Overnight – Stocks finish at records for 6th week in a row, Netflix shines

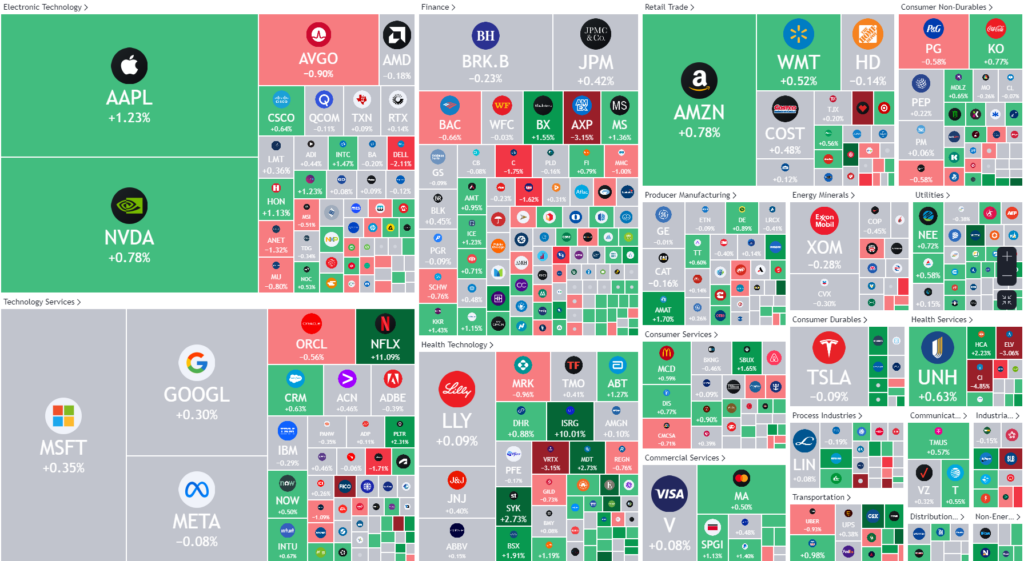

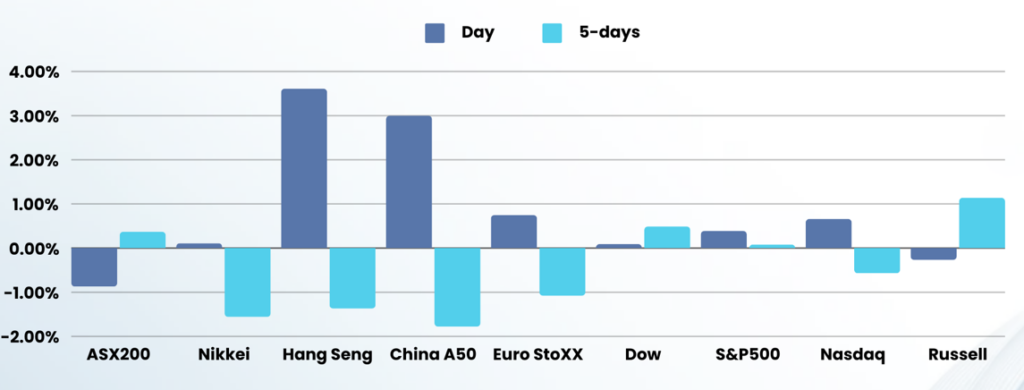

Stocks finished at record highs for a 6th consecutive week, as investors digested more quarterly corporate earnings, including stronger-than-expected numbers from streaming giant Netflix.

Netflix shares rose over 11% after the streaming giant reported stronger-than-expected third-quarter earnings and also provided an upbeat outlook for the current quarter. The firm added more subscribers than expected, with more people signing up for Netflix’s ads-based subscription tiers. The most significant advantage of the ad tier so far is that it limits churn, lowering pressure on adding new subscribers.

The earnings set a positive tone for upcoming prints from several technology firms in the coming week. Alphabet is set to report on Tuesday week, while Tesla and Amazon are due late next week.

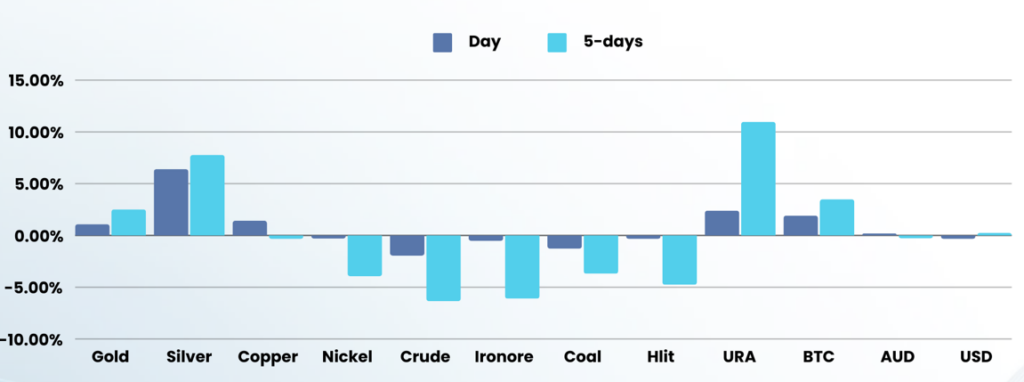

Gold prices broke out of a tight trading range seen in the past two weeks, hitting new peaks as the U.S. election approached. Silver also broke out of its long term range to hit a fresh 52-week high

Stock specific

- American Express – stock dropped over 3% after the credit card giant reported third-quarter profit revenue below expectations and bigger provisions for credit losses, even as higher spending on its cards prompted an increase in full-year guidance.

- Procter & Gamble – stock fell 0.6% after the household goods manufacturer missed expectations for first-quarter sales on Friday, as consumers in its major markets, the U.S. and China, switched to cheaper household and personal care brands.

ASX SPI 8365 (+0.52%)

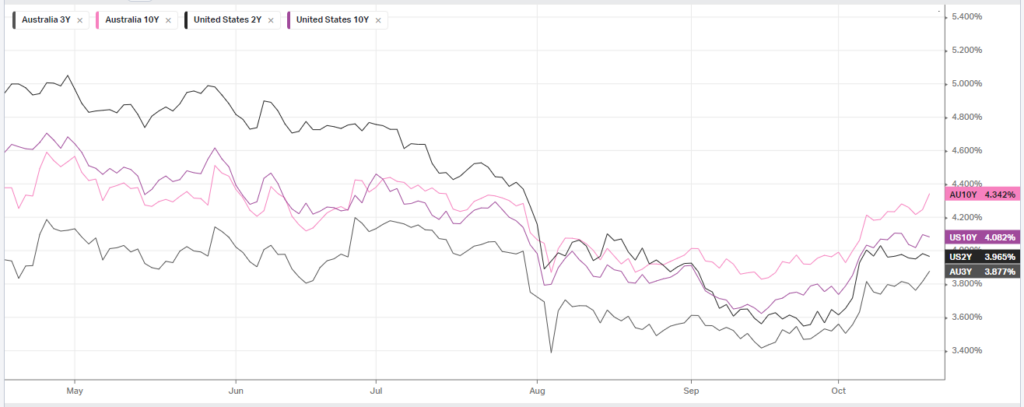

We expect the local market to follow the lead of the US and head higher today, particularly due to the positive start to US earnings. While the strong start to earnings and recently strong global economic numbers may mean rate cuts will be delayed by many central banks, including the RBA, this is only likely to affect the interest rate sensitive stocks like REITs and Consumer Discretionary.

Gold stocks are likely to continue their run higher with another record close on Friday and the looming BRICS summit which could see some interesting proposals from Russia and China to “De-Dollarize” the world (or the 35 countries going to the summit at the very least. Anything Silver related will also spike higher today as silver prices broke an 11 year high, rallying nearly 7% in Fridays session.