Overnight – Equities drift higher into Thanksgiving Holiday

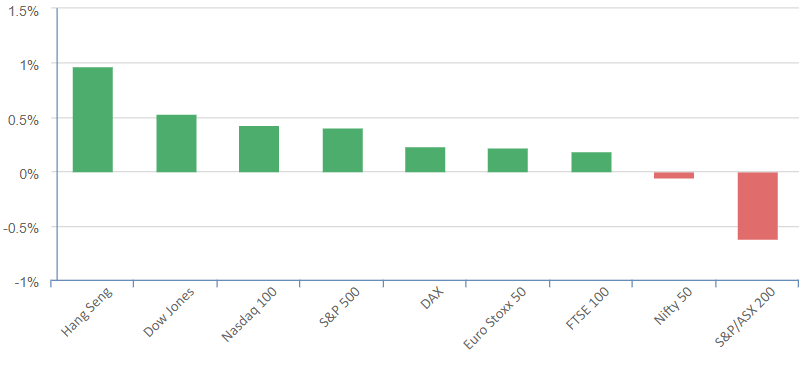

Global stock markets had a mixed night following a modest gain in Wall Street, with Japan and the U.S. closed for holidays. Oil prices initially dropped by about $1 per barrel as OPEC postponed a meeting on production cuts.

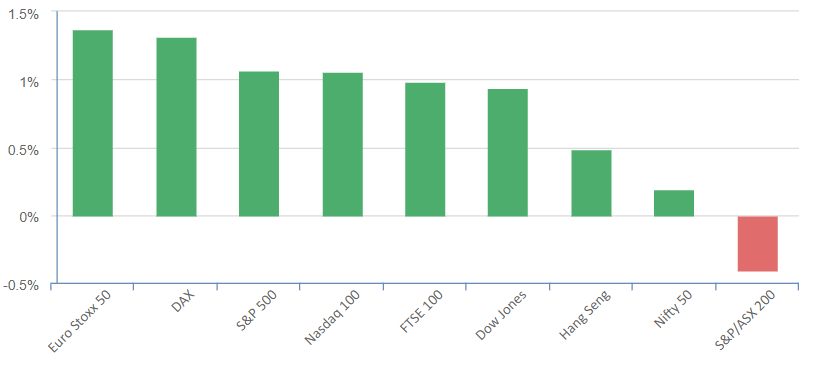

In Europe, Germany’s DAX and France’s CAC 40 saw slight gains, and Britain’s FTSE 100 inched higher. U.S. stock futures remained stable.

In Asia, Hong Kong’s Hang Seng and Shanghai Composite index both increased. Chinese markets reacted to regulatory moves aimed at stabilizing the property market, with shares of troubled developer Country Garden surging.

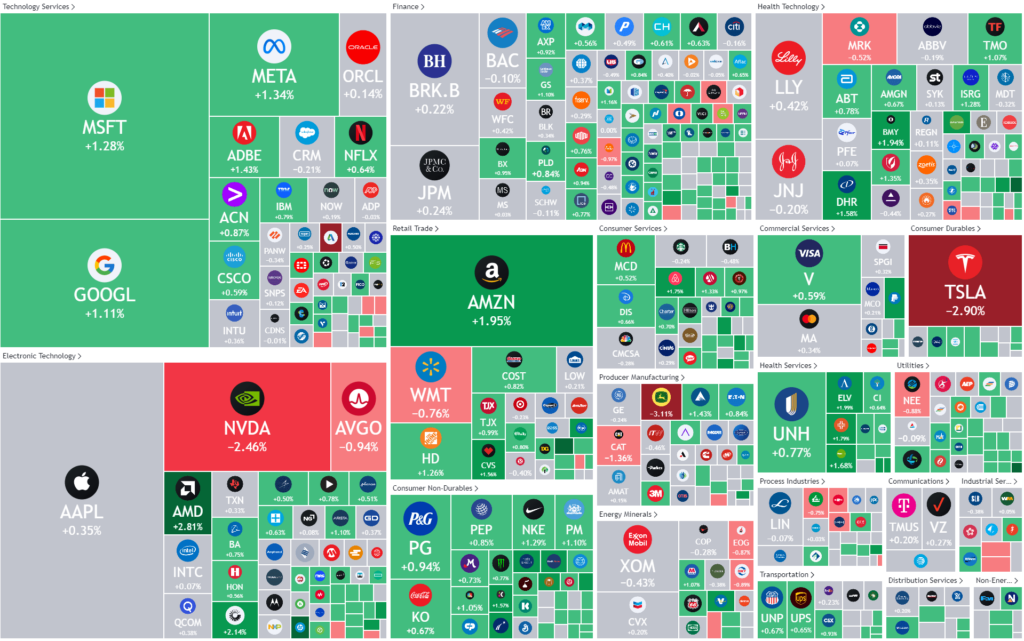

Technology and communications stocks performed well in the U.S. on the previous day, with Microsoft and Google parent Alphabet seeing gains. However, Broadcom’s stock slipped despite announcing the completion of a $69 billion deal to acquire VMWare.

Oil prices dropping by 0.9% negatively impacted energy companies, including Exxon Mobil and Halliburton. Nvidia faced challenges due to export restrictions to China.

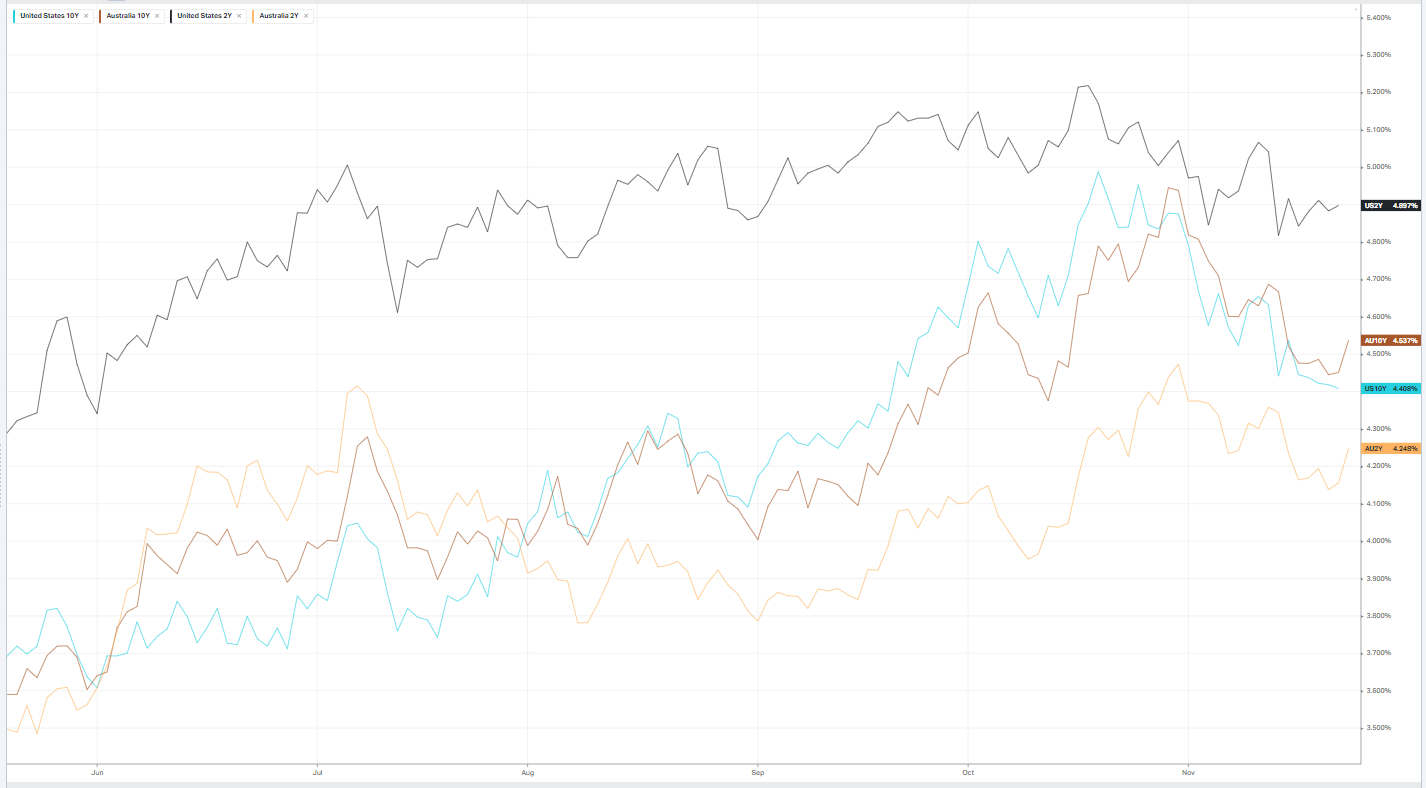

In the financial sector, Treasury yields remained relatively stable, and consumer sentiment stayed strong, pushing recession forecasts further into 2024, with hopes of a potential Federal Reserve rate cut.

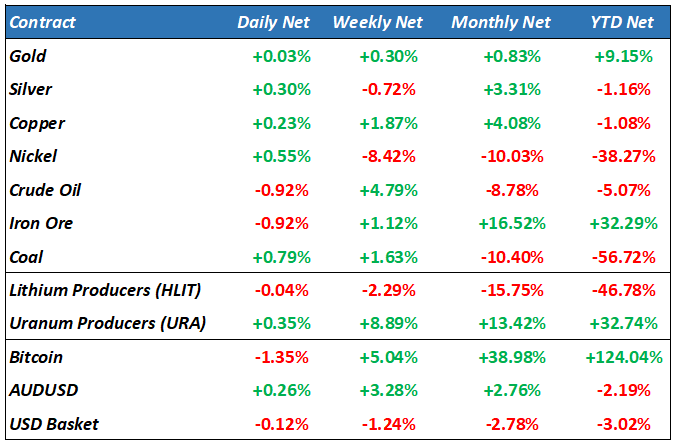

In commodity markets, U.S. benchmark crude oil and Brent crude both experienced declines. The U.S. dollar weakened against the Japanese yen but strengthened against the euro.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7084 (-0.02%)

The Australian sharemarket opened with a 0.1% gain, reaching 7036.1 on Friday, with limited direction from U.S. markets closed for Thanksgiving. The energy sector led the way, recovering from a previous sell-off despite a drop in crude oil prices. Energy stocks like Woodside, Santos, and Karoon saw gains of 1.2%, 1%, and 1.9%, respectively.

U.S. futures showed a slightly positive trend, with Dow Jones futures up by 0.09%, S&P 500 futures up by 0.05%, and Nasdaq 100 futures up by 0.08%.

Bond yields in Europe rose as Eurozone PMI data indicated only a modest improvement in the region’s economy, reducing expectations of European Central Bank rate cuts, in line with policymakers’ statements.

The Australian dollar strengthened by 0.3% to US65.60¢ due to a weaker U.S. dollar, improved risk sentiment, higher iron ore prices, and narrowing spreads between Australian and U.S. government bond rates. Despite the gain, it still traded below its estimated fair value range of US66¢ to US75¢, centered on US70.50¢, as a significant improvement in the Chinese property market may be needed for AUD/USD to reach fair value, according to Kristina Clifton, a senior economist at CBA.