Overnight – Stocks continue to fall as investors nervously await Nvidia earnings

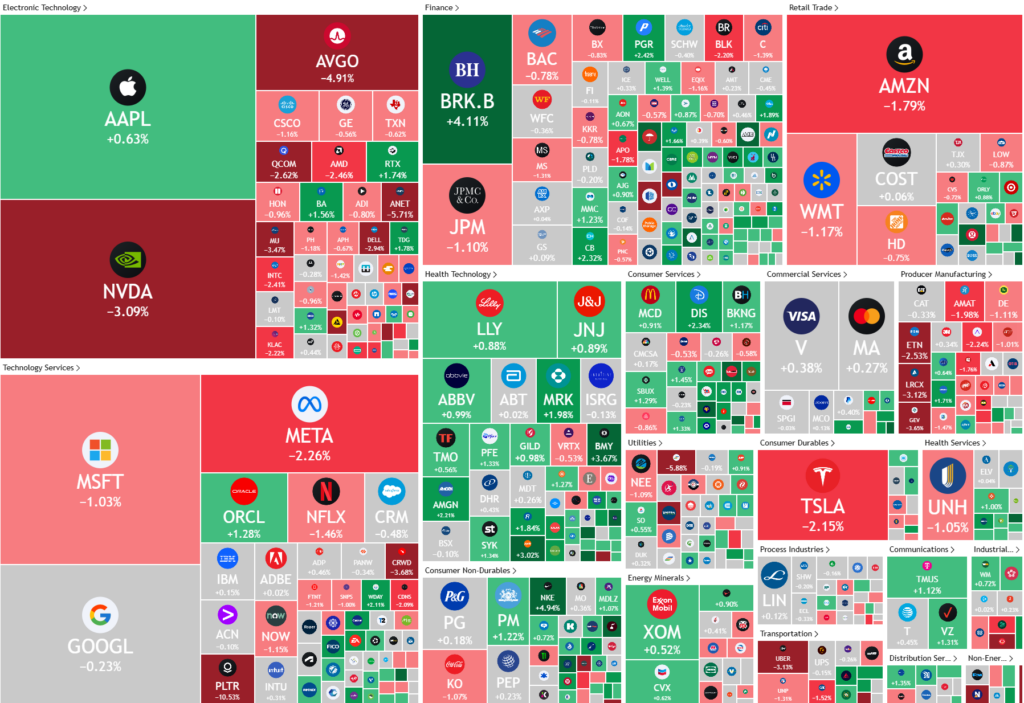

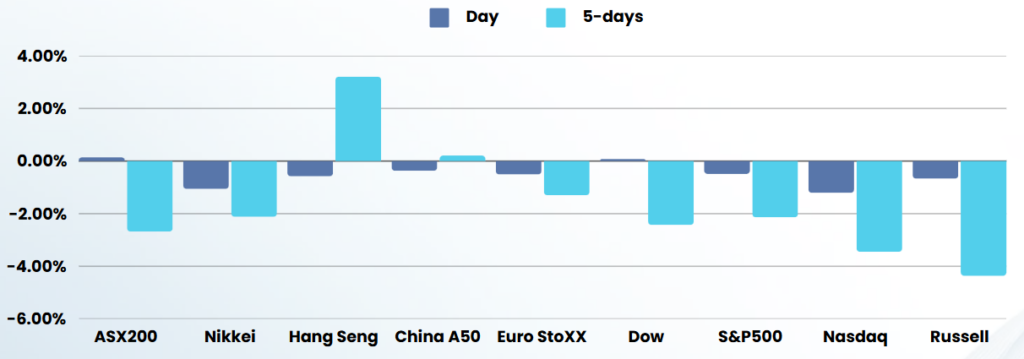

Stocks continued to fall overnight driven by an Nvidia-led decline in fall in tech ahead of earnings from chipmaking giant.

Nvidia fell more than 3% leading the broader slump in tech as ahead of its earnings slated for this week. The chipmaking giant’s quarterly results, due Wednesday after the market closes, are expected to serve as a barometer of AI appetite.

“We expect another robust performance and “clear beat and raise special” this week from Nvidia that should calm the nerves of investors as Jensen lays out the massive demand drivers from Blackwell and AI Capex in the field fueling this 4th Industrial Revolution,” Wedbush said in a recent note.

Apple however, sidestepped the selloff to end slightly higher after announcing plans to invest $500 billion in the U.S. over the next four years to boost AI, silicon engineering, and advanced manufacturing.

Markets will also be keeping tabs this week on developments around a budget framework laid out by Republicans in both the House of Representatives and Senate. House Republicans are reportedly set to move ahead with a vote early this week on their plan for one large budget bill, according to Roll Call.

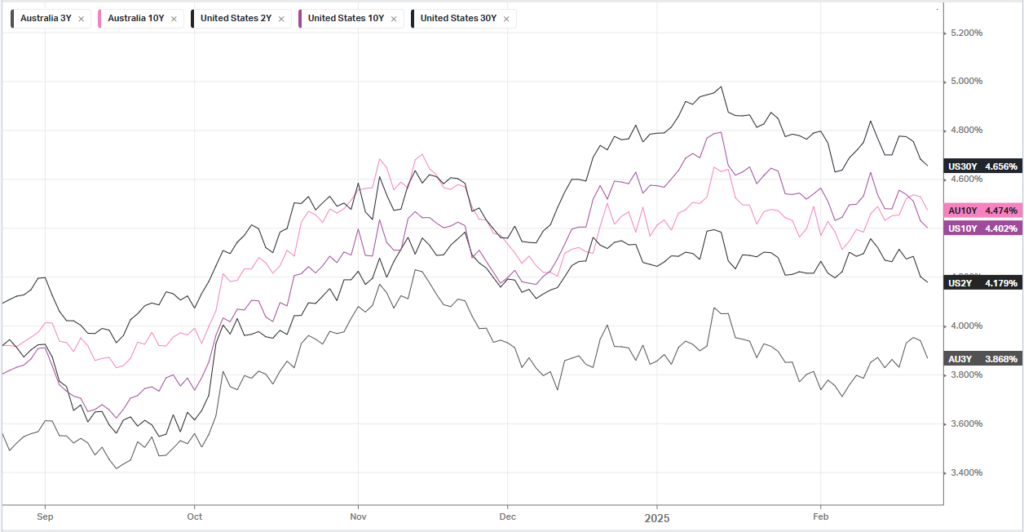

On the economic front, the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures Price Index, and the second estimate for fourth quarter gross domestic product, set to be released later this week, will likely stoke fresh clues on the Fed’s policy path ahead.

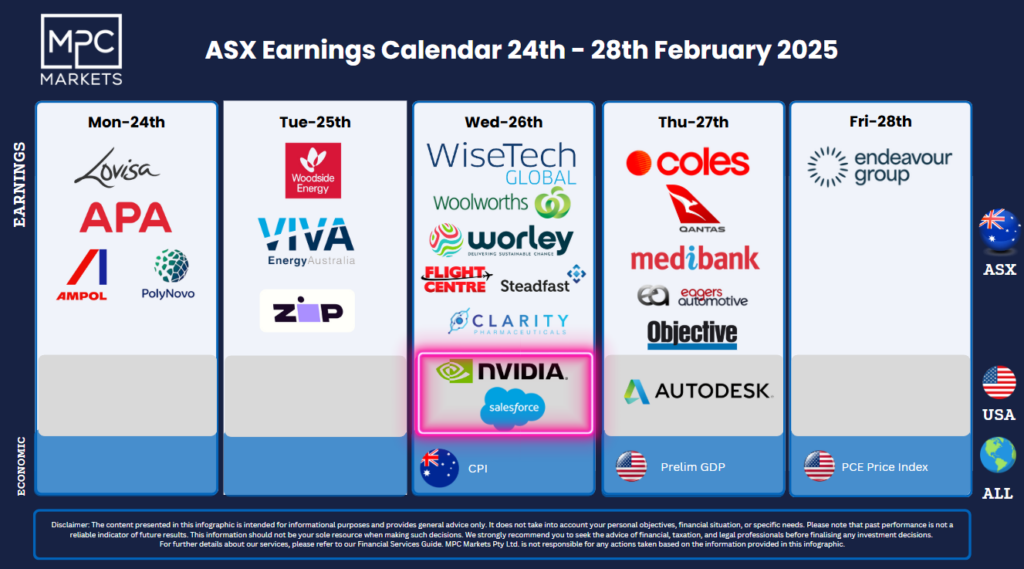

Corporate Earnings

- Alibaba Group – fell 10% after announcing plans on Monday to invest 380 billion yuan ($52.4 billion) over the next three years to boost its cloud computing and AI infrastructure, marking its largest technology investment to date. The move underscores Alibaba’s ambition to lead in AI-driven growth and solidify its position as a global cloud provider, the company said.

- Berkshire Hathaway – Warren Buffett’s fund rose 4% despite reporting a third-straight all-time peak in full-year profits and lifted its cash stake up to $334.2 billion. The 94-year-old Buffett also told shareholders that “it won’t be long” before Vice Chairman Greg Abel takes over at the helm of the investment conglomerate.

- Microsoft – slipped 1% the tech giant started to cancel leases for a significant amount of data capacity in the U.S., in a sign that the tech titan may be responding to concerns surrounding possible overspending on its AI capabilities, according to analysts at TD Cowen. Shares were lower.

- Nike – stock price climbed 5% after the athletic apparel firm’s rating was upgraded to “buy” from “hold” at Jefferies, with the analysts suggesting the company is well-positioned for a rebound in performance over the next two years.

ASX SPI 8217 (-0.76%)

As we enter the last big week of earnings in the local market, the index will start the week on thin ice as soft US economic data threatens the 15 month bull run that has been seemingly bulletproof. The weakness in the bank stocks has seen the local index heavy as ETF money flow reverses, causing a potential snowball effect as value bis are unlikely to appear for 15%+ on the downside

reporting season schedule includes Domino’s Pizza, Nine Entertainment, Platinum Asset Management, G8 Education and Woodside Energy.

Company Specific

- Domino’s PizzaEnterprises has tumbled to a loss of $22.2 million for the six months to December 31 owing to heavy restructuring costs as it closes 205 stores.

- Wisetech – 4 board members have resigned en masse as Richard White has said “I am Wisetech” the type of megalomania that rarely ends well