Overnight – Stocks rally on Trump/China De-escalation hopes

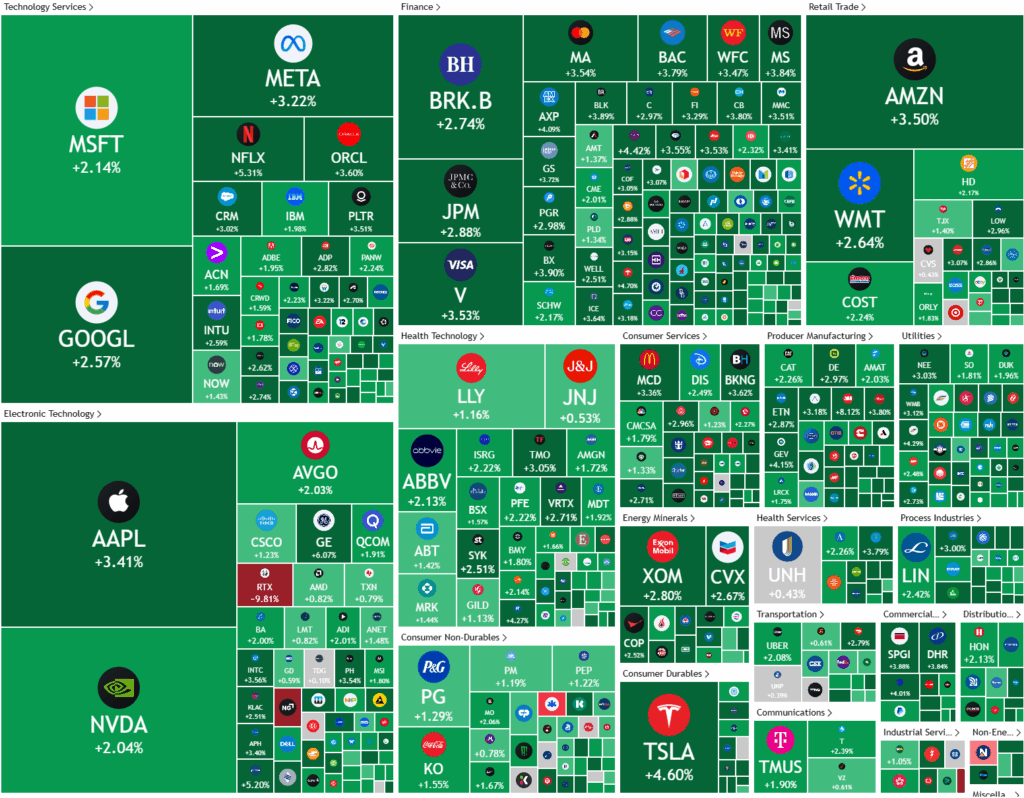

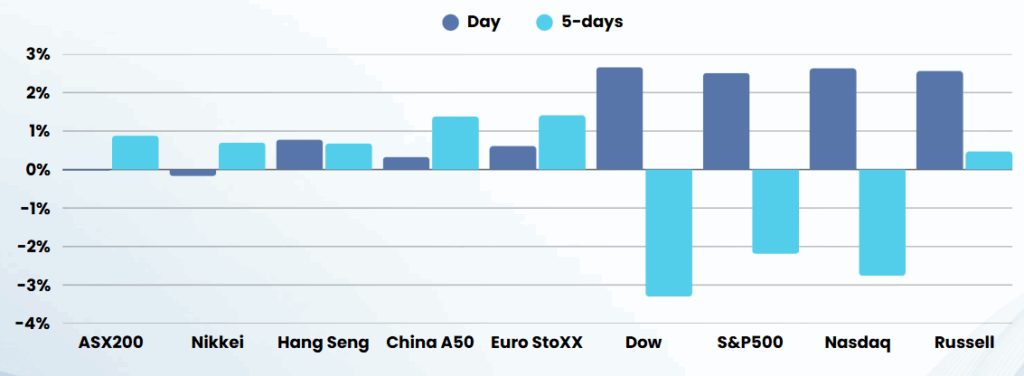

Stocks clawed back losses from a day earlier after Treasury Secretary Scott Bessent stokes hopes for a possible de-escalation in the U.S.-China trade war and President Trump showed the first signs of contrition in a press conference after the close

U.S. Treasury Secretary Scott Bessent reportedly said that he expects de-escalation in the ongoing tariff standoff between the US and China in the “very near future, CNBC reported, citing individuals present at the event.

“The next steps with China are, no one thinks the current status quo is sustainable” with tariff rates at their current levels,” Bessent said at a private investor summit hosted by JPMorgan Chase, CNBC reported, citing sources. The Treasury Secretary said he expects there will be a de-escalation” in the U.S.-China trade war in the “very near future,” a person in the room told CNBC.

The remarks come on the heels of a Bloomberg report. citing individuals present at the event, that the Treasury Secretary anticipates a de-escalation in the situation.

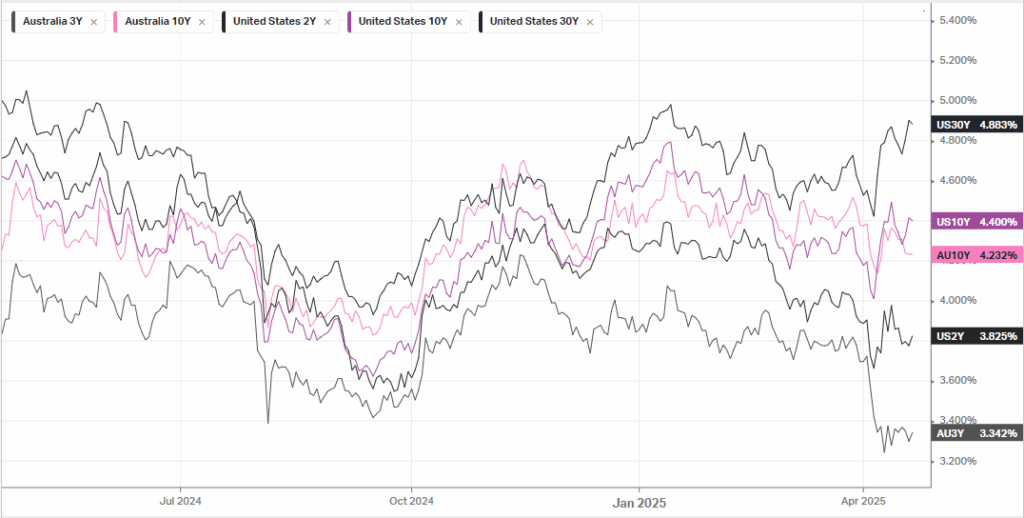

Fed speakers, meanwhile, continued to rise concern about the impact of tariffs. Minneapolis Federal Reserve President Neel Kashkari flagged worries about a tariff-driven recession following a sharp turn lower in economic confidence in the wake of President Donald Trump’s tariff rollout.

Richmond Fed president Thomas Barkin, however, delivered remarks that were in sharp contrast to those of his colleagues on inflation, saying that inflation expectations may have “loosened.” This suggests that the Richmond Fed president’s focus could be on the other Fed’s mandate maximum employment pointing to possible backing of rate cuts if the labor market deteriorates.

Amazon, up more than 3%, clawed back some losses from a day earlier, when the tech giant said it would be pausing some investment into new data centers.

Watching Trump’s most recent press conference at 655am AEST, he almost walked off with his tail between his legs, backpedalling in a number of issues “I’m not firing Powell”, “President Xi is my friend” “we are doing trade deals” then abruptly …. “thank you, no more questions”

Company Earnings

- Tesla – rose 4% during the day and a further 4% after market despite a miss on the top and bottom lines comes as automotive sales plunged 20% in Q1 from the same period a year. Automotive margins, a measure of profitability, fell to 12.5% in the first quarter from 17.2% in the fourth quarter. CEO Elon Musk said he will cut back his work for President Donald Trump to a day or two per week starting sometime next month, after the billionaire’s aggressive cost-cutting tactics sparked public backlash and investor concern.

The billionaire also reiterated his view that Tesla will be the most valuable company in the world “by far” and may be worth more than the next five companies combined. He said this will require solid execution.

On the Optimus humanoid robot, Musk said he is comfortable estimating 1 million Optimus units by 2030, maybe 2029.

- Verizon Communications – rose 0.6% after the telecom giant reported that retail phone customers slipped by more than expected, as it backed away from promotions to attract customers to help protect profits.

- 3M – rose 8% after the industrial conglomerate reported first-quarter 2025 results that exceeded analyst expectations, driven by organic sales growth and improved margins.

- Halliburton – stock fell 5.6% after the oilfield services provider posted lower first-quarter profit as a slowdown in drilling activity in North America dampened demand for its services and equipment.

ASX SPI 7936 (+1.27%)

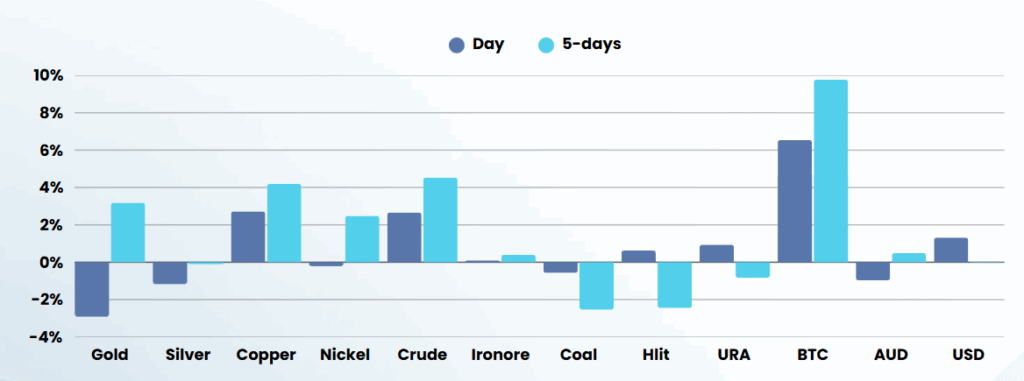

The ASX will be in for a bumper day as optimism on de-escalation of China-US tensions will shine through. Add to this the positive reactions to earnings in the US (so-far) and I think we’ve seen the high in gold for a while and we will see a 6-8 week bounce in equities.

If you are inclined to buy, we would be doing it under 8000 in the ASX200 or not at all. As mentioned in previous mornings updates, this will be a sucker rally until weaker economic numbers filter through in the coming months from Trumps confidence wrecking ball