Overnight – Wall St grinds out a positive day to snap 4-week losing streak

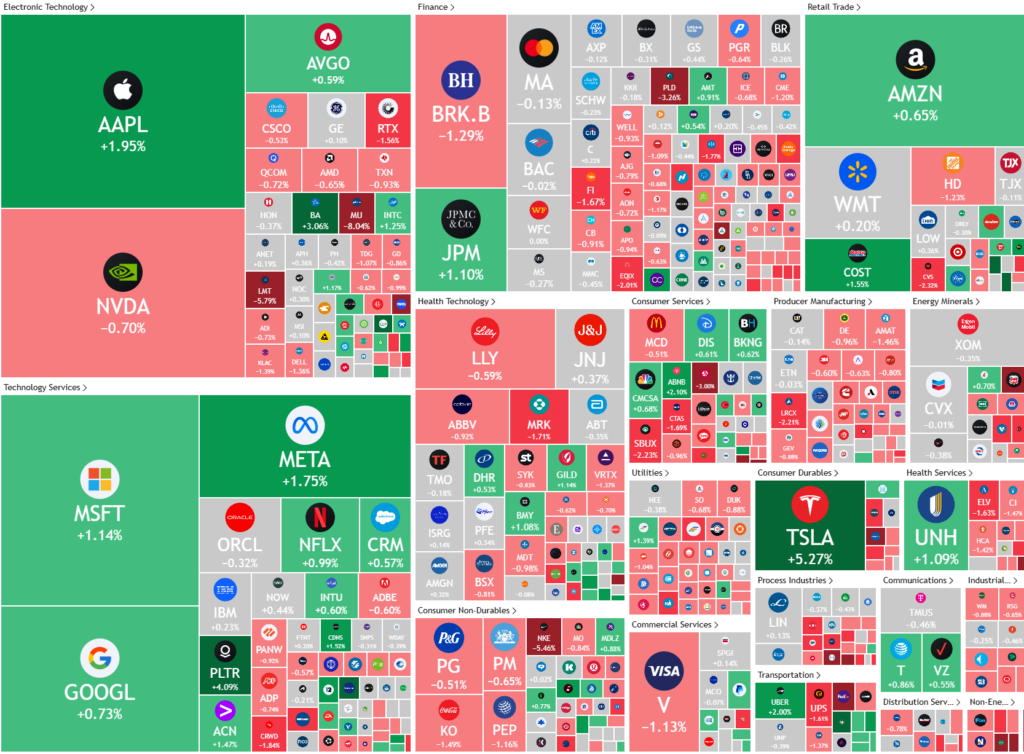

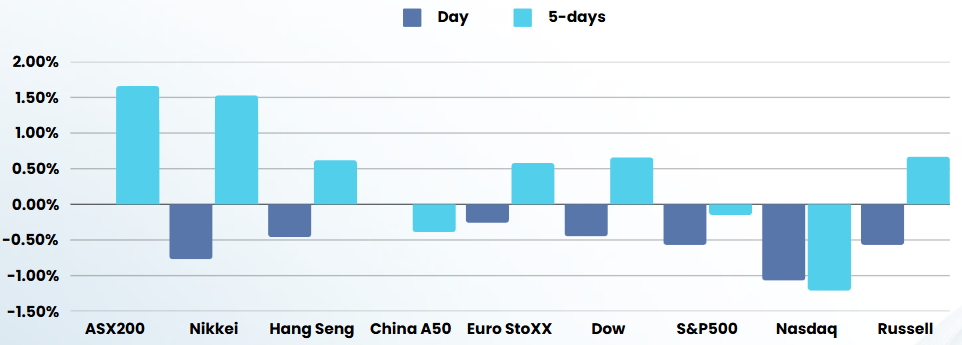

Stocks managed to snap a four-week losing streak with a slight gain on Friday after a volatile week, marked by trade policy uncertainty and a Federal Reserve policy update.

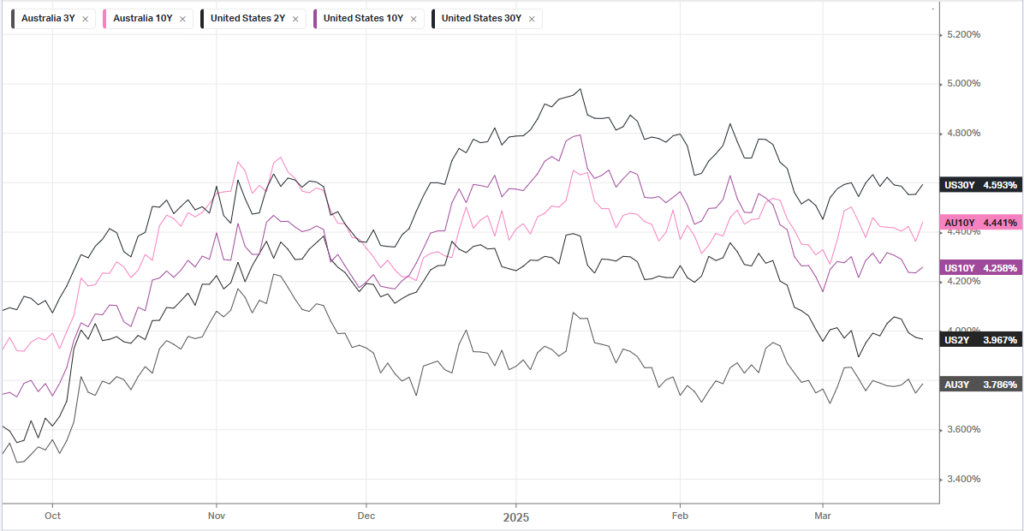

President Donald Trump’s comments on flexibility regarding reciprocal tariffs, set to take effect on April 2, contributed to market fluctuations. The Federal Reserve maintained interest rates unchanged but raised inflation forecasts and lowered growth projections for 2025, casting doubt on future rate cuts. The central bank remains uncertain about the impact of Trump’s tariffs on the economy. Additionally, the European Union’s decision to delay retaliatory tariffs on U.S. whiskey provided some relief, suggesting potential progress in trade talks.

In the corporate sector, FedEx and Nike saw significant stock declines after revising their outlooks downward. FedEx cited weakness in the U.S. industrial economy, while Nike’s revenue fell short of expectations. Micron Technology’s stock initially rose but later fell despite a positive revenue forecast. Global economic indicators and geopolitical tensions, including Israeli airstrikes on Gaza and a Ukrainian drone attack on a Russian airfield, further heightened investor uncertainty.

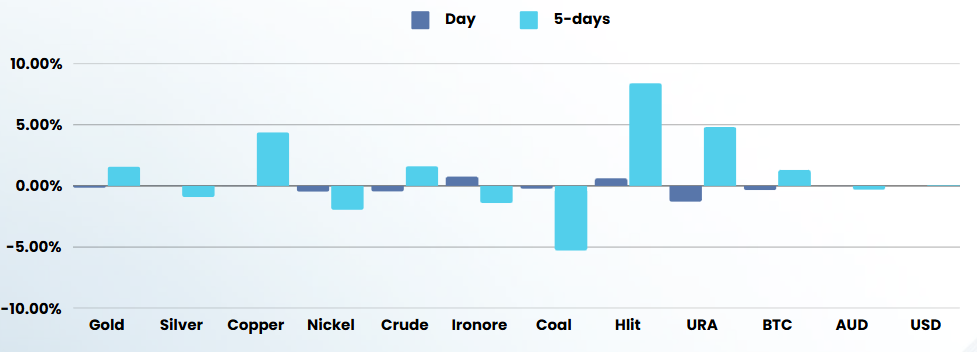

The dollar strengthened against major currencies, and U.S. Treasury yields saw mixed movements. Crude oil prices edged higher due to new sanctions and OPEC+ output plans, while gold paused its recent gains due to a stronger dollar. The coming week will feature key U.S. economic data releases, including housing and industrial figures, and the final GDP estimate for the fourth quarter.

ASX SPI 7945 (-0.51%)

The ASX is likely to open slightly lower as tariff concerns cast a shadow over investor sentiment. This week, the federal budget on Tuesday will take centre stage. Treasurer Jim Chalmers is expected to unveil an underlying cash deficit of about $20 billion this year, widening to more than $40 billion for 2025-26.

Analysts anticipate there will be about $8 billion in additional stimulus such as extending electricity rebates. That could provide some temporary relief to inflation for consumers ahead of Australia’s CPI print on Wednesday.

Company Specific

- James Hardie Industries plc has entered into a definitive agreement to acquire The AZEK Company Inc. for approximately $8.75 billion, including AZEK’s net debt. The transaction involves a combination of cash and James Hardie shares, offering AZEK shareholders $56.88 per share, representing a premium to AZEK’s recent trading prices. The merger will create a leading platform for exterior and outdoor living building products, enhancing growth and profitability through complementary product offerings and synergies