Overnight – Stocks rally as Trump appoints fund manager as Treasury Secretary

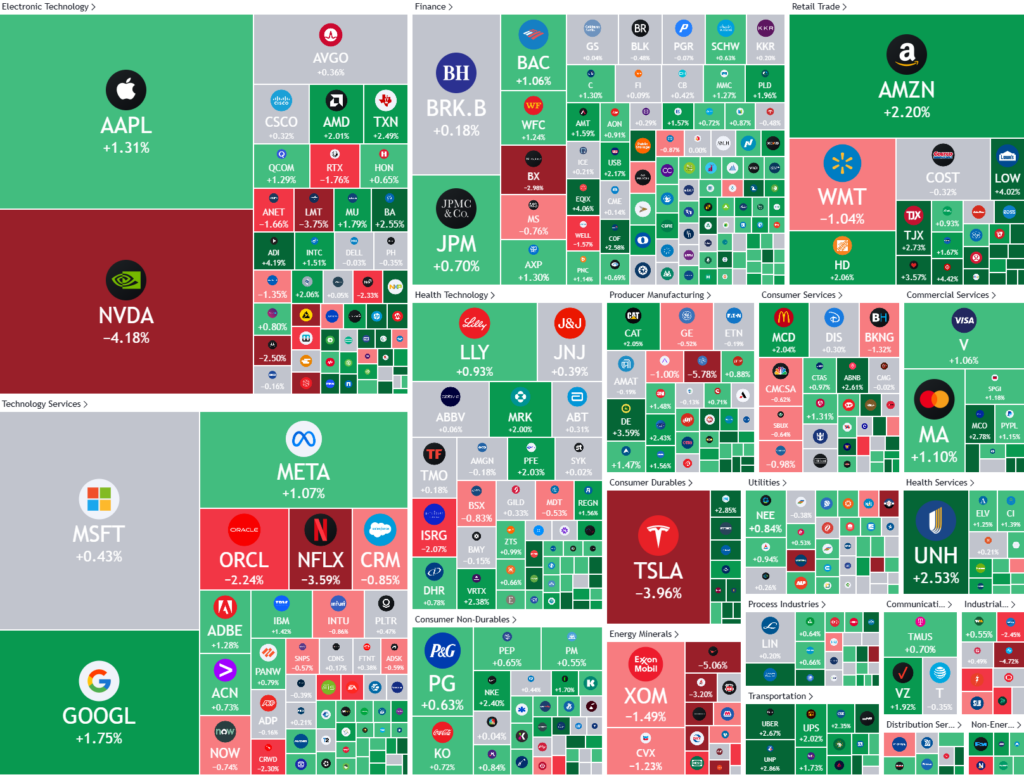

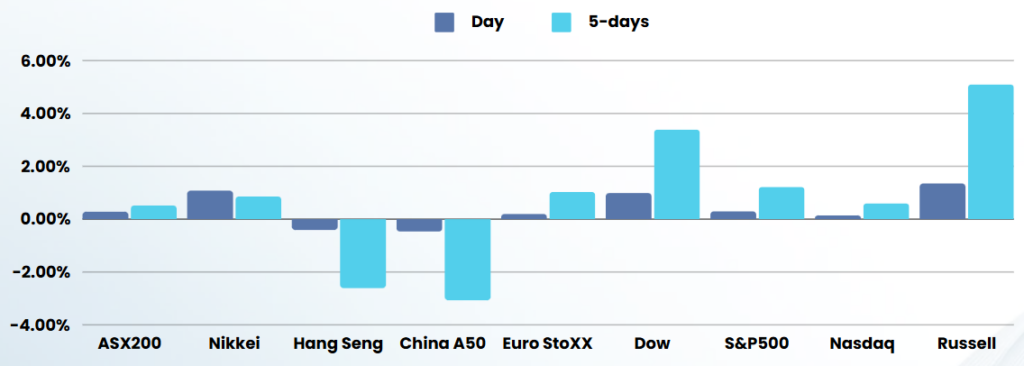

US indexes gained ground, with the S&P 500 and the Dow touching record highs as investors were encouraged by Donald Trump’s pick for the top economic job.

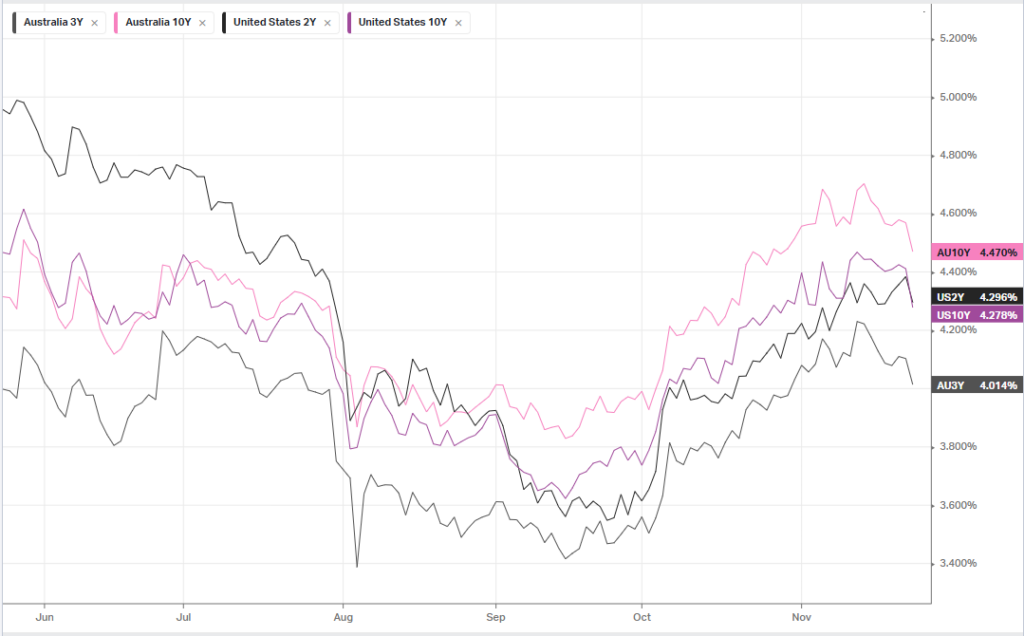

U.S. Treasury yields fell sharply as investors speculated on a more moderate than feared U.S. fiscal trajectory. In an interview published on Sunday, Bessent told the Wall Street Journal that both tax and spending cuts were priorities. And Bessent had told CNBC earlier in November, before his selection as Treasury secretary, that he would recommend “tariffs be layered in gradually.”

“Bessent understands a lot of different asset classes and is going to help Trump stay very sensitive to market reactions

Nvidia fell nearly 4% Monday, plummeting to a three-week low as investors continued to shift their focus towards cyclical stocks. The stock is now approaching a potential support zone, ranging from the July 11 reversal high near $136 to the 50-day moving average close to $134. A one-day Demark indicator, which is often used to identify potential price exhaustion and the likelihood of an impending price reversal.

Oil prices fell more than $2 per barrel after reports that Israel and Lebanon had agreed to the terms of a deal to end the Israel-Hezbollah conflict, citing officials from Israel, Lebanon, the U.S. and France.

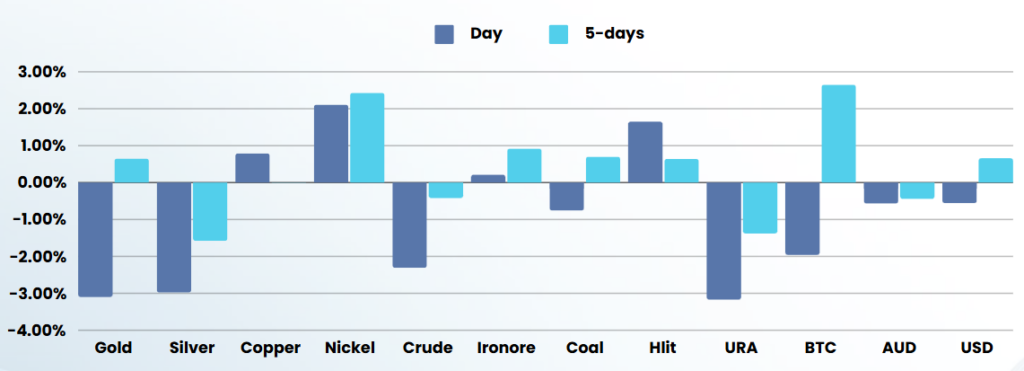

Gold prices fell sharply, breaking a five-session rally, as reports of Israel nearing a ceasefire with Hezbollah, coupled with Trump’s Treasury Secretary pick, tarnished demand for the safe-haven precious metal.

Spot gold fell 3.22% to $2,625.22 an ounce. U.S. gold futures fell 2.56% to $2,640.40 an ounce.

ASX SPI 8470 (+0.21%)

Australian shares are poised to rise following a strong rebound in the price of iron ore overnight, and adding to the record high the bourse achieved in Monday’s session. Gold and commodities did head lower in the US session on a ceasefire in the middle east (until the next conflict, lets face it)

Brickworks and Ramsay Health Care hold their annual general meetings, while shares in Newmont will enter ex-dividend trading.

Webjet has reported a slump in bookings for the online travel group in the company’s first half-year result since demerging its Web Travel business earlier in the year.

Market operator ASX Ltd will implement the final iteration of its settlement system upgrade in 2029.