Overnight – Cyclical stocks pull market higher (for the first time in a while)

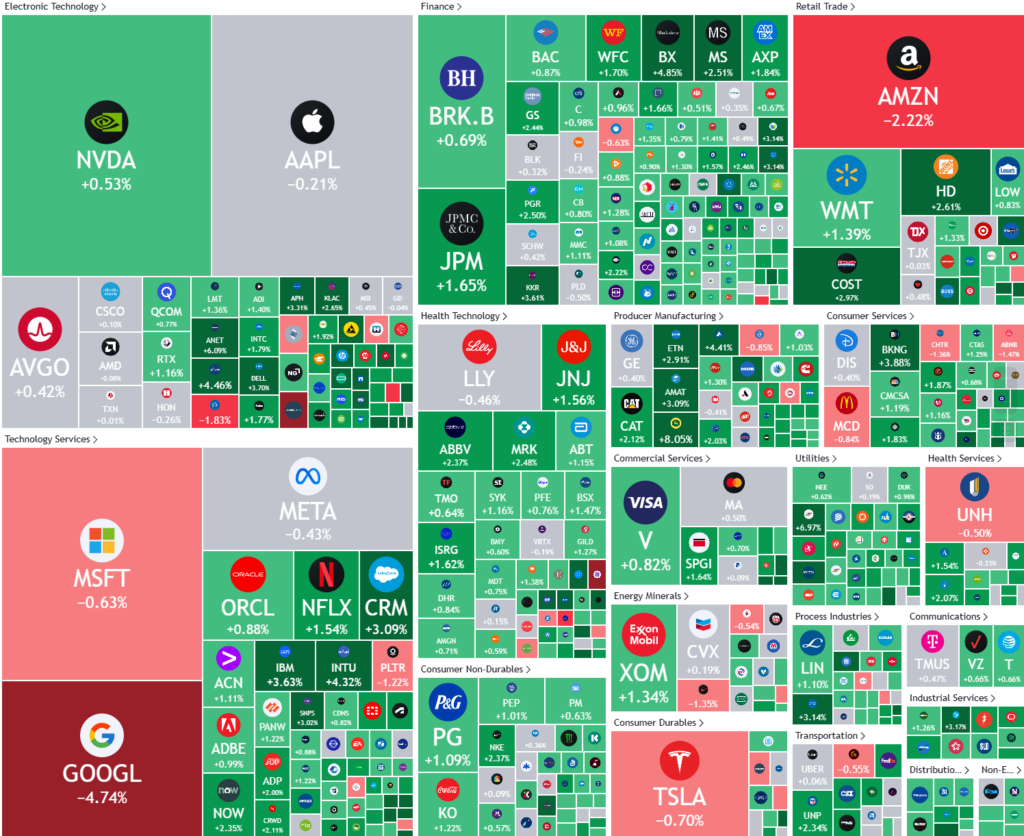

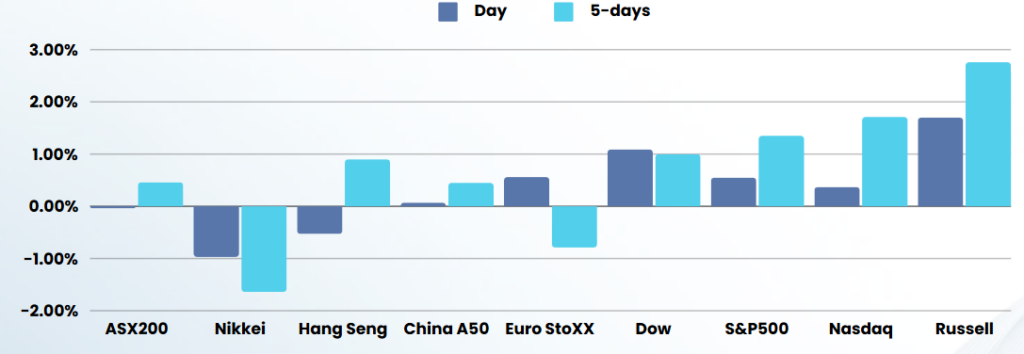

Stocks ground higher overnight led by cyclical stocks including financials and industrials boosting the broader market at a time when tech lagged as Google slumped on regulatory concerns.

The number of Americans filing new applications for unemployment benefits unexpectedly fell last week, with initial claims dropping 6,000 to a seasonally adjusted 213,000. This suggests job growth rebounded in November after abruptly slowing last month amid hurricanes and strikes, implying the underlying US labour market remains strong. The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls component of November’s employment report. Nonfarm payrolls increased by a scant 12,000 jobs in October, the smallest gain since December 2020, after rising by 223,000 in September.

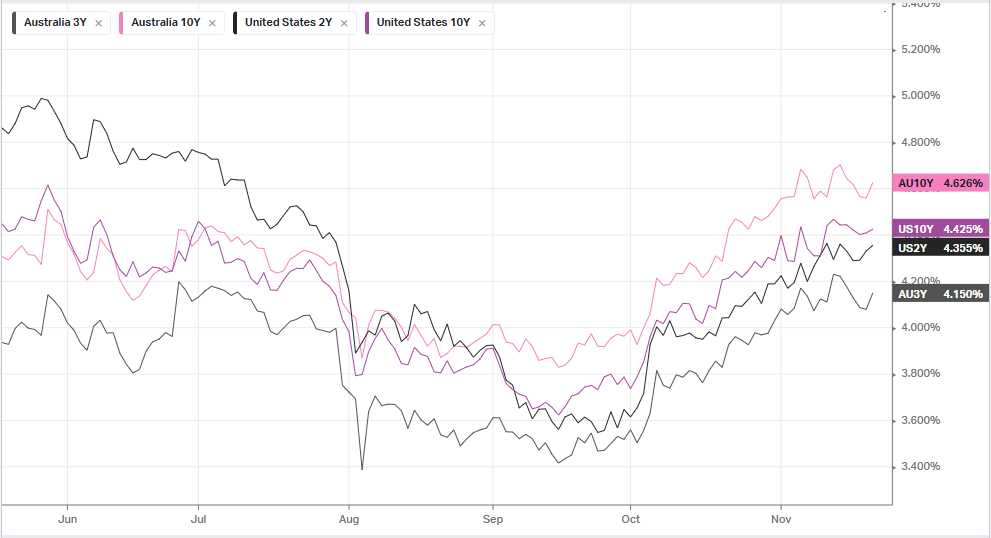

The market focus now turns to purchasing managers index data for November on Friday, while several Federal Reserve officials are also set to speak in the coming days.

Nvidia shares traded below the flatline after the tech giant beat expectations in the third quarter, though its fourth-quarter revenue forecast underwhelmed some traders hoping for a much bigger beat.

The revenue forecast presented a sharp slowdown in Nvidia’s quarterly revenue growth, given that the company guided much stronger year-on-year increases in revenue for the past three quarters.

Nvidia, which recently overtook Apple to become the world’s most valuable listed company, also flagged supply constraints, especially in its upcoming Blackwell line of next-generation AI chips, while adding that demand for its advanced AI chips remained robust.

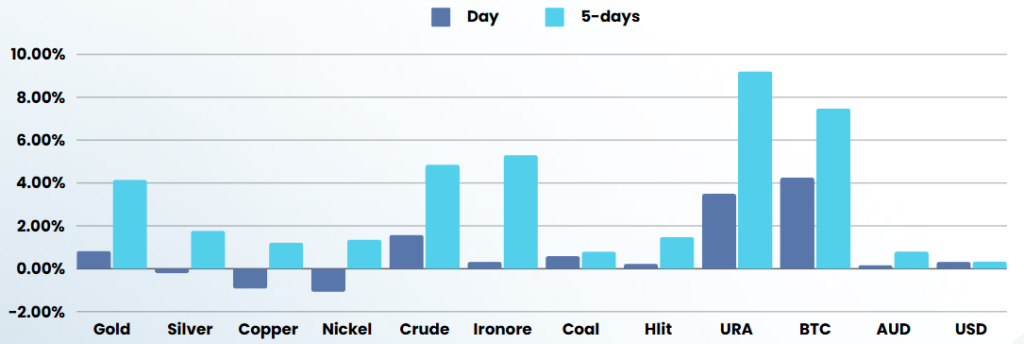

Bitcoin continued its recent rally that has seen the cryptocurrency surge more than 40% since the U.S. election on expectations President-elect Donald Trump will loosen the regulatory environment for cryptocurrencies.

Bitcoin gained 4.23% to $98,458 after reaching a record high of $99,057. The Securities and Exchange Commission said Chair Gary Gensler, who challenged the crypto industry, will step down on Jan. 20.

Alphabet fell more than 4% as the Department of Justice late Wednesday demanded Google sells its Chrome web browser as part of series of remedies to cut the tech giant’s monopoly in online search.

ASX SPI 8421 (+0.88%)

The ASX should lift from the open with commodities and cyclical stocks in favour globally.

In commodities, oil prices rose more than 1 per cent after Russia and Ukraine exchanged missiles, raising crude-supply concerns. Spot gold rose, on track for the fourth-consecutive session of gains after hitting a more than one-week high.

Iron ore futures rose to a one-week high as investors and traders weighed firm near-term demand against high portside stocks, while awaiting new clues on the consumption outlook for top consumer China.

Some 25 AGMs are scheduled, including Kogan, Lovisa, Megaport, NEXTDC, Orica, Washington H Soul Pattinson and WiseTech Global. Orica trades ex-dividend.