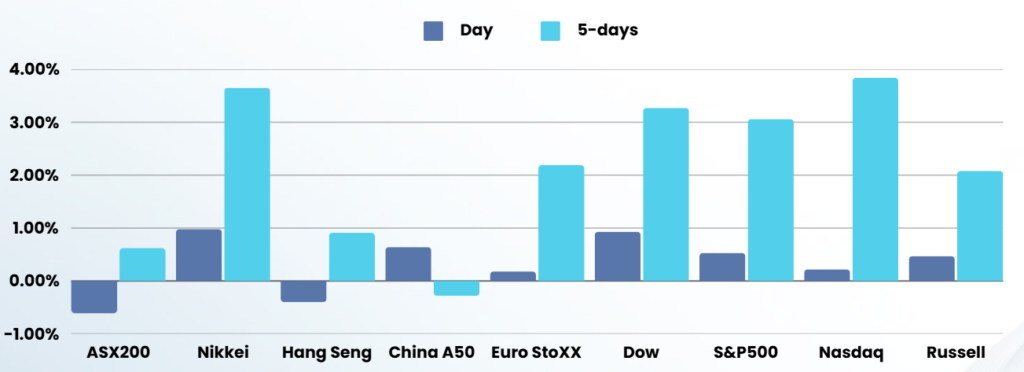

Overnight – Stocks hover at highs as Trump threatens “Trillions in Tariffs”

Stocks hovered around record highs overnight as investors digested more corporate earnings and remarks from President Donald Trump at Davos in which he said he would demand interest rates be lowered and charge Trillions in tariffs

The World Economic Forum (WEF) has been going on all week, overshadowed by the Presidential inauguration and Trumps ability to constantly steal headlines. Trump delivered a speech remotely to the World Economic Conference in Davos, Switzerland, touching on range of topics including interest rates, the US-China trade relationship, and domestic energy policy. On interest rates, Trump said he would “demand that interest rates drop immediately, and likewise they should be dropping all over the world.” The remarks come ahead of the Fed meeting next week, with many on Wall Street expecting the central bank to hold rates steady, the rate sensitive 2-year Treasury was largely unchanged, however, as he Fed like many other world central banks is independent.

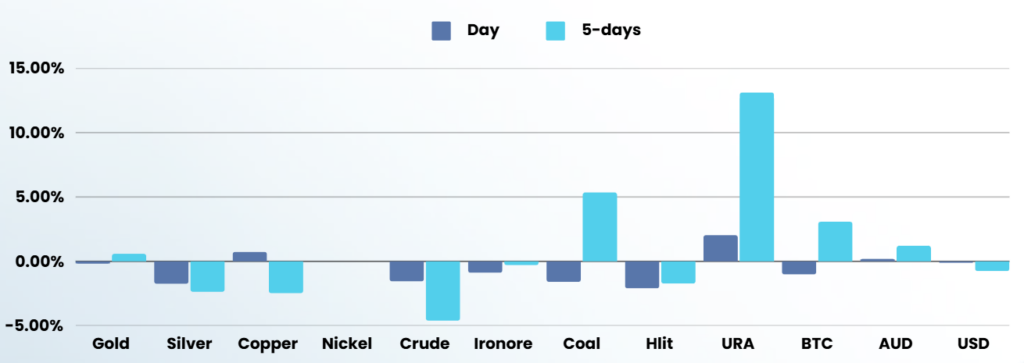

The president did, however, pressure oil prices after saying he would ask Saudi Arabia to lower the price of oil and he reiterated a pledge to accelerate U.S. energy production.

Data released earlier Thursday showed that the number of Americans filing new applications for unemployment benefits rose marginally last week, suggesting that solid job growth likely continued in January. Initial claims for state unemployment benefits increased 6,000 to a seasonally adjusted 223,000 for the week ended Jan. 18. However, freezing temperatures that have gripped large parts of the country and fires in Los Angeles could boost claims in the coming weeks.

Corporate Earnings

- GE Aerospace – stock rose 7% after the aircraft engine supplier forecast a stronger full-year profit as demand for its high-margin parts and services got a boost from airlines flying older jets to sidestep a persistent shortage of new aircraft.

- American Airlines – stock slumped 8% after the carrier’s first-quarter earnings outlook on Thursday fell short of expectations, forecasting an adjusted loss per share of 20 cents to 40 cents for the first three months of 2025, breaking from a more upbeat outlook from its rivals.

- Electronic Arts – slumped 17% after the video game maker slashed its guidance for net bookings due to sluggish performance of its soccer titles.

ASX SPI 8376 (+0.34%)

The market remains on heightened “Trump-watch” with the newly inaugurated President not disappointing media outlets with a steady supply of soundbites

Commodity strategists are cautiously optimistic that Donald Trump’s trade policies against China will not be as aggressive as feared, as concerns ease about a full-blown trade war that had threatened to hit raw material prices. Strategists have been encouraged by Mr Trump not immediately slapping China with aggressive tariffs, which they feel suggests he might take a more measured approach to his trade policy.