Overnight – Gold and Silver scale new heights on BRICS & US Election

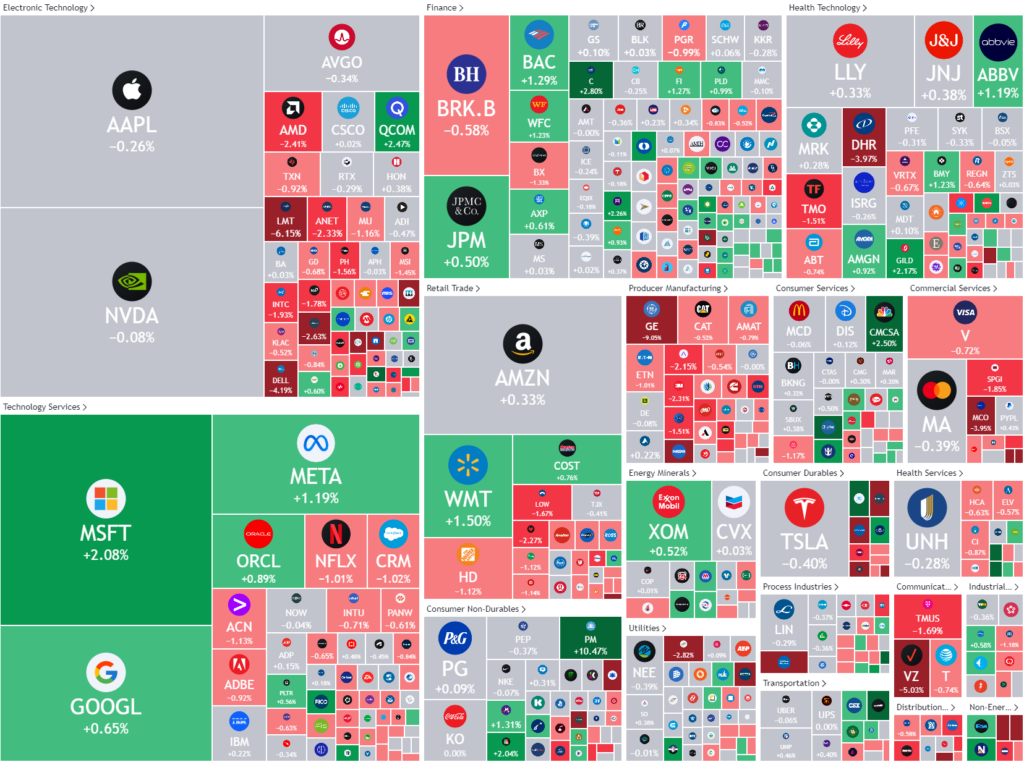

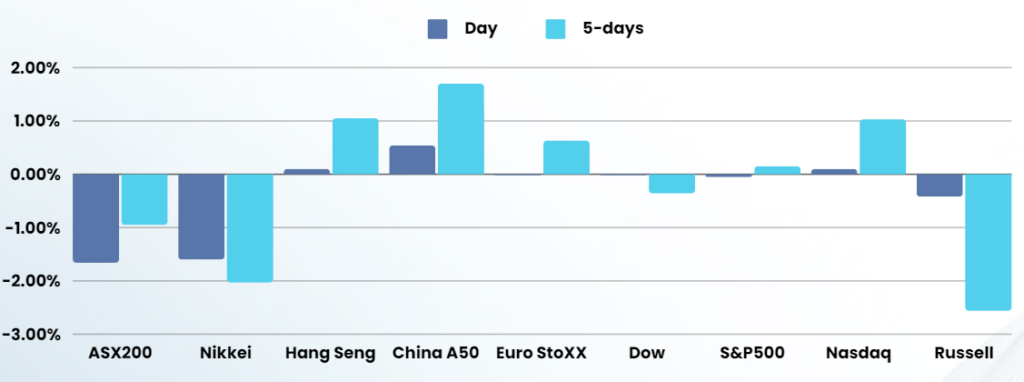

Precious metals continued their bull run overnight as stocks ended slightly lower, recovering the bulk of losses as traders weighed rising Treasury yields and mixed slate of quarterly corporate earnings.

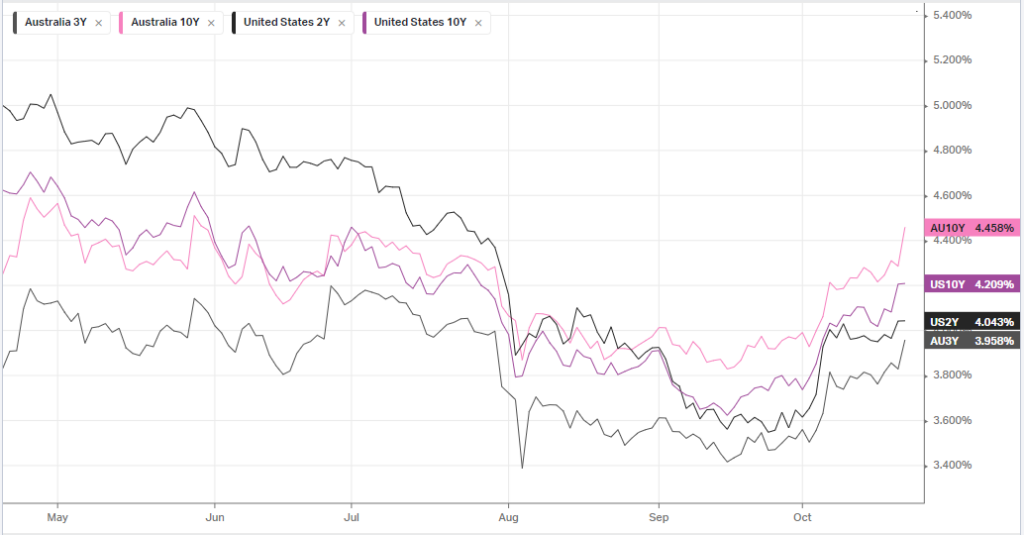

There wasn’t much top-tier data on the economic front, but Treasury yields continued their climb higher from a day earlier as the International Monetary Fund lifted its U.S. growth forecast. The IMF now expects U.S. growth of 2.8% for this year, up 0.2% from a prior forecast on expectations of that rising wages and asset prices will underpinned stronger-than-expected consumption.

The yield on the 10-year Treasury continued to rally, rising 2 basis points to 4.210%, a 50bps rally since the first rate cut from the FOMC

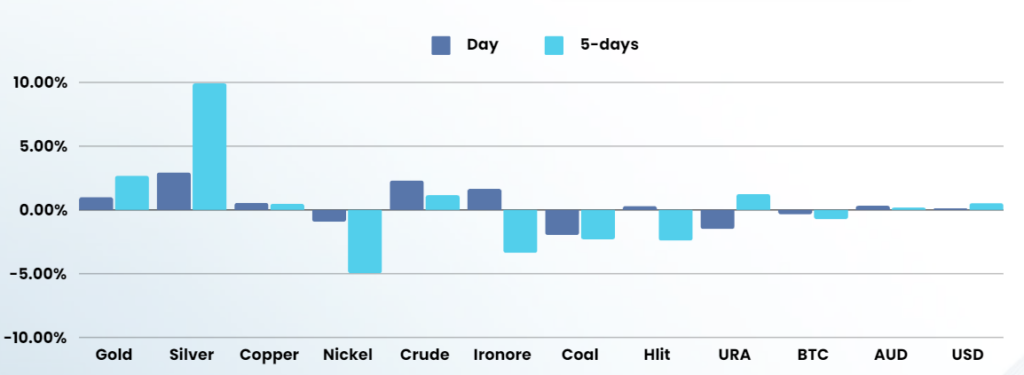

Gold hit an all-time peak on Tuesday as factors including safe-haven demand, spurred by U.S. election uncertainties and the Middle East war, combined with expectations of further monetary easing to amplify bullion’s surge and the BRICS conference where 35 countries are discussing a possible “de-Dollarization” with China and Russia leading the push

Tonight will see Tesla, IBM and Coca-Cola deliver earnings, with Amazon due to report Thursday night

Stock specific

- General Motors – stock rose 10% after the auto giant reported third-quarter earnings that exceeded analyst estimates, helped by robust revenue growth and improved profitability.

- Verizon – stock fell 5% after the telecom giant reported mixed third-quarter results, with earnings slightly beating expectations but revenue falling short. It maintained its full-year guidance as it continues to see growth in wireless and broadband subscribers.

ASX SPI 8267 (+0.27%)

The ASX is likely to start the day slightly higher after yesterdays beating due to higher yields. Precious metals stocks will again benefit from strength in the underlying.

Founder Fail week continues with the Wisetech saga continues as a $7m “hush-money” payoff to a Wisetech staff member from CEO, Richard White. Meanwhile MinRes has attracted the attention of ASIC reportedly interested in revelations that founder and chief executive Chris Ellison allegedly ran a tax evasion scheme for a decade.

Coles and Woolworths are headed to the Federal Court accused of fake discounts by the ACCC.

Today’s AGMS include Tabcorp and Codan.