Overnight –Whitehouse or White-noise, Stocks rally as tariffs soften… again

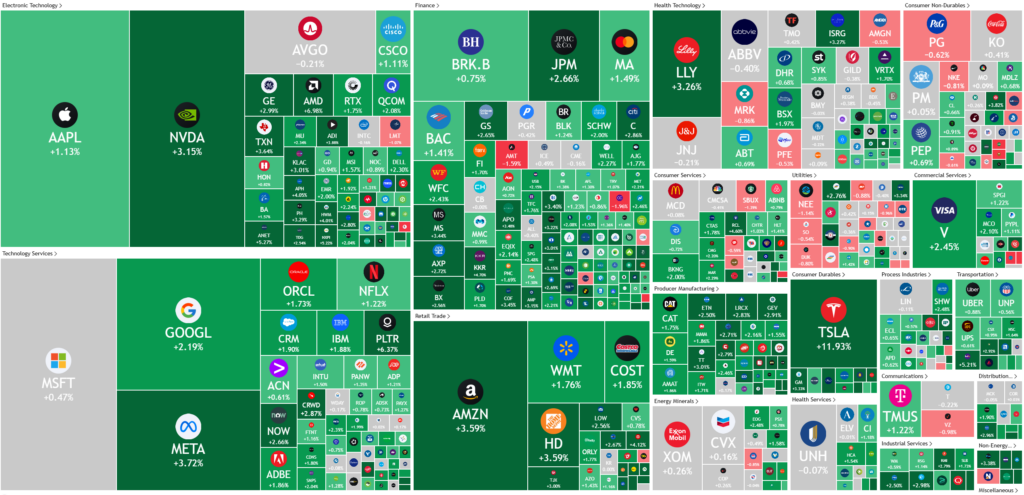

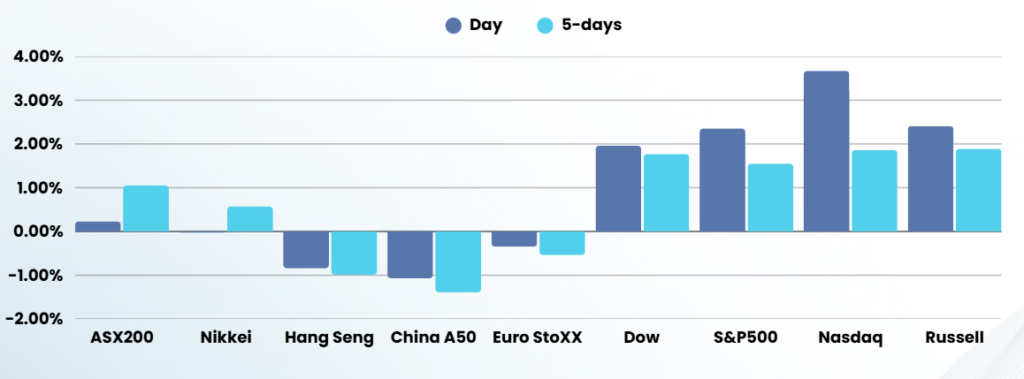

Stocks headed higher overnight led by tech as sentiment was boosted by reports indicating that upcoming U.S. trade tariffs will be narrower and less strict than initially feared.

Worries over the Trump administration’s tariffs have battered Wall Street in recent weeks, with the major indices slumping to six-month lows earlier this month as markets feared that the tariffs will increase inflation, disrupt global trade and dent economic growth.

However, reports from Bloomberg and the Wall Street Journal emerged over the weekend indicating that US President Donald Trump will likely not impose sectoral tariffs next week, and that his plans for reciprocal tariffs will be limited to about 15 countries. Trump has repeatedly touted April 2 as “liberation day” for the U.S., and while tariffs against major U.S. trading partners are still expected to weigh on the economy, their lessened scope offered investors some hope that the impact will be minimal. “Targeted is obviously better than the alternative, but the trade changes being envisioned are still substantial, and it’s likely they will have negative effects on the economy and corporate profits, at least in the near and medium term,” analysts at Vital Knowledge said in a note to clients.

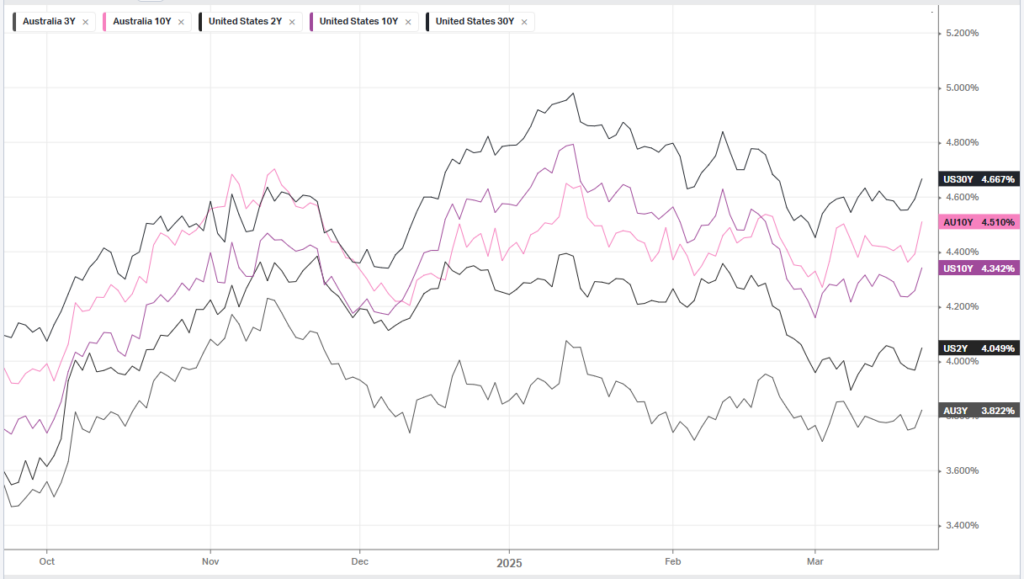

Focus this week is on a slew of addresses by Federal Reserve officials for more cues on the U.S. economy, especially after the central bank last week signaled heightened uncertainty over Trump’s policies. The Fed is widely expected to keep interest rates unchanged in the near-term, with sticky inflation also limiting the scope for rate cuts. Beyond the Fed, purchasing managers index data for March is set to offer more cues on U.S. business activity. A revised reading on fourth-quarter gross domestic product data is also due this week, as is the personal consumption expenditures price index, an inflation metric closely followed by Federal Reserve policymakers.

Company Specific

- Tesla jumped 12% as investors bought the recent dip in the EV maker that has seen its shares decline for straight weeks. There were also reports that the EV’s maker’s showroom in Texas had been targeted with incendiary devices.

- NVIDIA climbed 3% as the prospect of less harsher tariffs imposed by the Trump administration eased concerns about tariff-induced headwinds for the chipmaker.

ASX SPI 8020 (+0.36%)

The ASX will follow the US higher today as the concerns around Tariffs ease with Trump watering down his big talk.

The talk around Trump weakening his stance will likely result in another ego driven threat to a random country and fears escalating again, but the market is starting to realise that he is full of something…. And it isn’t tariffs