Overnight – Stocks extend gains on trade optimism, despite China denial

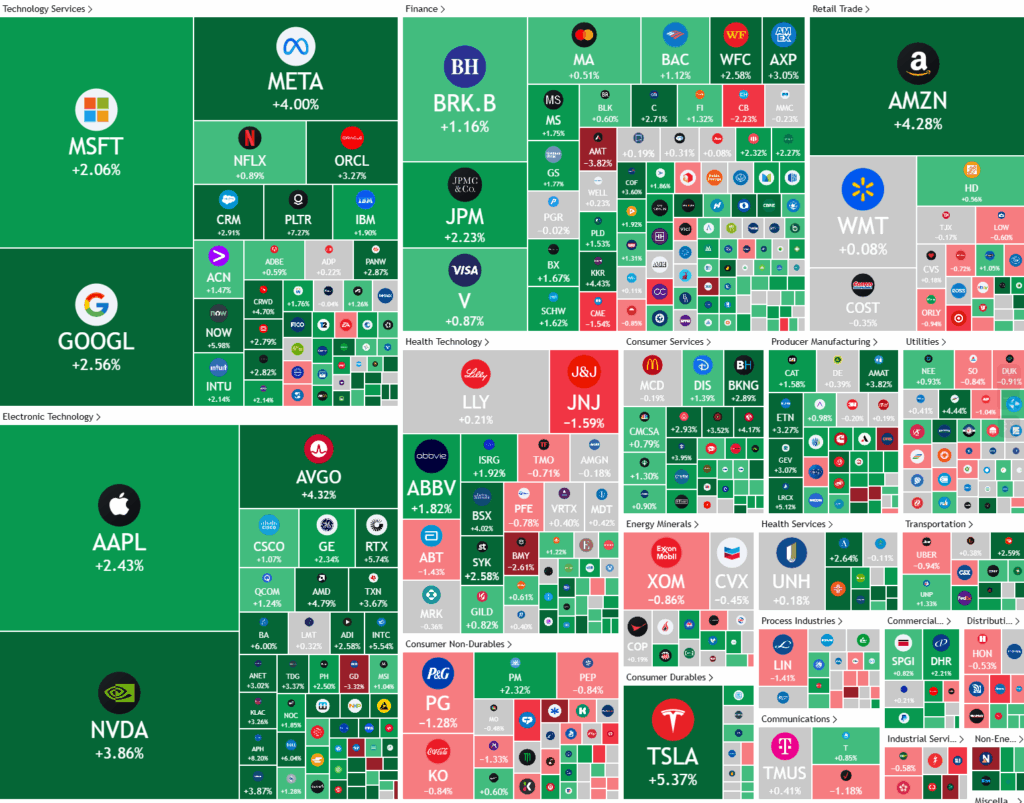

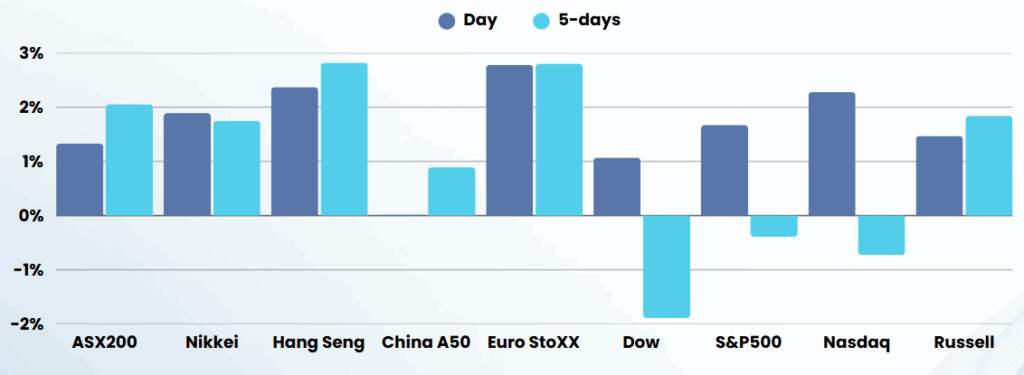

Stocks closed higher overnight, but well off session highs, as US Treasury Secretary Scott Bessent cooled some optimism on a quick resolution to the U.S.-China trade standoff.

Bessent and Trump cooled their optimism on a China deal after a folding like a deckchair in yesterdays press conference. Bessent said there was no unilateral offer from President Donald Trump to lower China trade tariffs, adding doubt to an earlier Wall Street Journal report that suggesting Trump was willing to reduce the 145% tariffs on China.

The remarks injected a sense of reality into the current U.S.-China trade standoff and suggest that the Trump administration could be waiting for China to make the first move. But China President Xi Jinping isn’t expected to cave in at the first offer of a trade truce from the Trump administration, FOX Business reported, citing unnamed CEOs with close ties to Chinese government. This suggest the current trade standoff between the world’s two biggest economies could continue for a while longer, dampening earlier optimism for a quick resolution.

Trump that high tariffs on China will come down “substantially,” but “it won’t be zero.”

Predictably after Trump folded yesterday, he went deep into his divert/distract playbook with an softball signing of an education executive order before moving onto a listless 30m+ ramble “we are taking meetings” “We’ve talked to 90 countries” “Maybe China is one of them” This will be Trump for the next 80 odd days…

Company Earnings

- Tesla – stock jumped 6%, after the electric vehicle manufacturer reported first-quarter profits at its core auto business that were better than rock-bottom estimates.

- Intel – gained more than 5% after Bloomberg reported the chipmaker is set to unveil plans this week to slash more than 20% of its workforce, in a move to streamline operations and reduce bureaucratic inefficiencies.

- Philip Morris – stock climbed more than 2% after the tobacco giant posted a solid first-quarter report, and raised its full-year 2025 earnings guidance.

- Boeing – stock surged 6% after the aircraft manufacturer posted its first growth in quarterly revenue since 2023

It will be quiet on the ASX today as we head into another long weekend. Expect some buying to continue as trade tension ease

Company news

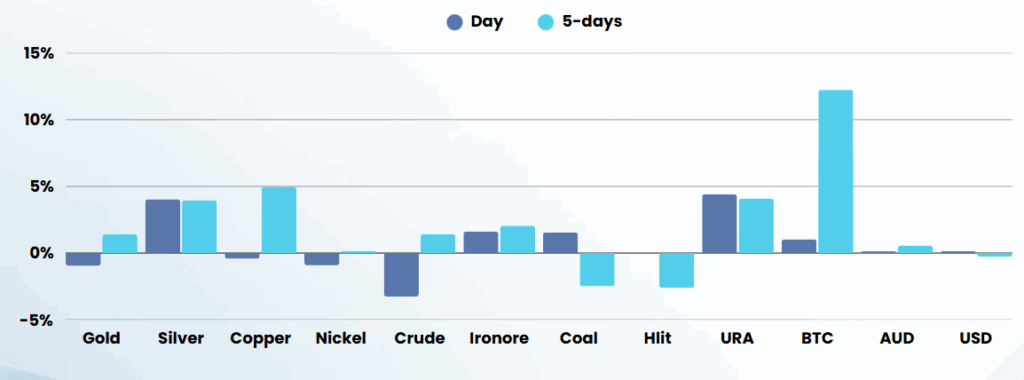

- Newmont reported a 19 per cent fall in gold production in the first quarter owing planned mine sequencing and safety improvements, and a lower output result from its Nevada Gold Mines joint venture. Ouput fell to around 1.5 million ounces, down from 1.9 million the prior quarter, though sales were made at a higher realised price of $US2944 an ounce. The Denver-headquartered gold miner declared a dividend of US25¢ a share (39.3¢) and said it remianed on track to meet 2025 guidance.