Overnight – Stocks hammered as consumer & business sentiment plummets

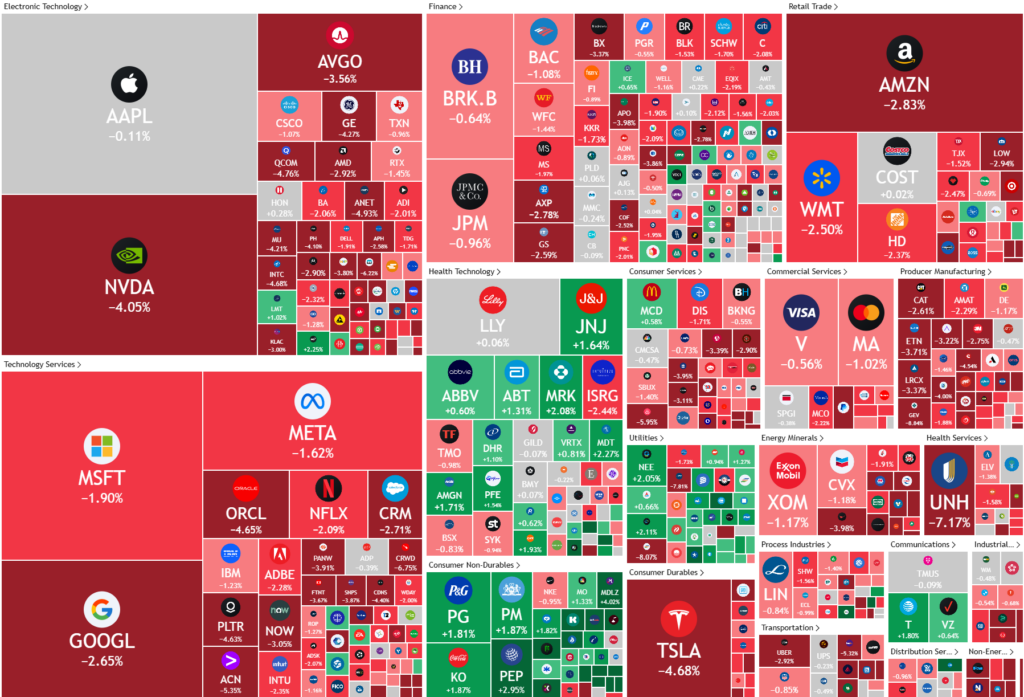

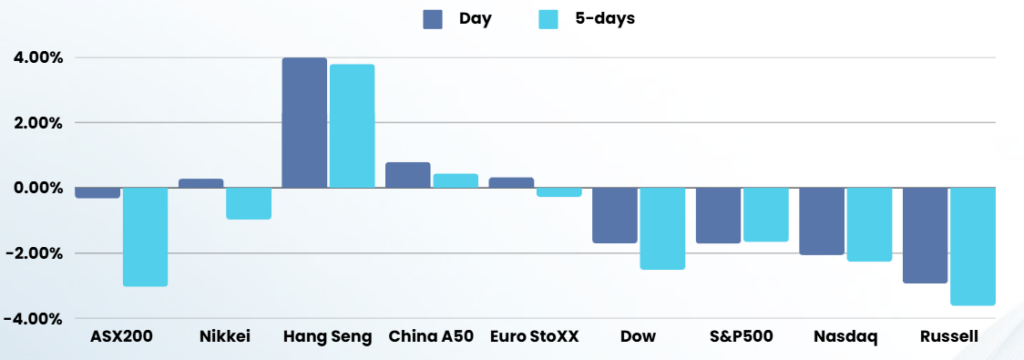

Stocks slumped Friday, ending the week with a loss as soft data flagging worries about the economy triggered a sea of red of across the market.

S&P Global’s preliminary composite purchasing managers’ index for the U.S., a tracker of both the manufacturing and services sectors, came in at 50.4 in February, down from 52.7 in January, while services PMI fell to 49.7 from 52.9. As well as weaker services data, the University of Michigan’s sentiment index showed U.S. consumer sentiment deteriorated further in February, falling to a reading of 64.7 from 71.1 and missing forecasts of 64.8. Still the warning from Walmart rattled other retailers, with Target Corp and Costco Wholesale Corp also trading in the red.

The latest quarterly earnings season is coming to close, although analysts at Vital Knowledge flagged that key reports are due out next week, including numbers from artificial intelligence-darling Nvidia

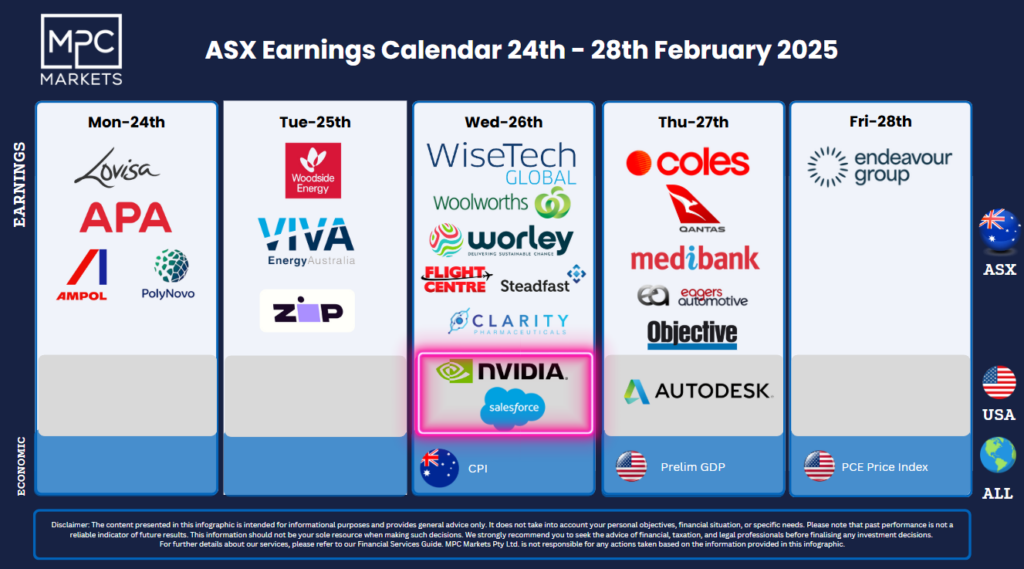

Corporate Earnings

- Block Inc – slumped 17.7% after its Q4 results fell short on expectations amid rising competition for payment system.

- Unitedhealth Group – shares fell 7.3% following a report in the WSJ that the DoJ has opened a civil fraud investigation into UnitedHealth’s Medicare billing practices in recent months. In response to the report, the company called the report “misinformation,” emphasizing that the government routinely evaluates plans associated with the program.

- Hims Hers Health – plunged 25% following an FDA announcement that the supply shortage of Novo Nordisk weight loss and diabetes drugs was ending

ASX SPI 8203 (-0.77%)

As we enter the last big week of earnings in the local market, the index will start the week on thin ice as soft US economic data threatens the 15 month bull run that has been seemingly bulletproof. The weakness in the bank stocks has seen the local index heavy as ETF money flow reverses, causing a potential snowball effect as value bis are unlikely to appear for 15%+ on the downside

Big names to report today are Ampol, Lovisa, Polynovo APA group.

For the rest of the week we will see Woodside, the supermarkets, Worley and Flight centre to name a few