new orders for major U.S.-manufactured capital goods unexpectedly declined in February. This downturn may persist due to economic uncertainty fuelled by tariffs, which could deter businesses from increasing equipment spending.

The market is increasingly watching economic indicators for signs of rising inflation and potential economic slowdown. This will increase the importance and effect on market moves for economic numbers like US Employment, PCE price index (Federal Reserve’s preferred inflation measure) set to be released on Friday and leading indicators. A raft of Fed members also speak in the next few days, including Chicago Fed President Neel Kashkari and Richmond Fed President Tom Barkin.

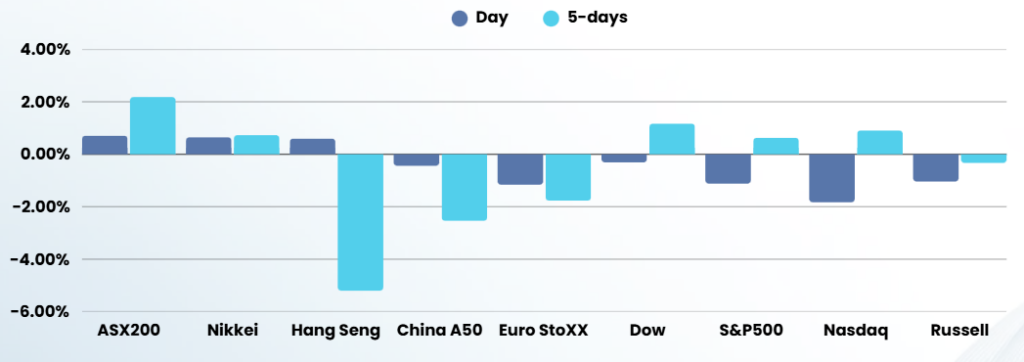

ASX SPI 8013 (-0.37%)

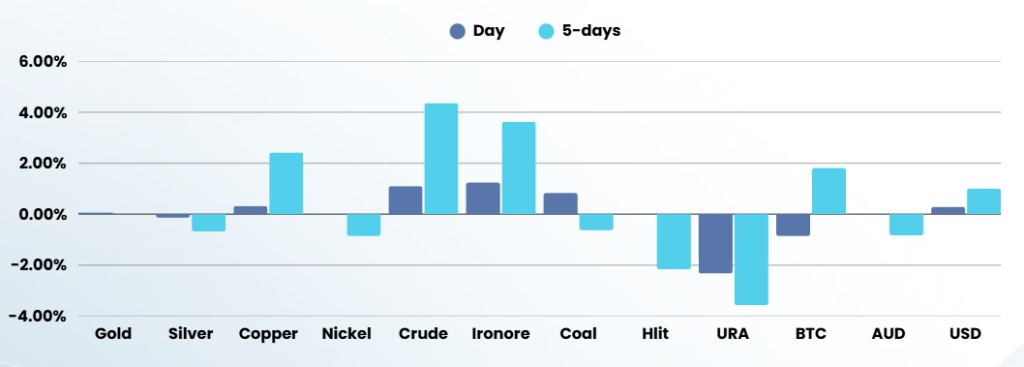

The local market should fare better than our US counterparts today as a rally in Iron ore and commodities generally will support the index. We remain happy to be in high levels of cash with a focus on US economic figures moving forward due to concerns about the health of the US economy and the disruption Trumps policies will bring to the economy