Overnight – Investor enthusiasm underwhelming as Nvidia beats

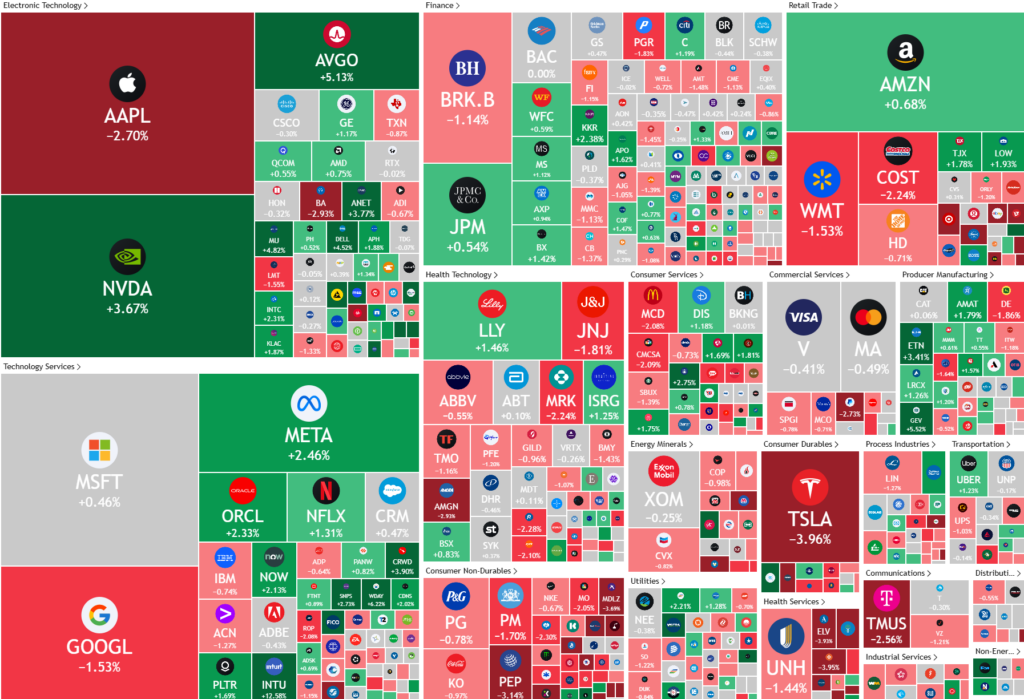

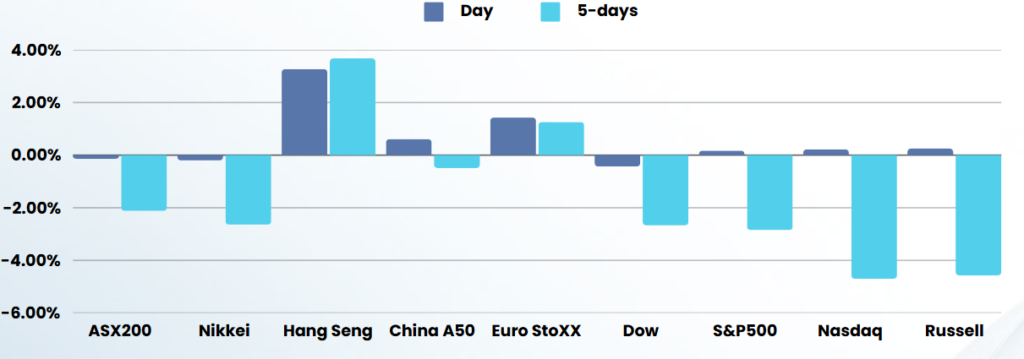

US indices gave up early gains as fresh tariff concerns soured investor sentiment just ahead of quarterly earnings from artificial intelligence-darling Nvidia.

Stocks were forced to give up gains after President Donald Trump said he would soon enact a 25% tariff on goods from the European Union, sparking worries about a global trade war. While Trump had previously said he would explore reciprocal tariffs on the EU made had hoped a deal would be made to avoid a deterioration in U.S-EU trade relations.

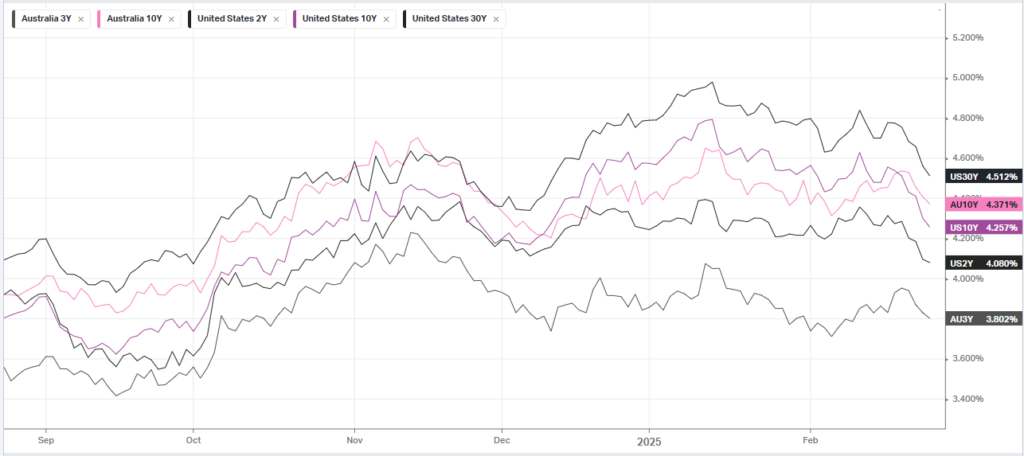

References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.

Trump also said that tariffs on Mexico and Canada would go into affect on Apr 2, nearly a month later than the initial Mar. 4 deadline. Trump further fueled fears of global trade war after the president said he was ended a deal with Venezuela, which was agreed under the Biden administration to get free elections, as the Venezuela was refusing to take back illiegal immigrants.

Tech stocks rebounded from the soft start to the week as investors bought the recent dip, with Nvidia leading the charge up 2% ahead of its quarterly results due after the market closes.

Corporate Earnings

- Nvidia – was broadly unchanged as reported better-than-expected revenue guidance for the current quarter after fourth-quarter results exceeded Wall Street estimates. The company announced Q4 adjusted earnings per share of $0.89 on revenue of $39.3B. Analysts polled by Investing.com anticipated EPS of $0.84 on revenue of $38.16B. Data center revenue was $35.6B, up 16% from Q3, beating estimates for $34.1B. Looking ahead to Q1, the company forecast revenue $43B, beating forecasts of $42.05B. The better-than-expected guidance helped alleviate concerns somewhat about rising competition. for enterprise spending from Chinese AI firms including Deepseek.

- Salesforce – fell 5% aftermarket as forecast fiscal 2026 revenue below Wall Street expectations on Wednesday, weighed down by slower adoption of its artificial intelligence agent platform. The company expects revenue to be between $40.5 billion and $40.9 billion, compared to the average analysts’ estimate of $41.35 billion,

- Lowe’s – gained more than 2% after reporting fourth-quarter adjusted earnings per share that topped consensus estimates, as the home improvement chain said it was boosted by its strategy to increase market share by selling to both retail and professional customers.

- Workday – shares spiked by more than 5% after the AI-powered enterprise management platform reported fourth-quarter earnings and revenue that exceeded analyst expectations, while also providing robust guidance for the upcoming fiscal year.

ASX SPI 8214 (-0.11%)

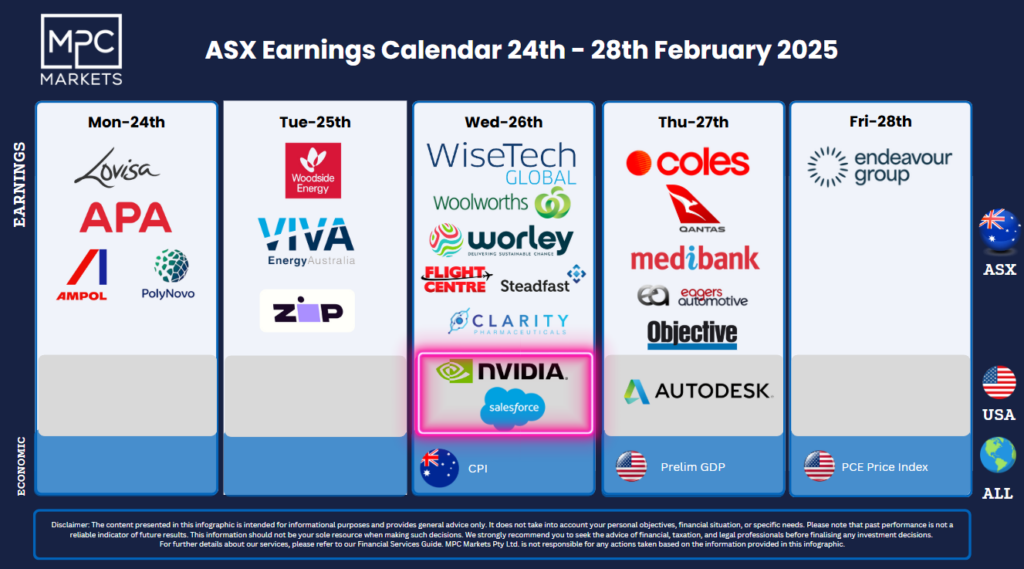

Today will see the last string of large-cap earnings for the ASX with the largely flat reaction to Nvidia earnings overnight a huge sigh of relief for international stock markets.

Company Specific

- Telix Pharma – JPMorgan was looking for buyers for $120 million worth of shares in Telix Pharmaceuticalson behalf of its co-founder and group CEO Christian Behrenbruch, apparently related to a divorce settlement

- Qantas – $1.4 billion interim profit, and has elected to return money to shareholders via a special dividend rather than increasing its share buyback program. Qantas said it would return 26.5¢ a share to its investors, fully franked, including a $150 million special dividend on top of a $250 million base dividend.

Federal Treasurer Jim Chalmers has approved Qatar Airways buying a 25 per cent stake in Virgin Australia, allowing the airline to start flying under a wet lease agreement in June.

- Coles – lifted its interim dividend as sales and earnings raced ahead in the first half at its key supermarket division with shoppers flocking to its stores after a strike left shelves empty at its main rival Woolworths. Australia’s second-biggest supermarket chain benefited from its larger rival’s stumble in December, investing heavily to get stock on shelves to meet increased demand. It gained about $120 million in sales and $20 million in extra earnings in the half