Overnight – Stocks surrender to rising bond yields, Tesla shines after the bell

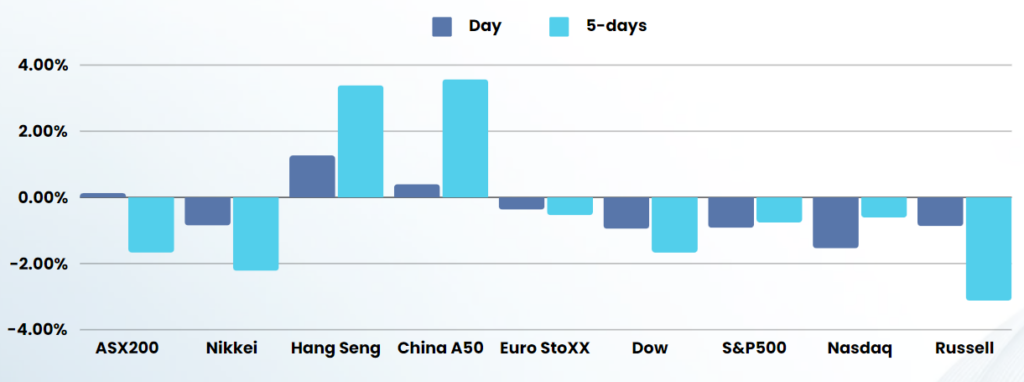

Despite Tesla impressing the market after the bell, stocks finally succumbed to rising Treasury yields putting pressure on megacap stocks, as investor confidence waned regarding significant rate cuts from the Federal Reserve.

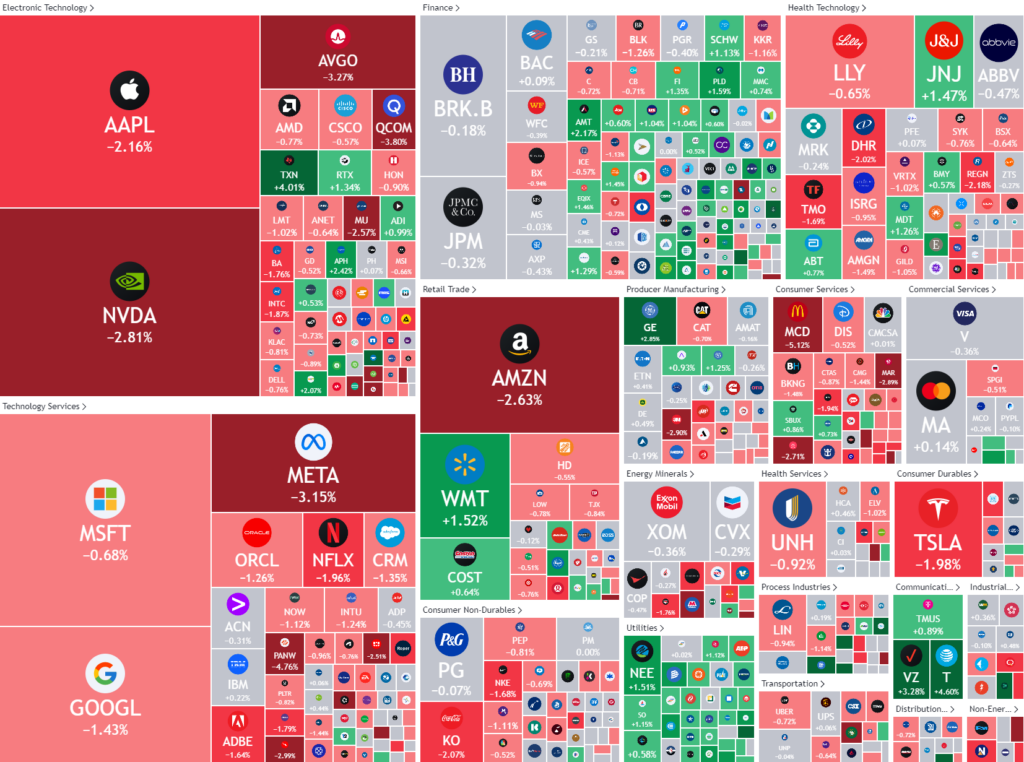

The benchmark 10-year U.S. Treasury yields hit a three-month high, prompting investors to reassess the Fed’s rate-cut outlook amid strong economic data and the upcoming presidential election. Adam Turnquist from LPL Financial noted that the market is struggling to adjust to the increase in yields, which is affecting stock prices. Major technology companies like Nvidia, Apple, Meta Platforms, and Amazon saw declines, contributing to the Nasdaq’s drop.

Adding to the Mega-cap woes, Apple fell more than 2%, leading a stumble in broader tech after market analyst Ming-Chi Kuo at TF International, known for his knack of nailing predictions on Apple, delivered a gloomy update on iPhone 16 demand.Tonight will see Tesla, IBM and Coca-Cola deliver earnings, with Amazon due to report Thursday night

McDonald’s faced a decline after an E. coli outbreak linked to its Quarter Pounder burgers resulted in one death and several illnesses.

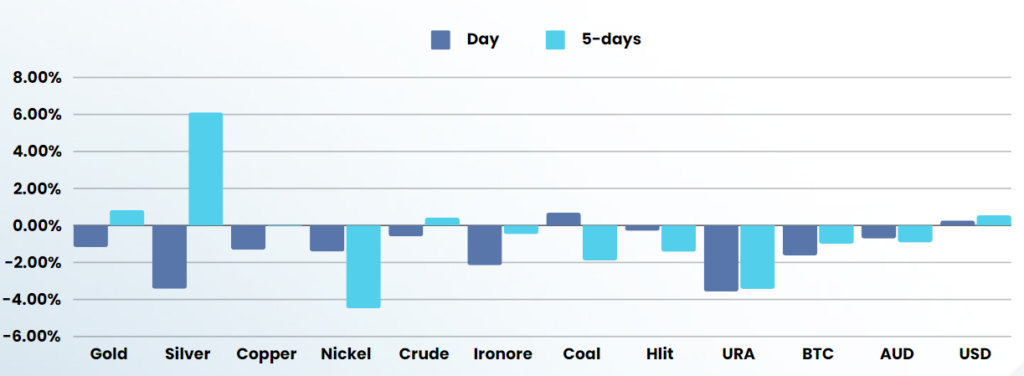

The rising bond yields also weighed on precious metals and commodities took a breather from their recent stellar run

It was a heavy night of earnings with Tesla, Coca-Cola, IBM & Boeing among the big names that delivered earnings overnight

Stock specific

- Tesla +8.8%– Shares soared 9% after the bell, as the company reported a better-than-expected profit margin for the third quarter despite offering financial incentives to boost demand for its older electric vehicle models. The company’s shares rose significantly after hours. Tesla’s strategy shift from price cuts to offering cheaper financing options and discounts has helped stabilize profit margins. Additionally, falling raw material costs for EV batteries are expected to reduce production costs. Tesla also unveiled new autonomous products, including the Cybercab robotaxi and a self-driving van, as part of its push into autonomous technologies.

- Boeing – fell 3% after reporting quarterly results that missed estimates, with the aircraft maker suffering its largest quarterly loss since 2020.

- AT&T – rose more than 4% after the telecoms giant reported a $4.4 billion goodwill impairment charge related to its business-wireline unit, which has overshadowed the company gaining more wireless subscribers than expected in the third quarter, driven by the steady adoption of its higher-tier unlimited plans.

- Coca-Cola – fell 2% after the soft drinks giant reported sluggish demand, even as higher prices meant that quarterly earnings beat expectations.

- Texas Instruments – rose 4% after the chipmaker reported third-quarter income that topped expectations, helped by “momentum” for electric vehicles in China.

- Starbucks – rose nearly 1% after the coffee chain reported preliminary results for its fourth quarter, posting declines in same-store sales, net revenue, and profit, driven by weaker demand in the US.

ASX SPI 8229 (-0.19%)

We are in for a rough day as equites finally realized they cant ignore the bond market forever. The last week has been very peculiar, as equities seemingly ignorant of the significant rally in AU and US bond yields of 50-60bps in October. Interest rate sensitive stocks are likely to be the focus of the selling.

Founder woes continue with many media outlets and pundits calling for the heads of the founding CEO’s of WiseTech & Mineral Resources . The AFR ran a story about ex-WiseTech board member, Christine Holman accusing billionaire founder Richard White of intimidation, bullying and overseeing poor corporate governance by one of the country’s leading directors as she quit the software giant’s board.

Quarterly updates are expected for Core Lithium, Fortescue, Karoon Energy,

Newmont, Northern Star and Strike Energy. Brambles, IAG, South32 and Super Retail Group all host AGMs.