Overnight – Tesla soars most in a decade, saving stocks from 4th down day

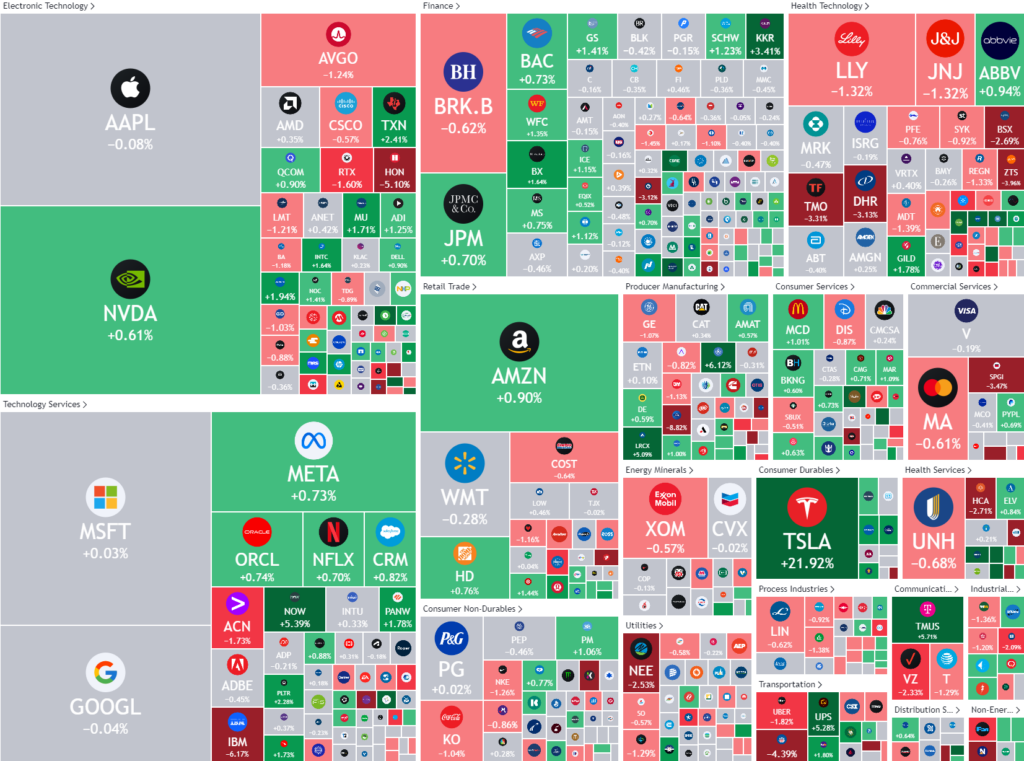

Stocks snapped a three-day losing streak overnight, as Tesla soared 22%, racking up its best day in over decade following the electric vehicle maker’s better-than-expected quarterly results.

Tesla rallied 22% notching its biggest after the electric vehicle maker reported robust third-quarter profits and surprised investors with a prediction of 20-30% growth in sales next year. The earnings beat was fuelled chiefly by improved margins, while the improved outlook for deliveries follows nearly a year of waning growth amid increased competition in major market China and saturating EV markets in the West. Gross margins excluding credits, a closely watched performance metric, rose to 17.05% from 14.7% in the prior quarter This all-important metric … beat “the Street’s estimate at 15.1% and now appearing to be on a trajectory back into the 20% level in 2H2025

Away from the corporate sector, the number of Americans filing new applications for unemployment aid unexpectedly fell last week, dropping 15,000, as the labour market retained a reasonably healthy tone. The Federal Reserve’s “Beige Book” report on Wednesday described employment as having “increased slightly” in early October, and the strong payrolls result at the start of the month helped the market reassess the likely size of future rate cuts by the Federal Reserve.

Investors will also be keeping an eye on the political situation, with a WSJ poll on Wednesday putting former President Donald Trump, the Republican presidential candidate, heading his Democratic rival Kamala Harris 47% to 45%. This is still within the poll’s margin of error, suggesting a tight election ahead.

Around 29% of S&P 500 companies have reported results so far this quarter, according to data compiled by LSEG, with 81% beating earnings estimates.

Stock specific

- Boeing – fell 1.4% after striking machinists rejected a revised contract offer, extending a crippling labor action that is placing heavy pressure on new CEO Kelly Ortberg’s plans to overhaul the jet manufacturer’s ailing finances.

- Southwest Airlines – rose 5.5% after Bloomberg reported that the carrier and Elliott Investment Management are closing in on a settlement that would avoid a proxy fight. The airline also reported a surprise third-quarter profit, benefiting from improved pricing and demand.

- United Parcel Service – rose more than 5% after the shipping company reported third-quarter earnings and revenue that exceeded expectations.

- Hasbro – fell 6% after the toymaker posted a steeper-than-expected drop in sales as consumers tightened spending on toys, but the company’s stringent cost controls boosted margins.

- IBM – fell more than 6% after the technology company reported reduced enterprise spending on non-GenAI projects pressured its consulting segment, clouding software unit strength.

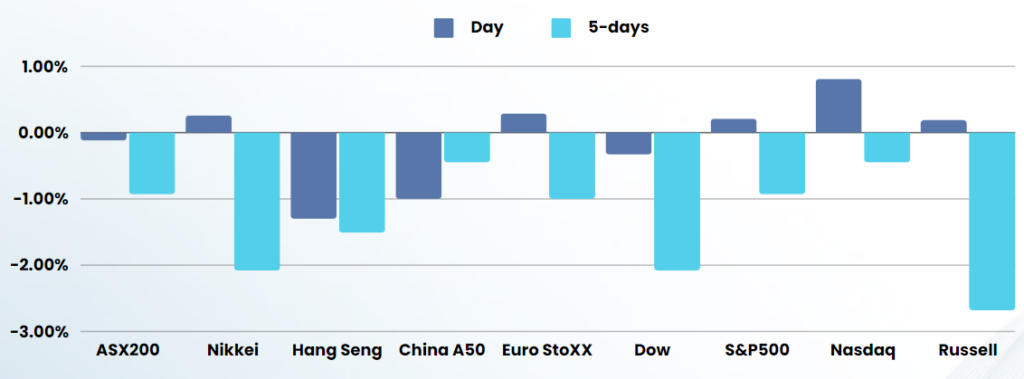

ASX SPI 8248 (+0.18%)

We are set to finish the week slightly firmer, which is a miraculous effort considering what has been thrown at the market this week. Rising bond yields, no further stimulus news from China, founder trouble from market darlings, Wisetech and Minres, continuing middle east conflicts and US election uncertainty, couldn’t de-rail the market, which leads to the question, what can?

In terms of historical market correlations, rising bond yields, especially the 50bp rise since the Fed’s first rate cut, would normally see equities falling at least 3%-5% and Gold and silver dropping even more, yet the market has ignored history and done its own thing.

We are very cautious (and confused) at the price action and being patient until the November 4th election is out of the way to make any significant changes to the portfolio

Wisetech Global founding CEO, Richard White, has succumbed to public pressure, stepping down from the role to take a leave of absence and return to the company in a “different role”. The move is window dressing at best, with the details looking like a mere job title change to appease the rabid press coverage