Overnight – Investors continue switch to small-caps out of MAG7

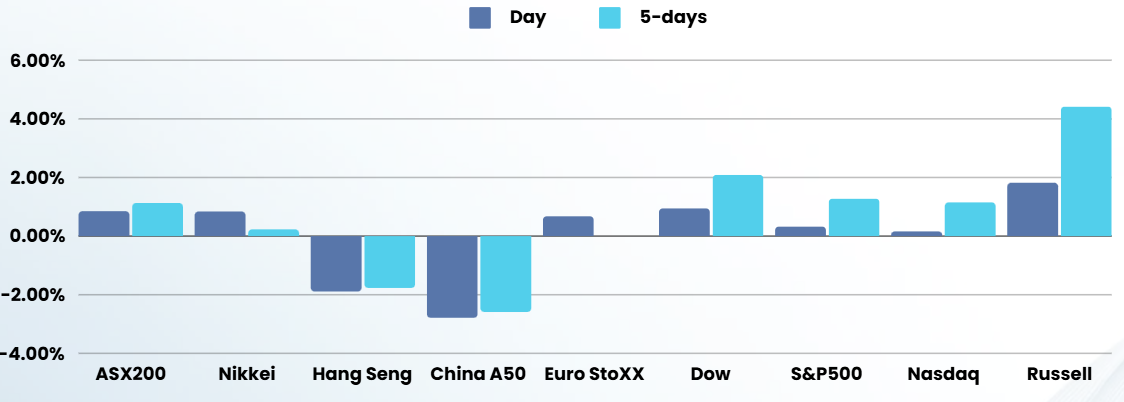

Wall Street closed higher on Friday, with the small-cap Russell the best performer as investors took comfort from data pointing to robust economic activity in the world’s biggest economy.

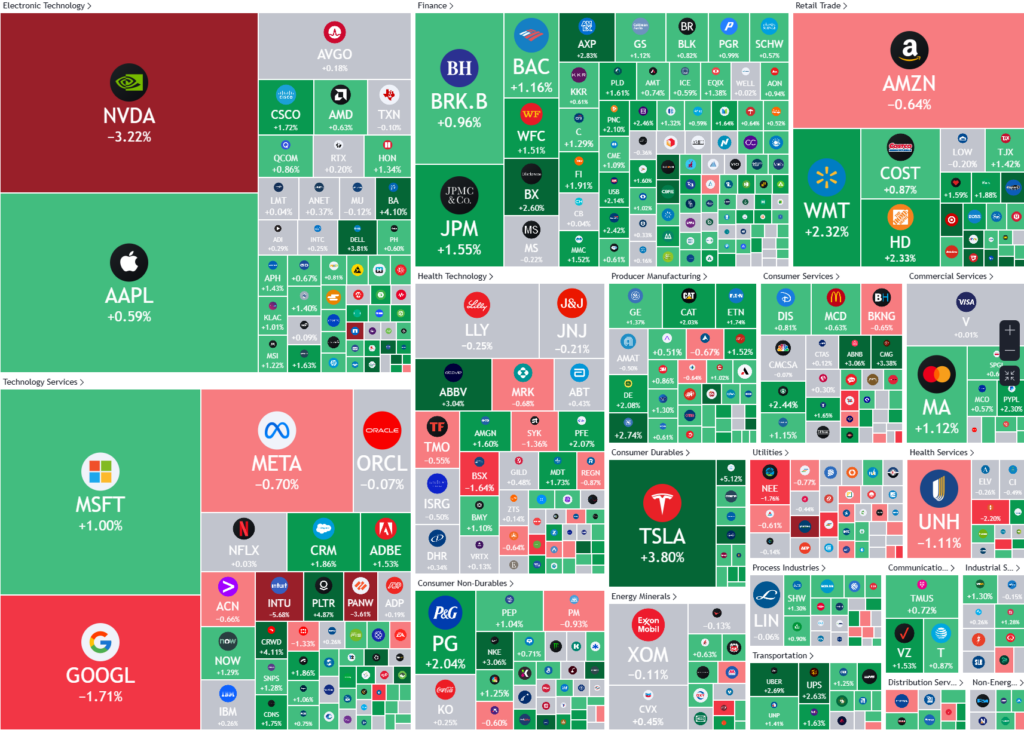

A measure of business activity raced to a 31-month high in November, boosted by hopes for lower interest rates and more business-friendly policies from President-elect Donald Trump’s administration next year. The domestically focused small-cap Russell 2000 index outperformed large-cap indexes and rose 1.8%. The index advanced 4.3% for the week, closing at its highest in more than a week. Meanwhile, Alphabet fell 1.7% following Thursday’s 4% drop, as the U.S. Department of Justice argued to a judge the company was monopolizing online search. AI bellwether Nvidia also slipped 3.2% in choppy trading following its quarterly forecast on Wednesday.

For the week, the S&P 500 gained 1.68%, the Nasdaq rose 1.73%, and the Dow climbed 1.96%.

Expectations on the Federal Reserve’s policy move in December have recently swayed between a pause and a cut, as investors weighed the likely impact of Trump’s plans on price pressures.

There is a 59.6% probability the central bank will lower borrowing costs by 25 basis points, as per the CME Group’s FedWatch Tool.

Geopolitics were top of mind this week as investors monitored a missile exchange between Ukraine and Russia, after Moscow lowered its threshold for a nuclear retaliation. The markets are also awaiting Trump’s Treasury Secretary pick.

The yield on benchmark U.S. 10-year notes fell 1.4 basis points to 4.418%, as markets reassess future rate cuts from the Federal Reserve given expectations that some of Trump’s policies could be inflationary. The market is now pricing in a 53% probability the Fed will cut rates by 25 basis points in December.

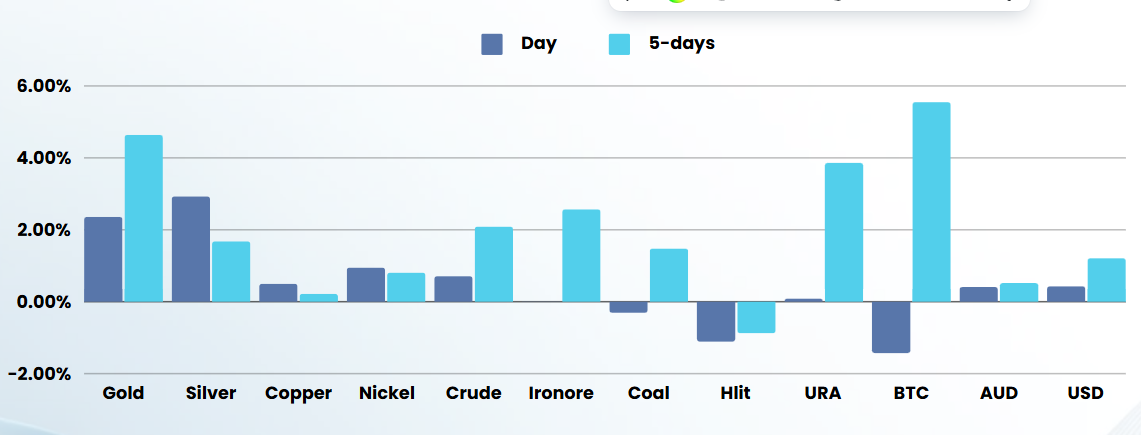

Oil prices climbed about 1%, settling at a two-week high, driven by the intensifying Russia-Ukraine conflict. Brent futures rose 1.3% to settle at $75.17 a barrel. U.S. West Texas Intermediate (WTI) crude rose 1.6% to settle at $71.24.

Gold prices breached the $2,700 threshold for the first time in two weeks, on track for their biggest weekly gain in over a year. Spot gold rose 1.37% to $2,706.39 an ounce. U.S. gold futures settled 1.4% higher at $2,712.20.

Week Ahead

- Inflation data: The US will release the PCE index on Wednesday, with economists expecting a 2.3% annual rise in October

- Black Friday: The start of the holiday shopping season will provide insights into consumer spending habits amid higher prices.

- Trump trade: The ‘Trump trade’ continues to drive market activity, with crypto and the dollar rising while clean energy and foreign assets decline.

- Oil prices: Crude benchmarks settled at a two-week high due to escalating geopolitical tensions in Ukraine.

- Eurozone inflation: The Eurozone will release inflation data on Friday, crucial for gauging ECB monetary policy direction

ASX SPI 8472 (+0.45%)

We should have a reasonable day with the broadening out of the MAG7 into small caps, generally a good thing for the Aussie market

Energy shares will likely have a strong start on Monday after rising tensions in the Ukraine-Russia conflict pushed Brent and West Texas Intermediate benchmarks 6 per cent higher last week. South 32, Woodside and Ampol have already rallied more than 4 per cent so far this month, while Whitehaven Coal has rocketed 13 per cent.

Yet, base metals and iron ore prices slipped on worries that threats of possible tariffs on Chinese products could dampen commodities demand next year.

Afterpay-owner Block, which is viewed as a proxy for cryptocurrency because nearly half of its revenues come from bitcoin, has soared 27 per cent this month.

Commonwealth Bank of Australia closed at a record $159.03 on Friday.

Smartpay releases earnings. Pro Medicus, Southern Cross Media and Regal Partners host AGMs.