Overnight – Stocks and bond yields drift higher into Christmas

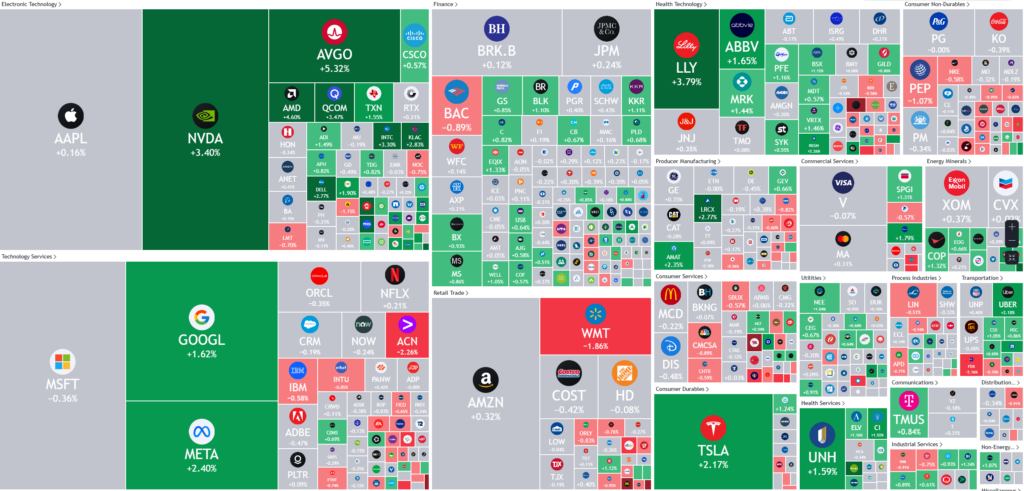

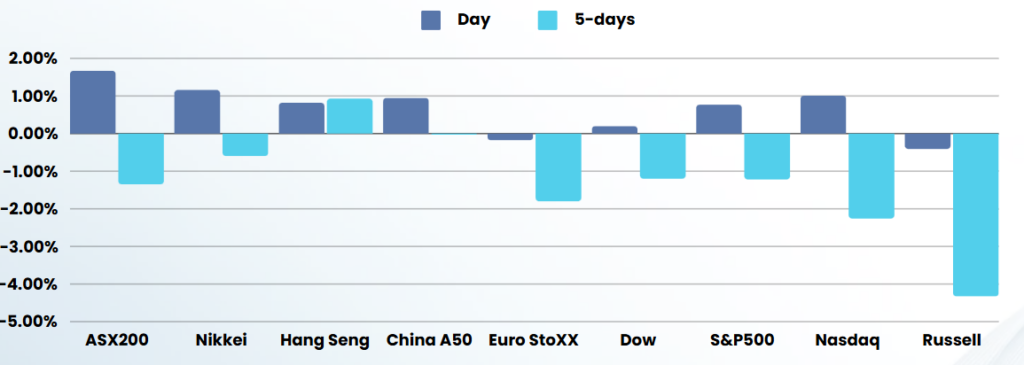

Equities were mixed overnight, supported by rallies in megacap stocks like Nvidia and Broadcom on Wall Street. The S&P 500 and Nasdaq saw gains, while the Dow Jones Industrial Average experienced a slight decline.

U.S. Treasury yields climbed as investors adjusted their expectations for fewer interest rate cuts in 2025. The benchmark 10-year Treasury yield rose to 4.597%, its highest level since late May. This increase in yields was attributed to the market adapting to a less dovish Federal Reserve policy.

Economic data released on Monday painted a mixed picture. The Conference Board’s U.S. consumer confidence index weakened unexpectedly in December, dropping to 104.7 from November’s revised 112.8. This decline was primarily due to concerns about future business conditions. In contrast, new orders for key U.S.-manufactured capital goods rose in November, indicating strong demand for machinery.

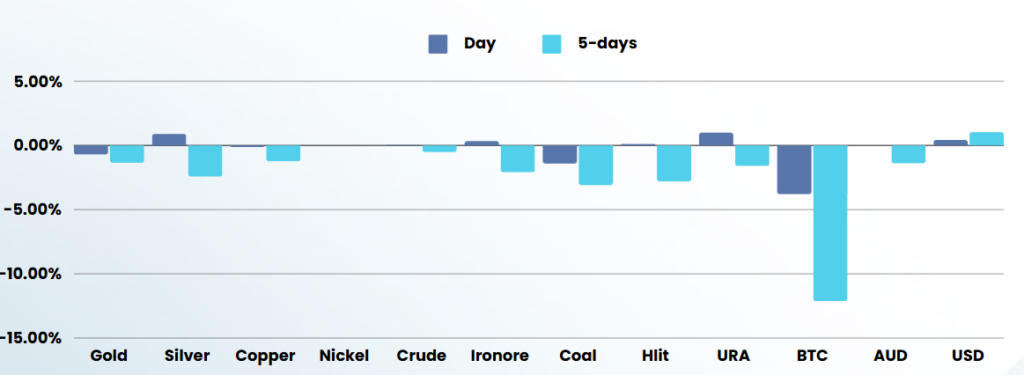

The currency market saw the dollar advance against a basket of major currencies, with the dollar index rising 0.25% to 108.06. The euro fell 0.2% against the dollar, while the Japanese yen weakened 0.44%.Oil prices edged down in thin trade ahead of the Christmas holiday, with concerns about a potential supply surplus in 2024 and a strengthened dollar weighing on the market. U.S. crude settled at $69.24 a barrel, down 0.32%, while Brent crude fell 0.43% to $72.63 per barrel.

Gold prices also experienced a slight decline in subdued holiday-season trading, affected by the robust dollar and high U.S. Treasury yields. Spot gold fell 0.42% to $2,609.73 an ounce.

Investors remained cautious, with concerns about the economy, potential Federal Reserve missteps, and uncertainty surrounding the upcoming U.S. presidential transition influencing market sentiment.

ASX SPI 8203 (+0.01%)

The ASX is likely to follow yesterdays trend of index buying driving the market higher, benefiting the over priced banks

The lack of volume could see sharp moves in some stocks. After todays session we will be shut until Friday

THIS WILL BE THE FINAL MORNING REPORT FOR 2025 – MERRY CHRISTMAS